Despite the impressive year-to-date performance of corporate credit, we remain prudent about prospects in the remainder of 2019. Corporate bonds have posted stellar total returns year to date, thanks to the positive combination of lower sovereign yields and tighter credit spreads. While high yield (HY) bonds have performed slightly better than investment grade (IG) ones on both sides of the Atlantic, the additional...

Read More »DM credit caught between opposing forces

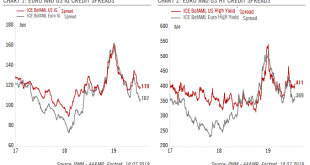

Despite the impressive year-to-date performance of corporate credit, we remain prudent about prospects in the remainder of 2019.Corporate bonds have posted stellar total returns year to date, thanks to the positive combination of lower sovereign yields and tighter credit spreads. While high yield (HY) bonds have performed slightly better than investment grade (IG) ones on both sides of the Atlantic, the additional return from taking more risk remains thin.As cracks continue to appear in both...

Read More »Debt energised

The energy sector in the US climbs back onto the high-yield issuance podium.As 2017 draws to a close, it is worth taking stock of this year’s highlights. On US financial markets, this year will probably be remembered as ‘Goldilocks’ time. Financial conditions have been very accommodative. Initial fears about the impact of the Federal Reserve’s monetary tightening have faded, since the Fed has hiked rates very gradually amid modest inflation. There has been a noticeable uptick in activity on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org