With a rate hike very unlikely to be announced at the Fed’s January 30-31 meeting, the focus will be on the post-meeting statement, which could contain some moderate hawkish hints.The Fed meets on 30-31 January, a ‘tier 2’ meeting as there will be no press conference nor new economic projections. Rates should remain on hold. Still, the Fed could drop some hints that its optimism about the US and global economy is on the rise.We think this increased optimism will pave the way for higher 2018 growth forecasts at its meeting in March, as well as for a new dot chart showing four 2018 rate hikes (versus three at the December meeting).We think the Fed will avoid sounding too hawkish just now – especially given the leadership transition between Yellen and Powell.In our recently updated Fed

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

With a rate hike very unlikely to be announced at the Fed’s January 30-31 meeting, the focus will be on the post-meeting statement, which could contain some moderate hawkish hints.

The Fed meets on 30-31 January, a ‘tier 2’ meeting as there will be no press conference nor new economic projections. Rates should remain on hold. Still, the Fed could drop some hints that its optimism about the US and global economy is on the rise.

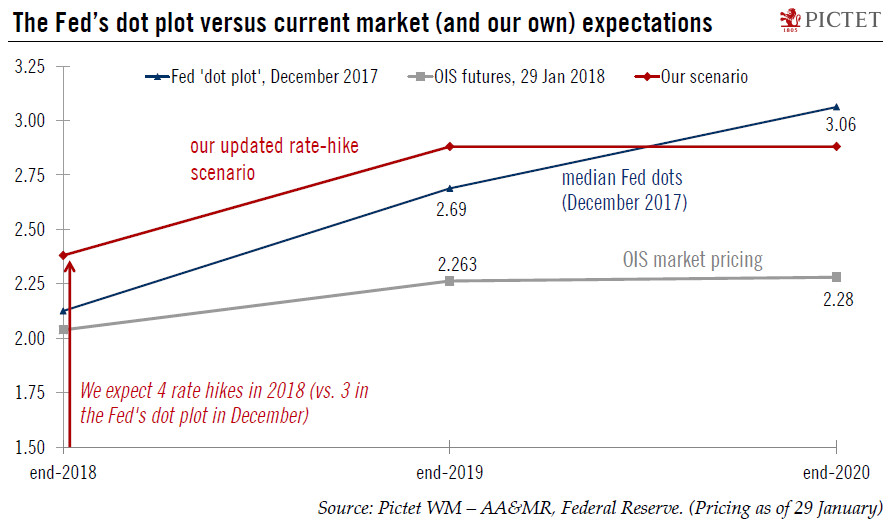

We think this increased optimism will pave the way for higher 2018 growth forecasts at its meeting in March, as well as for a new dot chart showing four 2018 rate hikes (versus three at the December meeting).

We think the Fed will avoid sounding too hawkish just now – especially given the leadership transition between Yellen and Powell.

In our recently updated Fed scenario, we see four rate hikes this year and two next year – more than are currently being priced by money markets.