Reforms to the rules governing offshore profits will have an impact on trade stats with other countries, especially Ireland.The US tax bill, enacted last December, could lead to dramatic changes in US international trade statistics – and particularly a lower trade balance, although it is not exactly certain to what extent. Indeed, alongside the tax bill’s headline cut of the statutory corporate tax rate from 35% to 21%, it contains some important reforms to the rules governing US corporations’ offshore profits. Two new taxes/mechanisms have been created: the Base Erosion Anti-Abuse Tax (BEAT) and Global Intangible Low-Taxed Income (GILTI, a minimum tax on intangibles). Both these taxes target transfer pricing. These new mechanisms, which aim to avoid excessive profit booking in low-tax

Topics:

Thomas Costerg considers the following as important: Macroview, US corporate taxation, US tax bill, Us trade balance, Us trade stats

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Reforms to the rules governing offshore profits will have an impact on trade stats with other countries, especially Ireland.

The US tax bill, enacted last December, could lead to dramatic changes in US international trade statistics – and particularly a lower trade balance, although it is not exactly certain to what extent. Indeed, alongside the tax bill’s headline cut of the statutory corporate tax rate from 35% to 21%, it contains some important reforms to the rules governing US corporations’ offshore profits. Two new taxes/mechanisms have been created: the Base Erosion Anti-Abuse Tax (BEAT) and Global Intangible Low-Taxed Income (GILTI, a minimum tax on intangibles). Both these taxes target transfer pricing. These new mechanisms, which aim to avoid excessive profit booking in low-tax jurisdictions (at the expense of the US), could change the way international corporates account for international transactions.

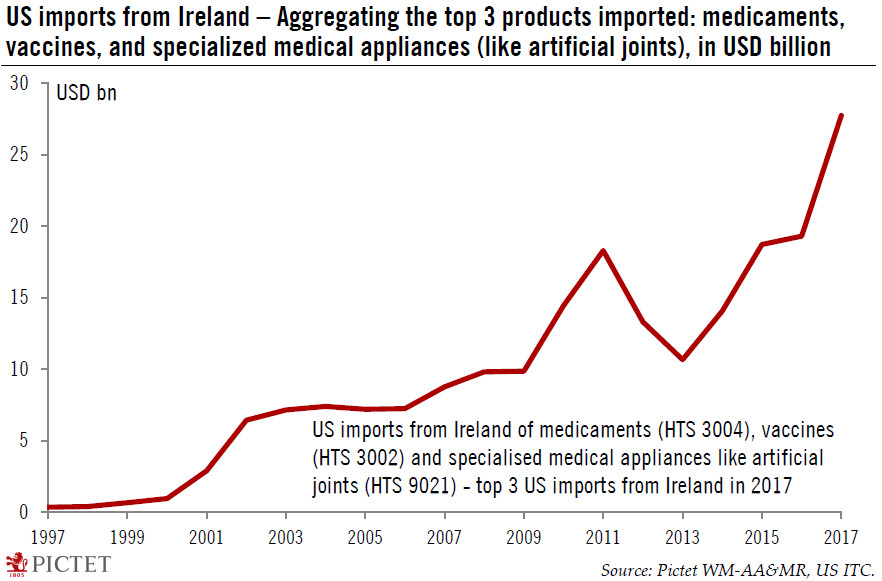

An example is US trade with Ireland (where the statutory corporate tax rate is 12.5%). Ireland is the 10th country for US imports, sandwiched between France and India. But these imports may be inflated by artificial profit booking rather than genuine trade flows. Currently, the top three merchandise imports from Ireland are medicaments, up an impressive 39% in 2017 (to USD12.9bn), followed by vaccines (up 66% in 2017, to USD10.7bn) and specialised medical appliances like artificial joints (up 14.8%, to USD 4.1bn). Taken together, these three sub-categories represented 57% of all imports from Ireland last year and were equivalent to just under 10% of Ireland’s GDP. These kinds of distortion may soon be a thing of the past.