Download issue:Sisyphus was punished by the gods by having to repeatedly roll a boulder up a hill after it rolled back down each time he reached the summit. Today, markets are subjecting the world’s central bankers to the same punishment. According to César Pérez Ruiz, PWM’s Head of Investments & CIO, “each time central banks attempt to normalise monetary policy, the ‘market gods’ compel them to revert to easing mode and lower rates. The result is we are living in an era of economic...

Read More »Weekly View – Powell throws in the towel

The CIO Office's view of the week ahead.After a brief lull, Trump renewed escalating trade tensions with China by threatening new tariffs on USD 300bn of Chinese imports to the US. A global sell-off ensued and the Chinese authorities now appear less inclined to resist renminbi weakness relative to the dollar, having allowed the renminbi to break the CNY7/USD “psychological threshold”. Unsurprisingly, exporter-heavy indices were hit particularly hard in equities, as investors fled to safety,...

Read More »The year of the doves

Download issue:English /Français /Deutsch /Español /ItalianoWith all major central banks now having turned dovish, we can expect the continuation of ultra-low global interest rates in 2019. This is a relief for markets, which have already rallied in response. The greater concern is whether global growth can make a comeback.César Pérez Ruiz, Pictet Wealth Management’s (PWM) Head of Investments & CIO, will be looking for stabilisation in earnings revisions against the current backdrop of...

Read More »Arbitraging between equity investment strategies

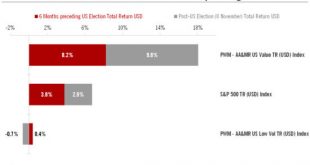

The market leadership of US ’Value' has strengthened considerably in the aftermath of the US elections.The US Value equity strategy’s outperformance has accelerated since the US elections on November 8. Over the 15 trading days following the elections, our Value index returned 9.8% (in US dollars), compared with 8.2% during the preceding six months.Current economic and equity market dynamics reveal an opportunity to arbitrage between two distinct equity investment strategies: US ‘Low Vol’...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org