A shake-up in interest-rate policy in China promises to cut lending rates and should benefit the broad Chinese economy over time.Over the weekend, the People’s Bank of China (PBoC) announced a major change in its benchmark lending interest rate, establishing a closer linkage between banks’ funding costs and their lending rates.Given the notable decline in short-term market interest rates since last year due to the PBoC’s liquidity injections, this likely will lead to a decline in commercial...

Read More »China: strong credit growth in March again

Chinese credit data surprised on the upside in March, following a surge in January and a sharp fall in February, but stimulus to the real economy may not be as strong.Chinese credit data surprised on the upside in March, following a surge in January and a sharp fall in February. Monthly total social financing (TSF) came in at Rmb2.86 trillion, much stronger than the market consensus forecast of Rmb1.85 trillion. New bank loans also surprised on the upside at Rmb1.69 trillion, compared with...

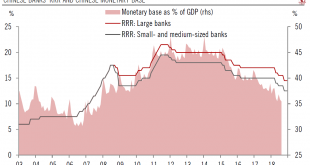

Read More »No massive monetary stimulus on the way from the PBoC

The latest cut in banks’ required reserve ratios seems likely to have been motivated by additional signs of slowdown in the Chinese economy, but may not herald a massive monetary stimulus.Over the weekend, the People’s Bank of China (PBoC) announced a cut of 100 basis points (bps) in banks’ required reserve ratio (RRR). This is the third RRR cut since April. The PBoC estimates that it will free up about Rmb 750 billion of net new liquidity in the banking system. According to the central...

Read More »Work in progress in China

The Chinese government’s work report for 2018 presents its priorities for growth and employment and lays down the roadmap for monetary and fiscal policy this year.China’s National People’s Congress (NPC) meetings are being held during March 5-20. On the first day, Premier Li Keqiang delivered the government work report, in which he outlined the major achievements of the past five years and laid out the key objectives and initiatives for 2018. The contents of the report are largely in line...

Read More »Chinese capital outflow pressure is moderating

Macroview The pace of capital outflows from China has slowed significantly since the central bank intervened in the market earlier this year. Capital outflow pressures remain, but are likely to stabilise at a moderate level going forward.We estimate capital outflows of about USD41 bn in August, roughly the same as in the previous month. This is a much more moderate level of outflows than previously. We estimate that, in all, outflows amounted to USD1.3 tn between Q2 2014 and Q2 2016, with...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org