Unlike some Fed policy makers, Fed economic staff have been downplaying the significance of recent yield curve flattening.The ongoing yield curve compression (the narrowing difference between short-term and long-term Treasury yields) has become a key focus for Federal Reserve (Fed) policymakers. Several Fed researchers have released notes dismissing some policymakers’ anxiety about a flattening yield curve, the latest coming from economic staff at the San Francisco Fed.Some of them, particularly on the dovish side of the spectrum, note that most recessions in recent decades have been preceded by yield curve inversion, and therefore are anxious that the ongoing compression of yield spreads might herald a potential slowdown. This would be in conflict with the Fed’s own ‘business as usual’

Topics:

Thomas Costerg considers the following as important: Fed staff, Macroview, rate hiking cycle, Treasury bond spreads, Yield curve flattening

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Unlike some Fed policy makers, Fed economic staff have been downplaying the significance of recent yield curve flattening.

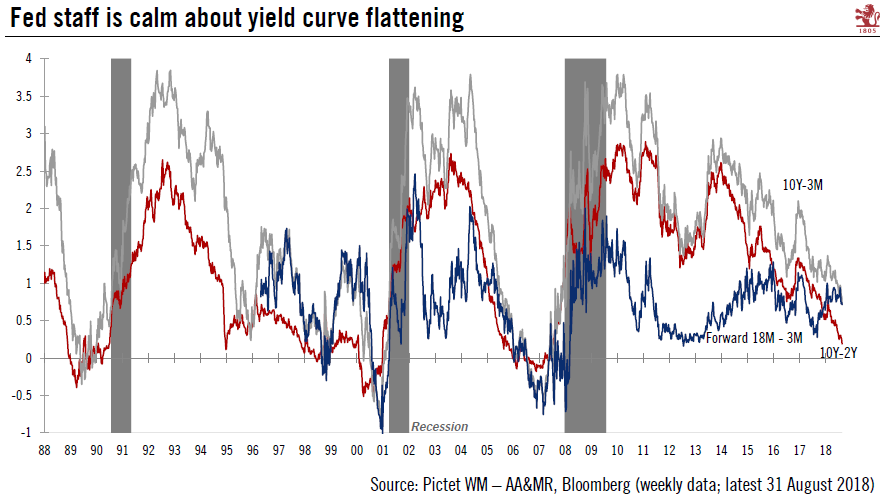

The ongoing yield curve compression (the narrowing difference between short-term and long-term Treasury yields) has become a key focus for Federal Reserve (Fed) policymakers. Several Fed researchers have released notes dismissing some policymakers’ anxiety about a flattening yield curve, the latest coming from economic staff at the San Francisco Fed.

Some of them, particularly on the dovish side of the spectrum, note that most recessions in recent decades have been preceded by yield curve inversion, and therefore are anxious that the ongoing compression of yield spreads might herald a potential slowdown. This would be in conflict with the Fed’s own ‘business as usual’ growth forecasts that underpin the case for continued rate hikes in the coming quarters (the Fed expects US GDP growth of 2.4% next year and 2.0% in 2020).

Economic staff at the Federal Reserve Bank of San Francisco suggested in a recent paper that it is wrong to look at the spread between the two-year and 10-year yield for clues about the US business cycle. Rather, they argued, one should look at the spread between the three-month and 10-year yield, and this is “is still a comfortable distance from a yield curve inversion”.

One should not worry about the narrowing yield curve yet, Fed staff economists have been telling their bosses. Their message should not be taken lightly: Fed staff has considerable influence on decisions taken by the Federal Open Market Committee (FOMC).

Fed Chairman Jerome Powell has paid relatively limited attention to the yield curve. In response to questions at the July congressional testimony, Powell hinted that the yield curve itself was not central to his thinking, although he did look at the 10-year yield as a proxy for where the market puts the neutral rate.

Although the current expansion is over nine years old, there is probably still juice in the US economy. In the near term it is being powered by solid corporate capex. Several leading indicators continue to flash green.

All in all, we still expect the Fed to maintain its current routine of one rate hike per quarter. Our scenario sees two more rate hikes this year (in September and December) and two in 2019 (in March and June), premised on the view that the US economy should continue to chug along in the coming quarters and that the risk of a near-term slowdown is quite low (even though this expansionary cycle, which started in mid-2009, is already protracted).