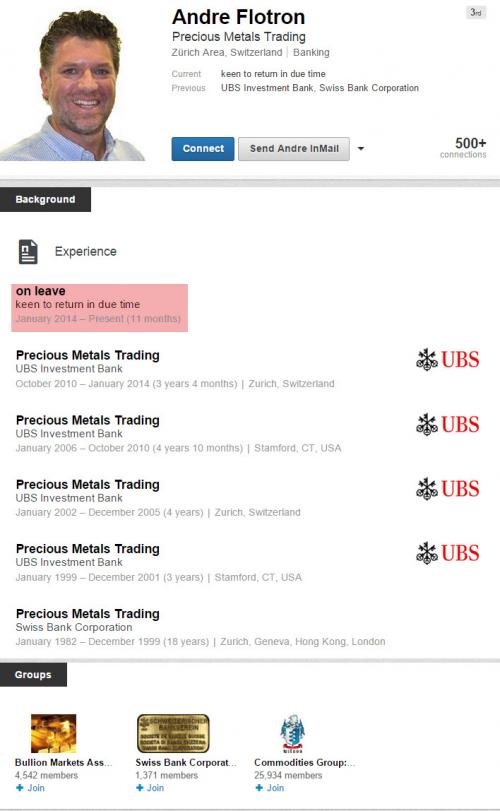

Three years after we first identified the former head of UBS's gold desk in Zurich as someone directly implicated in the rigging of precious metals prices, Bloomberg reports that Andre Flotron, a Swiss resident, was arrested while visiting the U.S., according to people familiar with the matter. Having been "on leave" since 2014, it appears ...

Topics:

Tyler Durden considers the following as important: Bloomberg News, Business, Chemical elements, Department of Justice, Deutsche Bank, economy, Finance, Gold as an investment, Law, Money, Native element minerals, Noble metals, Palladium, Precious Metals, Spoofing, Switzerland, Switzerland’s Financial Market Supervisory Authority, Transition metals, UBS, Zurich

This could be interesting, too:

investrends.ch writes Der Franken als letzter sicherer Hafen: Wenn die Welt am Dollar zweifelt

investrends.ch writes ODDO BHF holt UBS-Managerin Simone Westerfeld als stellvertretende CEO

investrends.ch writes Hedgefonds-Branche erlebt Gründungsboom – Kapital erreicht Rekordhöhe

investrends.ch writes UBS: Schweizer Pensionskassen bleiben risikobewusst – doch sie können die Rendite halten

Three years after we first identified the former head of UBS's gold desk in Zurich as someone directly implicated in the rigging of precious metals prices, Bloomberg reports that Andre Flotron, a Swiss resident, was arrested while visiting the U.S., according to people familiar with the matter.

Having been "on leave" since 2014, it appears Andre's hope that he was gone but "keen to return in due time" are now up in smoke.

As Bloomberg reports, Flotron was charged with conspiracy, wire fraud, commodities fraud and spoofing, according to a prepared complaint, and is the second person publicly charged in the U.S. investigation into the fixing of gold, silver, platinum and palladium prices.

As a a reminder, in June, David Liew, a former Deutsche Bank AG trader, pleaded guilty to fraud in federal court in Chicago for his role in the spoofing of contracts for gold, silver, platinum and palladium, according to court papers. Along with spoofing, he also acknowledged front-running customers’ orders.

Flotron’s arrest extends the Justice Department’s examination of whether bank traders conspired to rig interest-rate benchmarks and manipulate currency exchanges.

The probes, which led to guilty pleas and billions of dollars in payouts by some of the world’s biggest banks, also led prosecutors to begin investigating whether metals traders were placing orders without the intent of executing them in an attempt to move prices in their favor, a tactic known as spoofing.

“Flotron and his co-conspirators placed one or more large orders for precious metals futures contracts on one side of the market which, at the time Flotron and his co-conspirators placed the orders, they intended to cancel before execution,” the complaint said.

Swiss regulators have also shown an interest in Flotron, telling him in a2014 letter of a possible enforcement action, two people told Bloomberg News at the time.

It’s unclear whether Switzerland’s Financial Market Supervisory Authority disciplined him.

So it seems another conspiracy theory becoems conspiracy fact.

Thank you Monsieur Flotron for teaching us how market manipulators "trade" gold - Recall from 2013, when Flotron was 'trading', what "a humble block of 2000 gold futs (GC) taking out the bid stack, and slamming the price of gold, managed to halt the gold market: one of the largest "asset" markets in the world in terms of total notional, for 20 seconds" looks like: