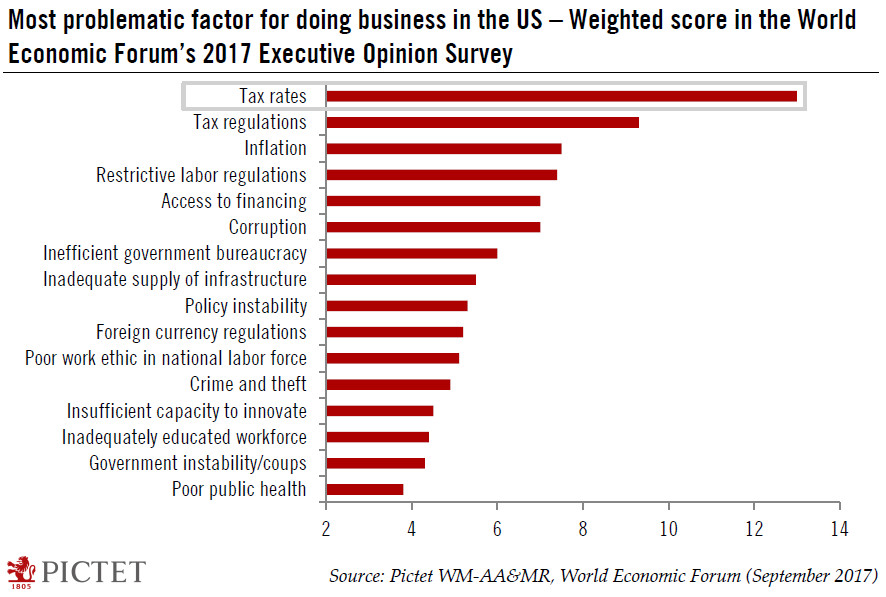

The US is about to enact significant corporate tax cuts, and could therefore edge closer to the number 1 spot in the World Economic Forum’s ranking – currently held by Switzerland.The US is about to enact significant corporate tax cuts, that will see the federal statutory corporate tax rate drop to 21%, from 35%, starting in January (see our latest note ‘US tax cuts update – 19 December 2017’).This will significantly increase the global competitiveness of the US economy, especially as high statutory tax rates were seen as a crucial blemish in an otherwise positive competitive picture. In fact, the 2017 Executive Opinion Survey by the World Economic Forum (WEF) highlighted high tax rates as the main hindrance for doing business in the US (see chart).In the last annual Global

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The US is about to enact significant corporate tax cuts, and could therefore edge closer to the number 1 spot in the World Economic Forum’s ranking – currently held by Switzerland.

The US is about to enact significant corporate tax cuts, that will see the federal statutory corporate tax rate drop to 21%, from 35%, starting in January (see our latest note ‘US tax cuts update – 19 December 2017’).

This will significantly increase the global competitiveness of the US economy, especially as high statutory tax rates were seen as a crucial blemish in an otherwise positive competitive picture. In fact, the 2017 Executive Opinion Survey by the World Economic Forum (WEF) highlighted high tax rates as the main hindrance for doing business in the US (see chart).

In the last annual Global Competititivness survey, the US had risen to 2nd place globally – behind Switzerland – from 3rd place in the past three years and 5th in 2013-14. The cut to the tax rate could provide further impetus to this favourable uptrend in the US’ competitiveness ranking.

That said, Switzerland continues to enjoy key competitive advantages, including its low rate of corporate taxation. Switzerland has a blended (federal and local-level) corporate tax rate of 21.15%, while in the US one should still add state-level taxation of 6.0% (the average according to OECD tax data) to the new 21% federal rate. In addition, Switzerland continues to have stellar budget and public debt metrics: its net debt is 23.0% of GDP in 2017, according to IMF data, compared with 82.5% for the US. Innovation-wise, the WEF also puts Switzerland just ahead of the US.