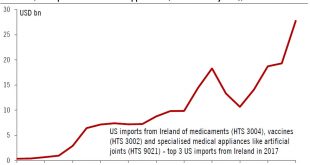

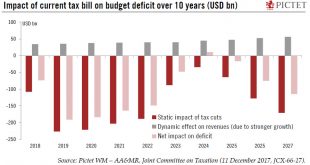

Reforms to the rules governing offshore profits will have an impact on trade stats with other countries, especially Ireland.The US tax bill, enacted last December, could lead to dramatic changes in US international trade statistics – and particularly a lower trade balance, although it is not exactly certain to what extent. Indeed, alongside the tax bill’s headline cut of the statutory corporate tax rate from 35% to 21%, it contains some important reforms to the rules governing US...

Read More »US tax bill looks set to pass

The tax bill continues to make its way through Congress at a swift pace, and now looks increasingly likely to be enacted into law this week, after clearing the conference committee hurdle (a compromise between the House and Senate versions). A few hesitating Republican Senators have eventually said they will vote in favour of the bill, which is key as the Republican majority in the Senate is slim at 52-48. It will...

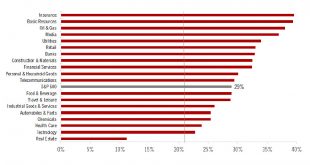

Read More »The US tax bill will boost 2018 earnings forecasts

The 21% corporate tax rate could cause 2018 expected earnings growth for US stocks to more than double. We see some upside risk to our US equity scenario.Last night, the US Senate approved the tax bill. It has since returned to the House of Representatives for administrative reasons, but, in line with an earlier vote, a green light looks now highly likely. Shortly thereafter, President Trump should sign it formally into law. If the tax reform is adopted, the statutory tax rate is expected to...

Read More »US tax bill looks set to pass

The tax bill continues to make its way through Congress at a swift pace, and now looks increasingly likely to be enacted into law this week.The Republican leadership seems to have corralled enough support to pass the tax bill approved in conference committee. The bill could be signed into law as soon as this week.The tax bill cuts the corporate tax rate to 21% from 35%, from January 2018. Global corporate taxation will move to a territorial regime, with a one-off tax on foreign investments...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org