The 21% corporate tax rate could cause 2018 expected earnings growth for US stocks to more than double. We see some upside risk to our US equity scenario.Last night, the US Senate approved the tax bill. It has since returned to the House of Representatives for administrative reasons, but, in line with an earlier vote, a green light looks now highly likely. Shortly thereafter, President Trump should sign it formally into law. If the tax reform is adopted, the statutory tax rate is expected to fall from 35% to 21% in January 2018. Ahead of the tax cuts, the expected effective tax rate for the S&P 500 stood at 29% for 2018.All US sectors will benefit from the fiscal boost, even the technology sector, which prior to the bill’s passage had an effective 2018 expected tax rate of 23%.The real

Topics:

Wilhelm Sissener and Jacques Henry considers the following as important: Macroview, US earnings forecasts, US tax bill, US tax reform

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The 21% corporate tax rate could cause 2018 expected earnings growth for US stocks to more than double. We see some upside risk to our US equity scenario.

Last night, the US Senate approved the tax bill. It has since returned to the House of Representatives for administrative reasons, but, in line with an earlier vote, a green light looks now highly likely. Shortly thereafter, President Trump should sign it formally into law.

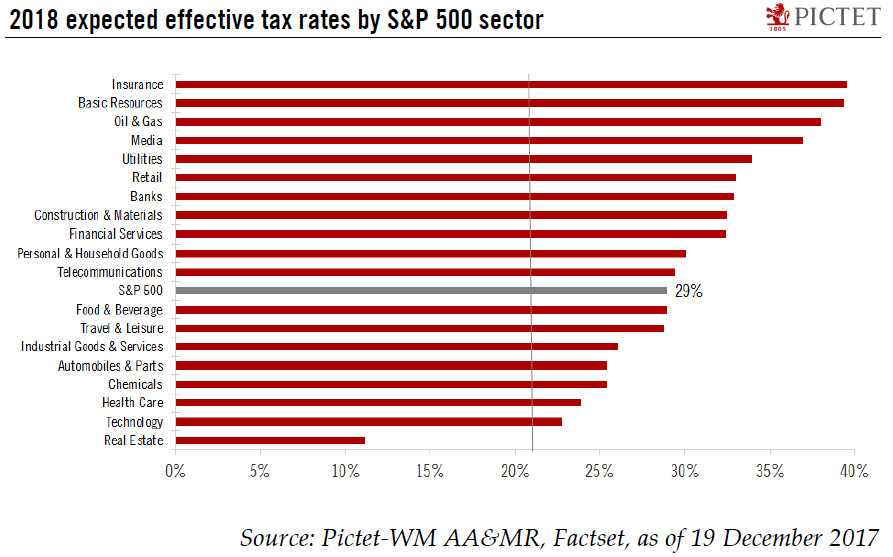

If the tax reform is adopted, the statutory tax rate is expected to fall from 35% to 21% in January 2018. Ahead of the tax cuts, the expected effective tax rate for the S&P 500 stood at 29% for 2018.

All US sectors will benefit from the fiscal boost, even the technology sector, which prior to the bill’s passage had an effective 2018 expected tax rate of 23%.The real estate sector is the only exception, with an effective expected tax rate of 11% 2018.

The reform could cause the 2018 expected earnings growth rate to more than double. The strongest impact is expected to be on the financial sector, which should see its earnings growth almost treble.

Since discussions started at the end of August, markets have discounted fiscal reform with a 3.4% 12-month forward PE ratio expansion.

Our 2018 scenario for US equity markets was based on the assumption that valuation levels at the time did not offer upside potential. This led to expected 2018 total returns matching earnings growth. The US fiscal reform has slightly altered this relationship in H2, with an expansion in the multiple. Accordingly, the US fiscal reform with a major boost in earnings growth provides some further upside risk to our US equity scenario.