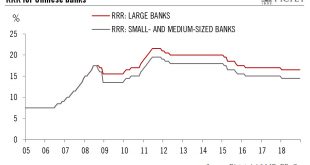

While the latest move will inject liquidity into the Chinese banking system, more direct stimulus can be expected in a bid to lift China’s slowing economy.The People’s Bank of China (PBoC) announced a further reduction in banks’ required reserve ratios (RRR) on Friday by 1 percentage point. According to the central bank, this round of RRR cuts will inject roughly Rmb800 billion of net liquidity into the banking sector.In our view, this move was partly motivated by the economy’s seasonal...

Read More »PBOC aims to stave off potential liquidity shock

The decision to lower reserve requirements for some lending does not represent a policy shift by the PBoC, still intent on reining in excessive financial leverage.The People’s Bank of China (PBoC) announced on 30 September that it would lower the required reserve ratio (RRR) for selected banks by 50-150 basis points (bps) from the beginning of next January.Specifically, banks eligible for a 50 bps cut to their RRR will include those that have at least 1.5% of their existing loans or of their...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org