Macroview The German 10-year Bund yield should rise only slightly from its current negative level. Peripheral bond spreads over Bunds should remain volatile. The financial markets’ reaction to the UK's Brexit referendum, together with the change in our economic scenarios as a result of UK voters’ decision to leave the European Union, are leading us to change our forecast for euro area bonds, particularly our forecasts for the German 10-year Bund and for yield spreads over Bunds for government bonds on the euro area periphery (Italy, Spain and Portugal).We have lowered our forecast for the German 10-year Bund yield at end-October 2016 to 0.08% from a previous forecast of 0.8%. While we believe the Bund yield should rise from its current levels (the 10-year Bund yield stood at about -0.08% on July 28), it will remain under downward pressure due to political and economic uncertainty related to Brexit and to the euro area itself (for example, a constitutional referendum in Italy in October, the issue of Italian banks’ nonperforming loans, or NPLs). Possible extension of the European Central Bank’s quantitative easing programme will also put downward pressure on German Bund yields and we remain conscious that possible spikes in volatility could force Bund yields down again.

Topics:

Laureline Chatelain considers the following as important: bond spreads, Bund yields, euro area bonds, Macroview, peripheral bonds

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The German 10-year Bund yield should rise only slightly from its current negative level. Peripheral bond spreads over Bunds should remain volatile.

The financial markets’ reaction to the UK's Brexit referendum, together with the change in our economic scenarios as a result of UK voters’ decision to leave the European Union, are leading us to change our forecast for euro area bonds, particularly our forecasts for the German 10-year Bund and for yield spreads over Bunds for government bonds on the euro area periphery (Italy, Spain and Portugal).

We have lowered our forecast for the German 10-year Bund yield at end-October 2016 to 0.08% from a previous forecast of 0.8%. While we believe the Bund yield should rise from its current levels (the 10-year Bund yield stood at about -0.08% on July 28), it will remain under downward pressure due to political and economic uncertainty related to Brexit and to the euro area itself (for example, a constitutional referendum in Italy in October, the issue of Italian banks’ nonperforming loans, or NPLs). Possible extension of the European Central Bank’s quantitative easing programme will also put downward pressure on German Bund yields and we remain conscious that possible spikes in volatility could force Bund yields down again.

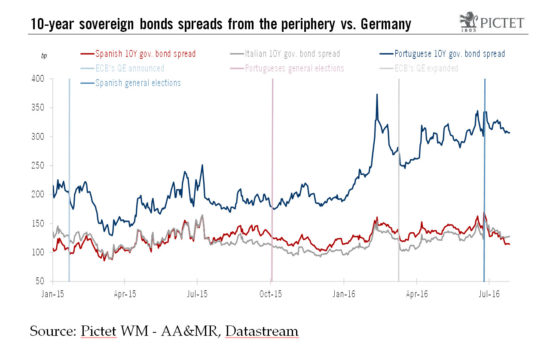

Indeed, the complicated political environment in Italy, Spain and Portugal has led to a renewed focus on credit risk and the possible impact of political changes on fiscal and economic policies. We therefore expect 10-year peripheral bond spreads over Bunds to remain volatile, with Italy underperforming Spain due to higher idiosyncratic risks (the referendum and banks’ NPL problems). The yield spread on Portuguese 10-year bonds should also remain higher than for Spanish equivalents as long as Portugal’s left-wing government does not shift to more market-friendly economic policies.