Summary:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWe maintain our neutral stance on equities overall on a rolling three-to-six month basis. We do have a more upbeat assessment further out, but the autumn is shaping up to be a sensitive time for risk assets overall.Recent sell-offs validate our cautiousness regarding emerging-market (EM) assets in general. But valuations are becoming more interesting and we do have a bullish short-term stance on Asia given increasingly attractive valuations. We have built up cash to seize opportunities there and in other asset classes at the appropriate moment.We are maintaining our neutral tactical stance on US Treasuries, but we are bearish on sovereign bonds overall and we continue to avoid the

Topics:

Perspectives Pictet considers the following as important: asset allocation, House View, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWe maintain our neutral stance on equities overall on a rolling three-to-six month basis. We do have a more upbeat assessment further out, but the autumn is shaping up to be a sensitive time for risk assets overall.Recent sell-offs validate our cautiousness regarding emerging-market (EM) assets in general. But valuations are becoming more interesting and we do have a bullish short-term stance on Asia given increasingly attractive valuations. We have built up cash to seize opportunities there and in other asset classes at the appropriate moment.We are maintaining our neutral tactical stance on US Treasuries, but we are bearish on sovereign bonds overall and we continue to avoid the

Topics:

Perspectives Pictet considers the following as important: asset allocation, House View, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Cure For High Prices

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Pictet Wealth Management's latest positioning across asset classes and investment themes.

- We maintain our neutral stance on equities overall on a rolling three-to-six month basis. We do have a more upbeat assessment further out, but the autumn is shaping up to be a sensitive time for risk assets overall.

- Recent sell-offs validate our cautiousness regarding emerging-market (EM) assets in general. But valuations are becoming more interesting and we do have a bullish short-term stance on Asia given increasingly attractive valuations. We have built up cash to seize opportunities there and in other asset classes at the appropriate moment.

- We are maintaining our neutral tactical stance on US Treasuries, but we are bearish on sovereign bonds overall and we continue to avoid the lowest-quality parts of the credit market.

Commodities

- Despite international trade disputes and the June producer agreement to boost output, oil supplies are set to remain tight until at least mid-2019. After rebounding in mid-August, we consider oil prices are now close to fair value. Our forecasts for end-2018 remain at around USD70 for WTI and USD77 for Brent.

Currencies

- The impact of the Turkish lira crisis, concerns about the upcoming Italian state budget and trade tensions have led to short-term euro weakness versus the US dollar and prompted us to revise our three-month forecast for the euro from USD1.18 to USD1.15.

- Nonetheless, our central scenario remains that the euro will strengthen against the dollar over the next 12 months as the growth differential and monetary policy divergence become less dollar supportive.

Equities

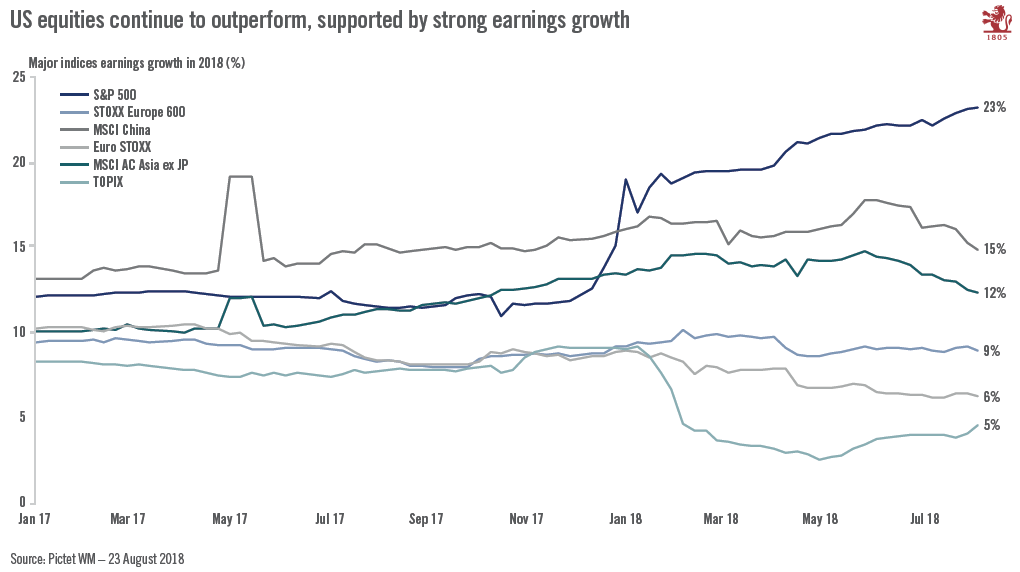

- The Q2 earnings season in the US was very solid, with positive earnings momentum in all sectors. The picture was more mixed in Europe.

- Q2 earnings for the cheap and under-owned US pharma sector were the best in years. We see further potential for positive earnings surprises in this sector like those seen in Q2.

- Concerns about the new Italian government’s budget plans mean the risk premium demanded of Italian debt has been rising again. Even though contagion risk should be limited, we remain bearish on euro area sovereign debt.

- US corporate bonds (especially high yield) are looking expensive in historical terms while we believe hard-currency emerging market debt still fail to compensate investors for risks.

Alternatives

- In hedge funds, Distressed strategies have performed positively this year in spite of a default rate that remains low.

- While the opportunity set has been shrinking, we remain on the lookout for Distressed managers able to find pockets of potential. Private equity investment opportunities in China are increasing, with the focus shifting to more mature companies and sectors, with ever larger capital being raised by a smaller number of companies.