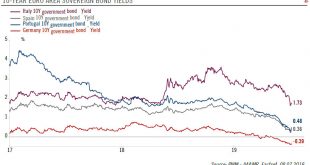

Prospects of more ECB easing has contributed to an across-the-board rally in euro sovereign bonds yields and could help limit volatility in peripheral bonds. Since Mario Draghi in June signalled the European Central Bank’s (ECB) readiness to embark on more easing should the euro area economy fail to regain speed, euro sovereign bonds yields have fallen across the board, with the 10-year Bund yield briefly moving below...

Read More »The ECB moves to keep euro bond yields down

Prospects of more ECB easing has contributed to an across-the-board rally in euro sovereign bonds yields and could help limit volatility in peripheral bonds.Since Mario Draghi in June signalled the European Central Bank’s (ECB) readiness to embark on more easing should the euro area economy fail to regain speed, euro sovereign bonds yields have fallen across the board, with the 10-year Bund yield briefly moving below -0.4% (the same level as the deposit rate) in intraday trading on July 4.We...

Read More »Fiscal battle looms over Italian bonds

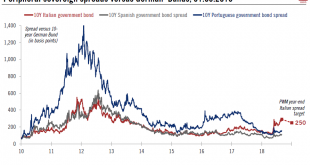

Given the market volatility we expect around 2019 budget discussions in Italy, we remain bearish on euro peripheral bonds in general.Italy is coming back into focus as investors become increasingly nervous about 2019 budget discussions. September will be a key moment to gauge the intentions of the Italian government regarding its 2019 budget. Indeed, more details will become available when the Italian government publishes the updated Economic and Financial Document (DEF), no later than 27....

Read More »Robust outlook supports low Spanish sovereign bond spreads

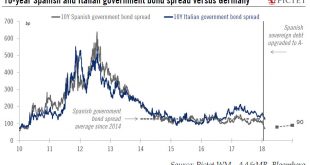

Strong metrics mean we expect the 10-year Spanish government bond spread over Bunds to widen less than we thought before.Strong, relatively broad-based economic recovery and the limited economic impact of the Catalan crisis pushed Fitch to upgrade Spanish sovereign debt by one notch to A-/Stable in January. The upgrade triggered a significant rally, with the spread on Spanish 10-year bonds versus Bunds dropping below 70 basis points (bp) on February 1 for the first time since 2009.The...

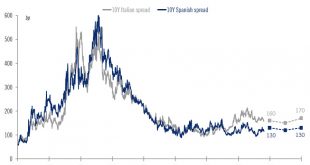

Read More »Italian and Spanish bonds relatively immune to politics

While political risks have fallen marginally in Italy, political tensions have intensified in Spain. But, as things stand, we do not think that political risk in either country will lead to a systemic crisis.Italy and Spain have been at the centre of market attention again in recent weeks. Italian politics have livened up as we move towards the general election next spring 2018, while the threat of Catalan independence has placed the spotlight on Spain. But we expect only a slight widening...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org