The recent US tax cuts and abundant signs of increased corporate investment have led us to raise our forecast for growth and inflation in the US this year and next.December’s US tax cuts – which saw corporate taxation sharply reduced– are being echoed in signs that ‘animal spirits’ are finally kicking in. Both set the stage, in our view, for higher US growth, in large part driven by greater investment. We have raised our 2018 US growth forecast to 3.0% (from a previous forecast of 2.0%), as we assume that non-residential investment growth will go up sharply (7.0%). We expect 2019 GDP growth of 2.4%.We are also raising our inflation forecasts, although we anticipate some inertia in core inflation this year as the higher wages we expect might take a few quarters to feed into prices. We

Topics:

Thomas Costerg considers the following as important: Macroview, US Fed rate hikes, US growth forecast, US inflation forecast, US tax cuts

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The recent US tax cuts and abundant signs of increased corporate investment have led us to raise our forecast for growth and inflation in the US this year and next.

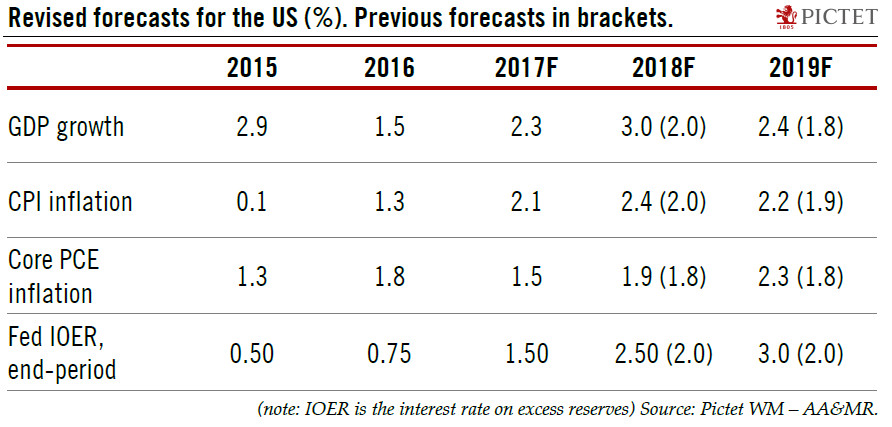

December’s US tax cuts – which saw corporate taxation sharply reduced– are being echoed in signs that ‘animal spirits’ are finally kicking in. Both set the stage, in our view, for higher US growth, in large part driven by greater investment. We have raised our 2018 US growth forecast to 3.0% (from a previous forecast of 2.0%), as we assume that non-residential investment growth will go up sharply (7.0%). We expect 2019 GDP growth of 2.4%.

We are also raising our inflation forecasts, although we anticipate some inertia in core inflation this year as the higher wages we expect might take a few quarters to feed into prices. We expect core PCE inflation to move up from 1.5% on average in 2017 to 1.9% in 2018 and 2.3% in 2019.

We now expect the Federal Reserve to hikes rates four times this year (compared with our earlier forecast of two). And we see two rate hikes in 2019 (compared with none before), with the Fed eventually pausing the rate-hiking cycle when short-term rates are at 3.0%.

The main risk to our macro forecast is a sudden return of inflation and a sharp rise in bond yields. We expect a gentle upward slope in wages and core inflation as the labour market continues to tighten, but the risk to our view is that the Phillips curve reasserts itself more vigorously than we think, and wage-driven inflation accelerates more noticeably. This could unsettle Fed officials and lead to more aggressive tightening.

There are several other risks to our US scenario: the recent investment pick up could fizzle, global energy prices could drop sharply (leading to a rapid end to the domestic energy boom), and US politics could turn more conflictual, both domestically and internationally (especially with the US’s trade partners).

But there are also some upside risks. The US could experience a leverage boom that translates into higher consumer spending, for example. Federal government spending could also provide some positive surprises— perhaps in the form of increased infrastructure spending.