Employment in Texas rose more quickly than in California in 2017 as recovering oil prices boosted the energy sector and associated industries in the Lone Star State.One of the major rivalries in the US is that between California and Texas, the country’s biggest and second-biggest states respectively in GDP terms. They have different growth drivers (most notably Silicon Valley in California and the energy industry in Texas), and they also have different political landscapes – and local taxation regimes. But which one’s ahead when it comes to employment growth?The two states were neck-and-neck between 2010–17: the seven-year compounded annual growth rate of employment was 2.5% p.a. in Texas and 2.4% p.a. in California – both well above the US average of 1.7% p.a. But after outpacing Texas

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

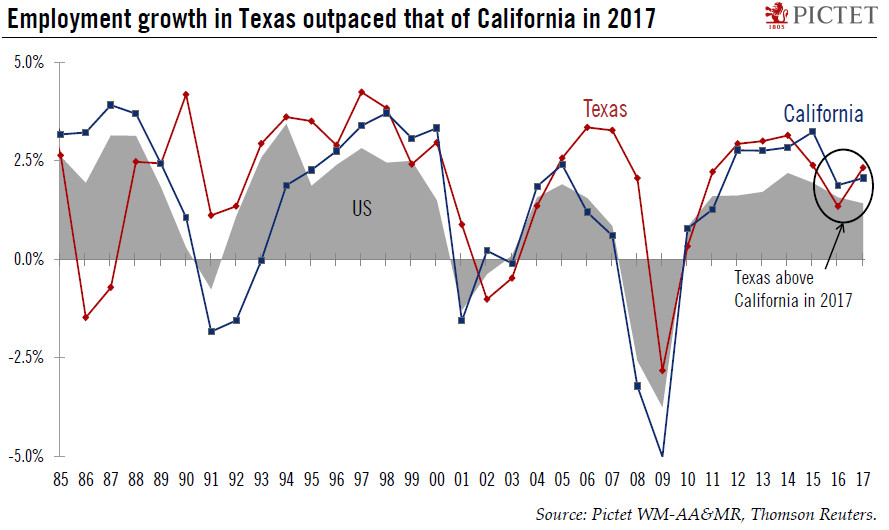

Employment in Texas rose more quickly than in California in 2017 as recovering oil prices boosted the energy sector and associated industries in the Lone Star State.

One of the major rivalries in the US is that between California and Texas, the country’s biggest and second-biggest states respectively in GDP terms. They have different growth drivers (most notably Silicon Valley in California and the energy industry in Texas), and they also have different political landscapes – and local taxation regimes. But which one’s ahead when it comes to employment growth?

The two states were neck-and-neck between 2010–17: the seven-year compounded annual growth rate of employment was 2.5% p.a. in Texas and 2.4% p.a. in California – both well above the US average of 1.7% p.a. But after outpacing Texas for two years, California’s rate of employment growth slipped below that of Texas in 2017, with its total employment up by 2.1%, slightly below the rate of 2.3% in Texas. By contrast, employment in the US was up by just 1.4%.

The ‘comeback’ of Texas in 2017 can be attributed to the solid rebound in the local energy sector, which is cascading down to related industries such as petrochemicals and manufacturing. In fact, manufacturing employment jumped by 4.3% in Texas last year after contracting for two years in the wake of the 2014–15 period of oil price weakness.

The good news for Texas is that global oil prices have started the year on a strong footing, and this bodes well for its economy in 2018. Texans like to say their economy is diversified, but the figures show that it remains highly correlated to the energy sector. US oil production is set to reach record highs in 2018, partly driven by the oilfields of West Texas and New Mexico.