The BoJ remains the last major central bank still firmly committed to large-scale monetary easing. After its Monetary Policy Meeting of December 21, the Bank of Japan (BoJ) announced its intention to keep its current monetary easing programme intact. The BOJ will continue with its “Quantitative and Qualitative Monetary Easing with Yield Curve Control ”, aiming to achieve and overshoot the core inflation target of 2%....

Read More »The BoJ is sticking to monetary easing

The BoJ remains the last major central bank still firmly committed to large-scale monetary easing.After its Monetary Policy Meeting of December 21, the Bank of Japan (BoJ) announced its intention to keep its current monetary easing programme intact. The BOJ will continue with its “Quantitative and Qualitative Monetary Easing with Yield Curve Control ”, aiming to achieve and overshoot the core inflation target of 2%.The reason for the BoJ deciding to stay put is the stubbornly low inflation...

Read More »The BoJ’s ETF purchases mark a major shift for Japanese equity market

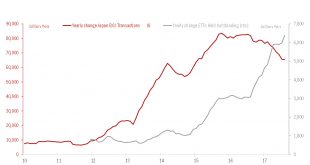

Through its asset purchase programme, the Bank of Japan owns 4% of the TOPIX’s market capitalisation and two-thirds of Japanese equity ETFs.Although it has made no major monetary policy announcement since September 2016, the Bank of Japan (BoJ) has actually been tapering its government bond purchases ever since. As a result, equity ETF purchases have steadily increased over the past year from 3% of total BoJ purchases to 9% recently, above the initial implicit target of 7%.The central bank...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org