China is actively trying to loosen the link between the Chinese yuan and the US dollar. In 2016 the divergence in monetary policies should prompt a gradual move towards CNY6.70 per USD. Since the beginning of November, the Chinese yuan (also known as the renminbi) has moved from roughly CNY6.32 per USD to CNY6.46 per USD, with an acceleration over the past few days. This depreciation means that the Chinese yuan has lost more than 2% against the US dollar, rekindling fears of a broad CNY devaluation instrumented by China. While we do not believe this will be the case, it does highlight a significant shift in China’s monetary policy. The “Impossible Trinity” One of the key reasons for the change in the Chinese yuan fixing on 11 August stems from Mundell’s “Impossible Trinity”. As China wants to open up its capital markets (and reduce its capital controls) and keep an independent monetary policy, it has to loosen its tight rein on the exchange rate. Whereas the Fed is set to raise rates in December and again in 2016, the People’s Bank of China (PBoC) is looking to cut rates to fight persistent disinflationary pressures. Consequently, the Chinese yuan should depreciate against the US dollar.

Topics:

Luc Luyet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

China is actively trying to loosen the link between the Chinese yuan and the US dollar. In 2016 the divergence in monetary policies should prompt a gradual move towards CNY6.70 per USD.

Since the beginning of November, the Chinese yuan (also known as the renminbi) has moved from roughly CNY6.32 per USD to CNY6.46 per USD, with an acceleration over the past few days. This depreciation means that the Chinese yuan has lost more than 2% against the US dollar, rekindling fears of a broad CNY devaluation instrumented by China. While we do not believe this will be the case, it does highlight a significant shift in China’s monetary policy.

The “Impossible Trinity”

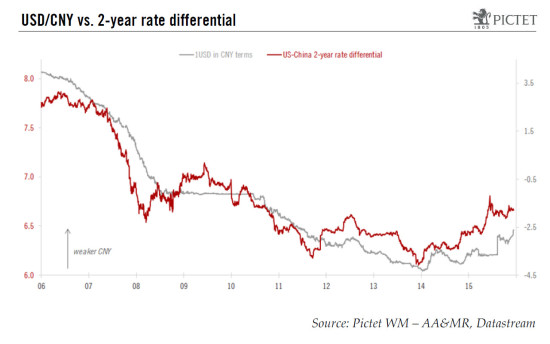

One of the key reasons for the change in the Chinese yuan fixing on 11 August stems from Mundell’s “Impossible Trinity”. As China wants to open up its capital markets (and reduce its capital controls) and keep an independent monetary policy, it has to loosen its tight rein on the exchange rate. Whereas the Fed is set to raise rates in December and again in 2016, the People’s Bank of China (PBoC) is looking to cut rates to fight persistent disinflationary pressures. Consequently, the Chinese yuan should depreciate against the US dollar. While the PBoC probably has enough forex reserves to keep the Chinese yuan stable against the US dollar in 2016, the recent trend of the USD/CNY suggests that the Chinese central bank is slowly moving away from a managed-float FX regime, with large FX interventions, to a market-driven FX regime, with fewer FX interventions.

PBoC targeting a CNY basket

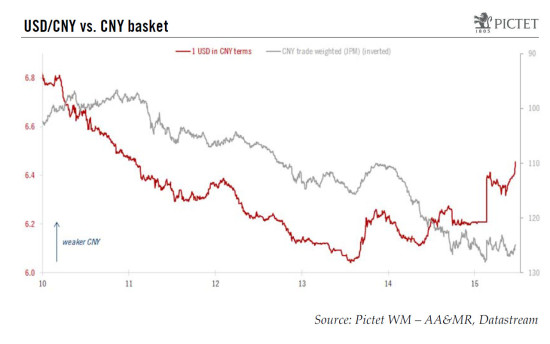

On 11 December, the PBoC announced the publication of a renminbi index as a way to better “capture the competitiveness of a country’s goods and services”. While there is nothing ground-breaking about such an announcement, given that other central banks do the same, it does suggest a significant shift in currency policy. Indeed, since 2005, although the Chinese yuan was officially pegged to a basket of currencies (with undisclosed weights), it has in practice been closely linked to the US dollar. As a result, any depreciation or appreciation of the Chinese yuan was always compared to the US dollar. However, it is becoming increasingly clear that the PBoC is now targeting its currency against a basket of currencies and not just the US dollar. The published weights of the new CNY basket show that the three largest components are the USD with 26.40%, the EUR with 21.39% and the JPY with 14.68%. Therefore, when the PBoC talks about a stable exchange rate, it means stable compared to a weighted average of different currencies like the US dollar, the euro and the Japanese yen and not just the US dollar.

PBoC unlikely to welcome a CNY that is too strong

With the new CNY fixing announced on 11 August, the PBoC has paved the way for a more market-driven movement of its currency at a time when the Fed was hesitating to raise rates in September. The publication of this renminbi index to “help guide market participants to shift their focus” from the bilateral USD/CNY exchange rate to the trade-weighted exchange rate “in their efforts to observe exchange-rate movements” just a few days before a probable Fed hike is a clear signal that the PBoC is ready to loosen its grip on the USD/CNY. Indeed, with sustained disinflationary pressures in China and a structural shift in its economic growth model, a stronger Chinese yuan on a trade-weighted basis would be unwelcome. As the PBoC sees its currency as fairly valued on a trade-weighted basis, China is increasingly willing to leave more freedom to its currency against the US dollar should the greenback continue to appreciate. In other words, a stable CNY basket could entail depreciation of the yuan against the US dollar if the greenback moves up against the basket of currencies.

USD/CNY driven up by stronger USD

The divergence in monetary policies favours a strong US dollar against most currencies, notably the euro and the yen. In China, the more market-driven regime since 11 August and the shift in focus towards managing CNY against a basket since 11 December mean that the yuan will likely have to depreciate against the US dollar to keep the CNY basket close to its fair value. However, this does not point towards a sharp decline of the yuan against the greenback. First of all, a US dollar that is too strong would likely lead to a slowdown in the pace of the Fed’s tightening cycle, thus hurting the US dollar. Second, a sharp devaluation of the Chinese yuan against the US dollar would be detrimental to China’s wish to open up its capital markets (where the inclusion of the CNY in the Special Drawing Rights basket was merely a milestone). Finally, the PBoC has enough FX reserves to manage an orderly depreciation of its currency against the US dollar. Overall, then, if the US dollar does remain strong in 2016, the PBoC is likely to leave its currency grinding towards CNY6.70 per US dollar.