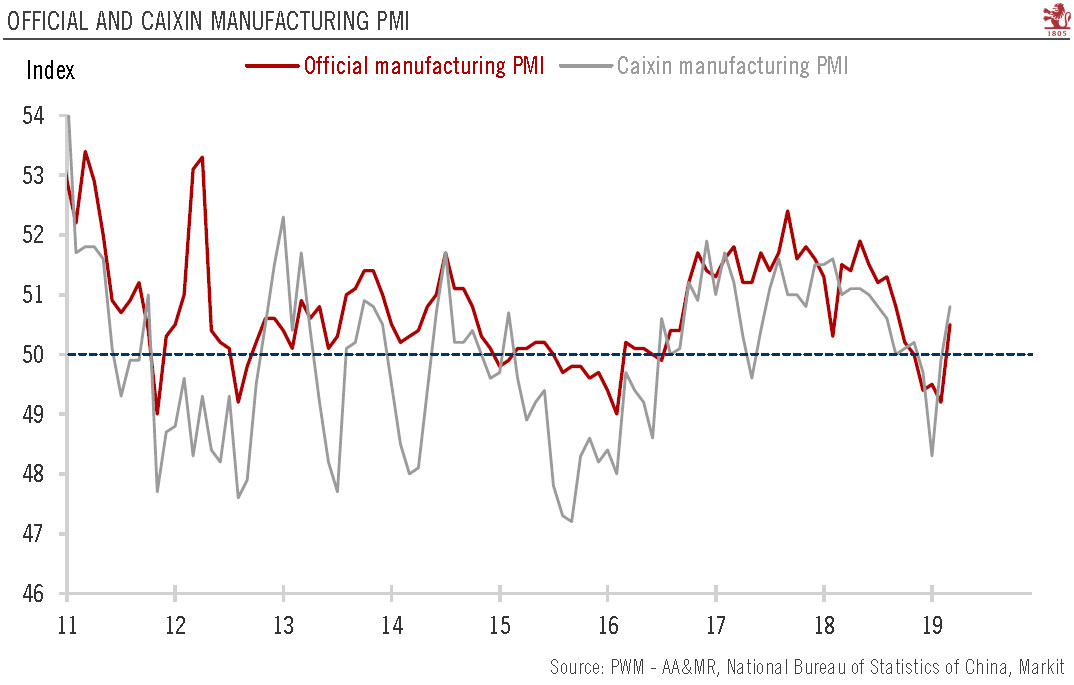

Industrial gauges rebound on seasonality as well as policy easing.Chinese PMI readings moved back into expansion territory in March. The official Chinese manufacturing PMI rose to 50.5, up from 49.2 in February, and beating the Bloomberg consensus of 49.6, while the Caixin manufacturing PMI came in at 50.8, also up from 49.9 in February and beating the consensus expectation of 50.0. Details of the PMI survey report generally point to improvement in growth momentum, both on the domestic and external fronts.While historical data suggest that the March jump in PMI figures could be partly due to seasonality related to the Lunar New Year holidays, the rebound is still encouraging and could suggest a reduced likelihood of a further sharp deceleration of the Chinese economy. Since H2 2018, the

Topics:

Dong Chen considers the following as important: China economy, China policy stimulus, Chinese PMIs, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Industrial gauges rebound on seasonality as well as policy easing.

Chinese PMI readings moved back into expansion territory in March. The official Chinese manufacturing PMI rose to 50.5, up from 49.2 in February, and beating the Bloomberg consensus of 49.6, while the Caixin manufacturing PMI came in at 50.8, also up from 49.9 in February and beating the consensus expectation of 50.0. Details of the PMI survey report generally point to improvement in growth momentum, both on the domestic and external fronts.

While historical data suggest that the March jump in PMI figures could be partly due to seasonality related to the Lunar New Year holidays, the rebound is still encouraging and could suggest a reduced likelihood of a further sharp deceleration of the Chinese economy. Since H2 2018, the Chinese government has stepped up policy stimulus to support the economy, both on the monetary and fiscal fronts, especially the latter. The realised fiscal deficit for 2018 amounted to 4.2% of GDP, compared with 3.7% in 2017, despite the smaller deficit target set at the start of the year. For 2019, more aggressive cuts in corporate taxes have started to be implemented since Q2. Combined with the cuts in personal income tax announced last year, these measures will likely provide some meaningful boost to domestic demand. At this point it remains to be seen to what extent the optimism shown in the survey results will be reflected in the hard data of the coming months, but these latest PMI figures represent a moderately positive surprise regarding China’s growth momentum.

Our view that Chinese growth may bottom at the end of Q2 remains unchanged, although now it seems the deceleration in H1 may not be as deep as we had earlier expected. As a result, our current GDP forecast of 6.1% may face some upside risk.