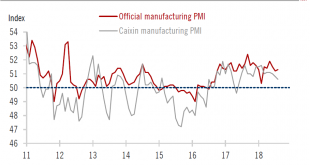

Industrial gauges rebound on seansonality as well as policy easing. Chinese PMI readings moved back into expansion territory in March. The official Chinese manufacturing PMI rose to 50.5, up from 49.2 in February, and beating the Bloomberg consensus of 49.6, while the Caixin manufacturing PMI came in at 50.8, also up from 49.9 in February and beating the consensus expectation of 50.0. Details of the PMI survey report...

Read More »China PMIs jump in March

Industrial gauges rebound on seasonality as well as policy easing.Chinese PMI readings moved back into expansion territory in March. The official Chinese manufacturing PMI rose to 50.5, up from 49.2 in February, and beating the Bloomberg consensus of 49.6, while the Caixin manufacturing PMI came in at 50.8, also up from 49.9 in February and beating the consensus expectation of 50.0. Details of the PMI survey report generally point to improvement in growth momentum, both on the domestic and...

Read More »Mixed signals from Chinese PMIs

Latest data suggests continued growth moderation in Q3. Our 2018 Chinese GDP forecast remains unchanged, but we see potential downside risk.In August, Purchasing Manager Indices (PMIs) sent mixed messages about the Chinese economy. Official PMIs compiled by the national bureau of Statistics and the China Federation of Logistics and Purchasing showed the market picking up slightly in August, while the Markit PMIs (also known as the Caixin PMIs) indicated further growth deceleration. Taking...

Read More »PMIs further evidence of short-term economic strengthening in China

Recent data points to possibility of upside surprise in third-quarter GDP, but momentum may not last. September purchasing manager indices (PMIs) provided the latest evidence pointing to relatively strong Q3 GDP growth in China (the GDP report will be released later this month). However, we believe the structural downward trend in Chinese growth will resume as property investment loses momentum and the government continues to cut industrial overcapacity.China’s official manufacturing PMI...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org