The flash PMI for the euro area was better than expected in July, although some sub-indexes pointed ahead to a deceleration in the rate of expansion. PMI data indicate a contraction of activity in the UK. Today’s flash PMI surveys for the euro area were more resilient than expected. The euro area composite PMI index eased only marginally in July, from 53.1 to 52.9, according to Markit’s flash estimates. However, some forward-looking indicators point to weaker developments ahead. In the manufacturing sector, the sub-index of new orders fell and there was a sharp drop in business expectations in the services PMI report.The main news was that the improvement in PMI data for Germany and France contrasted with the rest of the euro area. Markit mentioned that for the euro area overall “surveys signalled the weakest rise in activity since December 2014 as growth rates fell in both manufacturing and services”. But in Germany, composite PMI rose to 55.3 in July, its highest level this year, while in France the composite PMI also rose above consensus expectations (to 50.0). Overall, the German PMI report points to solid GDP growth in the current quarter, but we think GDP growth in France is likely to slow markedly in Q2-Q3 following a strong rebound in Q1 (+0.

Topics:

Nadia Gharbi considers the following as important: Composite PMI, Euro area PMI, European business activity, July PMI, Macroview

This could be interesting, too:

Jeffrey P. Snider writes As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

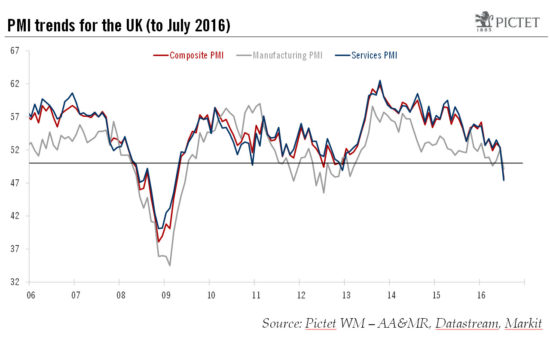

The flash PMI for the euro area was better than expected in July, although some sub-indexes pointed ahead to a deceleration in the rate of expansion. PMI data indicate a contraction of activity in the UK.

Today’s flash PMI surveys for the euro area were more resilient than expected. The euro area composite PMI index eased only marginally in July, from 53.1 to 52.9, according to Markit’s flash estimates. However, some forward-looking indicators point to weaker developments ahead. In the manufacturing sector, the sub-index of new orders fell and there was a sharp drop in business expectations in the services PMI report.

The main news was that the improvement in PMI data for Germany and France contrasted with the rest of the euro area. Markit mentioned that for the euro area overall “surveys signalled the weakest rise in activity since December 2014 as growth rates fell in both manufacturing and services”. But in Germany, composite PMI rose to 55.3 in July, its highest level this year, while in France the composite PMI also rose above consensus expectations (to 50.0). Overall, the German PMI report points to solid GDP growth in the current quarter, but we think GDP growth in France is likely to slow markedly in Q2-Q3 following a strong rebound in Q1 (+0.6% quarter over quarter), if only because the 4% annualised growth since in the first quarter in domestic demand does not look sustainable.

In contrast with France and Germany, first-time flash estimates for the UK showed a marked decline in business activity in July. The composite PMI for the UK fell to 47.7 in July, its lowest level since April 2009, with sharp drops in new orders and business expectations. The only bright spot was the increase in the sub-index for new exports, on the back of a fall in sterling.

Overall, for the moment, we are leaving unchanged our GDP growth forecasts for 2016 for the euro area and the UK at 1.5% and 1.3%, respectively. However, with more data coming soon, the real extent of the Brexit vote still remains to be seen.