Overview: The one-two punch of the disappointing US job opening report and the downbeat Beige Book weighs on the US dollar, which is softer against all the G10 currencies. The Canadian dollar is a notable exception. Prime Minister Trudeau's minority Liberal Party lost key support and the Bank of Canada affirmed expectations for more rate cuts. Japan's wage growth was stronger than expected, underscoring the divergence of policy and the dollar was sold to almost...

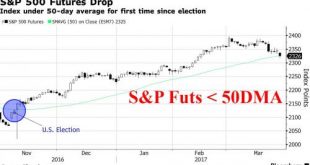

Read More »Global Stocks Slide, S&P Futures Tumble Below 50DMA As “Trump Trade” Collapses

Global stocks are lower across the board to start the week, as concerns about Trump's administration to pull off a material tax reform plan finally emerge, pressuring S&P futures some 20 points lower this morning, following European and Asian shares lower, while crude oil prices fall unable to find support in this weekend's OPEC meeting in Kuwait where a committee recommended to extend oil production cuts by another 6 months. Safe havens including the yen and bonds climbed as did gold,...

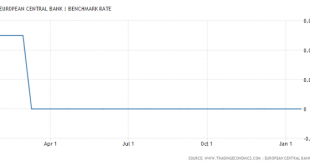

Read More »Interest Rate Differentials Increasing Financial Market Leverage To Unsustainable Levels

We discuss the rate differentials between Switzerland, Britain, Europe, Japan and the United States and how this Developed Financial Markets carry trade is incentivizing excessive risk taking with tremendous leverage and destabilizing the entire financial system in the process in this video. You want to know what is behind weekly market records, borrowed money via punchbowl central bank liquidity. This ends badly every...

Read More »Attack The Fed’s War On Savers, Workers And The Unborn (Taxpayers)

Submitted by David Stockman via Contra Corner blog, The central banks have gone so far off the deep-end with financial price manipulation that it is only a matter of time before some astute politician comes after them with all barrels blasting. As a matter of fact, that appears to be exactly what Donald Trump unloaded on bubble vision this morning: By keeping interest rates low, the Fed has created a “false stock...

Read More »Are Central Banks Setting Each Other Up?

Authored by Mark St.Cyr, There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those times. And if correct? What at first might appear apocryphal, may in fact, be down right apocalyptic. And besides, what good is a tin-foil capped conspiracy theory anyhow if it doesn’t have the potential for doom, correct? So, with that in mind, let’s...

Read More »Are Central Banks Setting Each Other Up?

There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those times. And if correct? What at first might appear apocryphal, may in fact, be down right apocalyptic. And besides, what good is a tin-foil capped conspiracy theory anyhow if it doesn’t have the potential for doom, correct? So, with that in mind, let’s venture down some roads...

Read More »BoJ Adopts Negative Interest Rates, Fails To Increase QE

Well that did not last long. After initial exuberance over The BoJ's wishy-washy decision to adopt a 3-tiered rate policy including NIRP, markets have realized that without further asset purchases (which were maintained at the current pace), there is no ammo to lift stocks. An almost 200 point surge in Dow futures has been erased and Nikkei 225 has dropped 1000 points from its post BOJ highs... Dow futures have plunged... What a mess... And Nikkei has crashed over 1000 points... And...

Read More »Currencies: persistent market volatility should support funding currencies

The risks implied by the Fed’s tightening cycle and the new Chinese monetary regime, among other things, will favour funding currencies over carry currencies in the next twelve months. Instead of looking at single currencies, it is sometimes interesting to look at broader themes to have a better understanding of how a certain group of currencies might behave. Among the best-known themes or strategies are carry trades, which are based on the principle of systematically buying...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org