The downward revision to 3Q GDP will make the Italian government’s targets more difficult to achieve and complicate the budget debate with Europe.The Italian statistical office’s (ISTAT) final reading showed that the economy shrank 0.1% q-o-q (-0.5% q-o-q annualised) in Q3, whereas a preliminary reading on October 30 showed that growth was flat. The details were quite negative and confirmed the idiosyncrasy of the Italian economy. Unlikely other euro area economies, net trade contributed positively to growth as exports increased more than imports. However, domestic demand contracted significantly, with a negative print for both private consumption and investment. The decline in domestic demand was the worst since Q2 2014.Of note, as Italy is the euro area’s third-largest economy, this

Topics:

Nadia Gharbi considers the following as important: Italian budget, Italy government, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The downward revision to 3Q GDP will make the Italian government’s targets more difficult to achieve and complicate the budget debate with Europe.

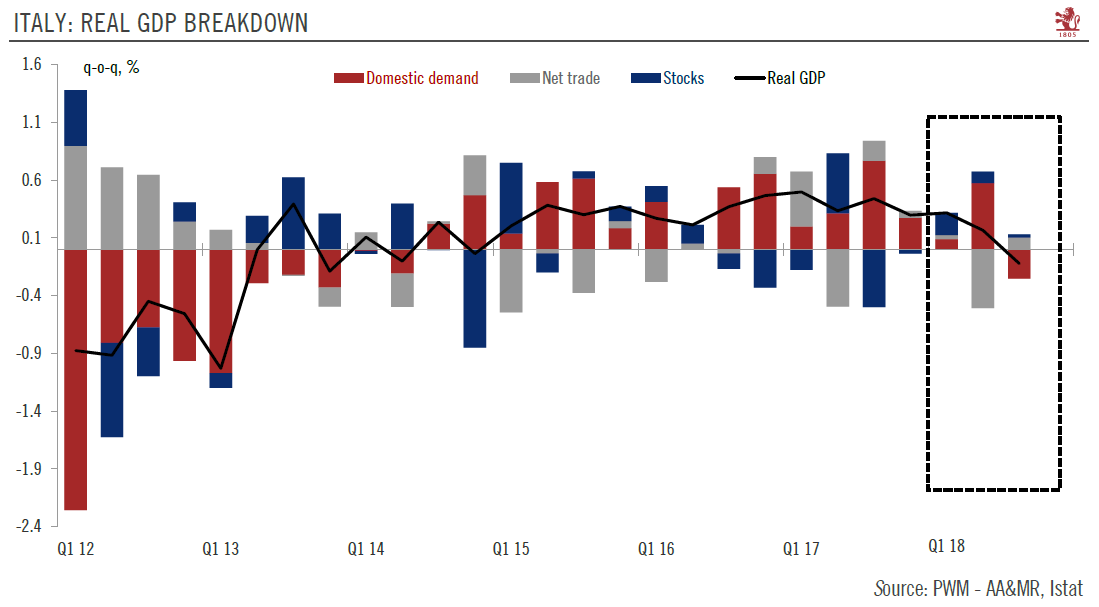

The Italian statistical office’s (ISTAT) final reading showed that the economy shrank 0.1% q-o-q (-0.5% q-o-q annualised) in Q3, whereas a preliminary reading on October 30 showed that growth was flat. The details were quite negative and confirmed the idiosyncrasy of the Italian economy. Unlikely other euro area economies, net trade contributed positively to growth as exports increased more than imports. However, domestic demand contracted significantly, with a negative print for both private consumption and investment. The decline in domestic demand was the worst since Q2 2014.

Of note, as Italy is the euro area’s third-largest economy, this downward revision to Q3 numbers could impact the currency area’s Q3 GDP final print that will be published on December 7.

Today’s GDP data revision adds to pressure on the government, as the GDP targets (1.2% in 2018 and 1.5% in 2019) presented in its draft budget plan appear increasingly challenging, if not impossible to reach. Last week, the European Commission (EC) issued its opinion on Italy’s budget plans. Deeming them noncompliant with the EU’s budgetary rules, it recommended that an Excessive Deficit Procedure (EDP) be opened (see our previous Flash Note). The EDP protocol for Italy will probably start to be discussed at the Eurogroup meeting of 3 December.

Since the EC issued its opinion, Italian political leaders have indicated some willingness to revise the budget plan change. But for the time being, it is not very clear how far the government is willing to go to meet European demands. Press reports suggest that the Italian government has been thinking about reducing its deficit target for 2019 from 2.4% to 2.2% of GDP, with some changes in the composition of the budget to induce the European Commission to soften its tone. Nothing concrete has been published yet, but a reduction of the deficit to 2.2% would probably not be enough to avoid an EDP as it still represents a significant breach of EU fiscal rules.

The political calendar makes the situation more complicated and could play against significant changes in the composition of Italy’s budget. With the European elections coming up in May, both government parties want to maximise their support by introducing the measures they promised, in particular the citizen income, tax cuts and repeal of pension reform.