But the underlying pick-up in inflation in January was not as severe as it seems.January core CPI inflation was firm, as the index rose 0.35% month-on-month (m-o-m). The year-on-year print was unchanged at 1.8%.Was inflation that bad? Probably not. The sharp increase in apparel prices (1.7% m-o-m, the biggest monthly increase since February 1990) appears particularly suspicious and may fall back again next month. Some notoriously volatile sub-indices, such as leased cars, provided a further boost to the CPI number.But while there are signs of inflationary pressures firming against the backdrop of solid US economic growth, we think January’s core CPI data exaggerates the underlying trend. We note there are still many CPI categories where structural drags from globalisation and technology

Topics:

Thomas Costerg considers the following as important: Macroview, US core inflation, US CPI inflation, US Fed policy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

But the underlying pick-up in inflation in January was not as severe as it seems.

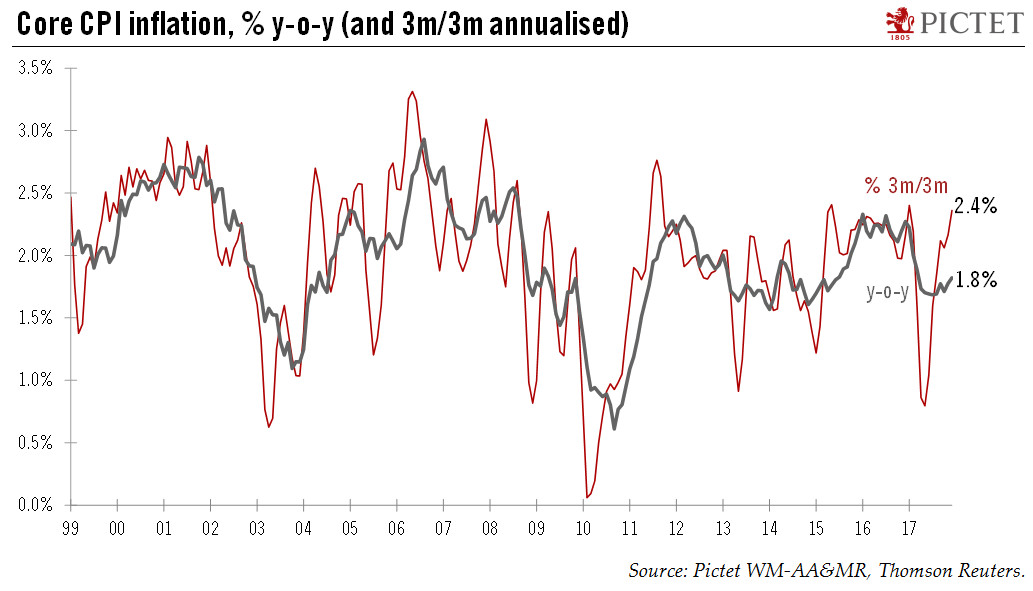

January core CPI inflation was firm, as the index rose 0.35% month-on-month (m-o-m). The year-on-year print was unchanged at 1.8%.

Was inflation that bad? Probably not. The sharp increase in apparel prices (1.7% m-o-m, the biggest monthly increase since February 1990) appears particularly suspicious and may fall back again next month. Some notoriously volatile sub-indices, such as leased cars, provided a further boost to the CPI number.

But while there are signs of inflationary pressures firming against the backdrop of solid US economic growth, we think January’s core CPI data exaggerates the underlying trend. We note there are still many CPI categories where structural drags from globalisation and technology are still at play. We maintain our annual forecast of 2.1% core CPI inflation in 2018, with a slight upside risk (core CPI rose 1.8% in 2017).

We think the latest core CPI data are unlikely to move the needle much regarding Fed policy. Even before the CPI release, most Fed officials were already convinced about the need to continue tightening given the cyclical pick up in US growth and the risk of additional fiscal stimulus from Washington DC. The sharp increase in core inflation is therefore likely to just ‘validate’ the Fed’s existing more hawkishly-inclined stance.

We think the Fed’s focus is really on GDP, which is now looking much better than the Fed expected at its last meeting in December. We therefore believe the Fed will revise its 2018 growth forecast up, and therefore might move up its dot plot at its March meeting to four quarter-point rate hikes this year from three. Our own forecast is still for four rate hikes this year and two next year.