US companies are showing little propensity to use healthy profits to increase their investments. We remain prudent about the outlook for US capex in the coming months.A major feature of the US growth recovery since mid-2009 has been the significant improvement in corporate profits. But improvement has been mostly achieved at the expense of investment (capex) and wage growth, which have been kept on a tight leash. This has puzzled policymakers, including the Federal Reserve, which has been somewhat disorientated by such intense corporate cost control, leading it to tilt towards caution when it comes to rate hikes. Q2 corporate profit data released by the Bureau of Economic Analysis* suggest this trend is still in place.Based on NIPA data, corporate profits before taxes rose 7.0% y-o-y in

Topics:

Thomas Costerg considers the following as important: Macroview, US economic activity, US economic projections

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

US companies are showing little propensity to use healthy profits to increase their investments. We remain prudent about the outlook for US capex in the coming months.

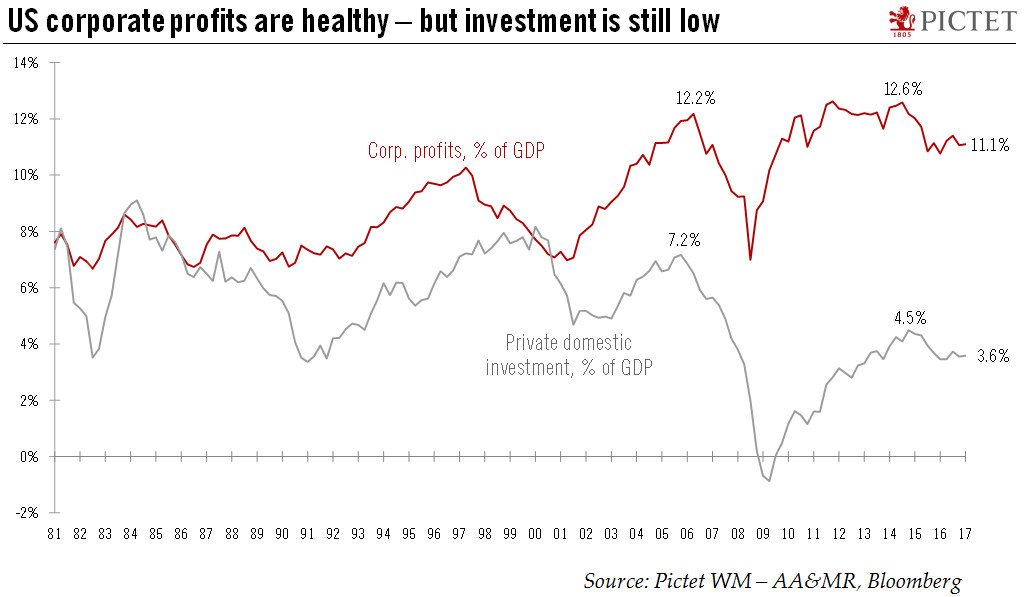

A major feature of the US growth recovery since mid-2009 has been the significant improvement in corporate profits. But improvement has been mostly achieved at the expense of investment (capex) and wage growth, which have been kept on a tight leash. This has puzzled policymakers, including the Federal Reserve, which has been somewhat disorientated by such intense corporate cost control, leading it to tilt towards caution when it comes to rate hikes. Q2 corporate profit data released by the Bureau of Economic Analysis* suggest this trend is still in place.

Based on NIPA data, corporate profits before taxes rose 7.0% y-o-y in Q2, outperforming nominal GDP growth of 3.8%, although profit growth was flattered by base effects (notably turmoil in the US energy sector). As a share of US GDP, corporate profits now stand at 11.1% of GDP, well above the 1981-2017 average of 9.2%. Meanwhile, net private domestic investment remains stuck at just 3.6% of GDP versus a long-term average of 5.3%.

While most business surveys indicate that US companies are bullish on their capex intentions, hard data reveal they are still not putting their money where their mouth is. We therefore remain prudent about the outlook for US capex in the coming months—and about the bullish interpretation of recent surveys. Furthermore, stalling oil prices mean that a major source of capex, the US energy sector, seems to be plateauing, with fewer new oil rigs coming on stream. A regime shift in corporate investment does not seem to be around the corner.