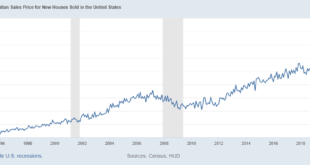

New home sales were reported for July as down nearly 13% to 511K, a number that is just about the average since 2010 (543k). But that doesn’t tell the whole story obviously. New home sales have fallen sharply since December of last year, down 39%. The drop from the peak in August 2020 is even more dramatic, down nearly 51%. Obviously, the fall this year is related to rising mortgage rates but that can’t be the reason sales have been falling for nearly two years....

Read More »Monthly Macro Monitor – September 2020

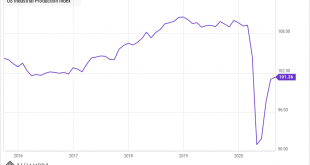

The economic data over the last month continued to improve but the breadth of improvement has narrowed. Additionally, while most of the economic data series are still improving, the rate of change, as Jeff pointed out recently, has slowed. I guess that isn’t that surprising as the initial phase of the recovery comes to an end. 2nd quarter was a giant downdraft and 3rd quarter saw an initial rapid climb out the giant hole dug by the shutdowns (an own goal of epic...

Read More »Bi-Weekly Economic Review: Gridlock & The Status Quo

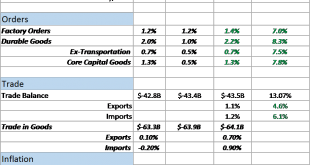

The good news is that the economy just printed its second consecutive quarter of 3% growth, a feat not accomplished since Q2 and Q3 2014. The bad news is that the growth spurt in 2014 was better, quantitatively and qualitatively. Those two quarters produced gains of 4.6% and 5.2% (annualized) in GDP, much better than the most recent 3.1% and 3% prints of Q2 and Q3 2017. And it took a hurricane to get the most recent...

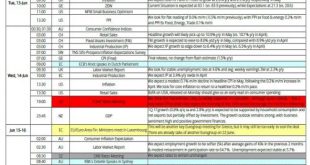

Read More »Key Events In The Coming Week: All Eyes On Fed Balance Sheet Announcement

This week attention will fall on US FOMC rate decision, BoJ policy rate announcement, German and NZ elections. Economic data releases include PMI in the Euro area, retail sales in the UK and existing home sales in US. In Emerging Markets, there are monetary policy meetings in South Africa, Indonesia, Hungary, Taiwan and Philippines. BofA highlights the week's key global events: Central bank meetings: US FOMC and BoJ The Fed will make policy announcement on Wednesday. Balance sheet...

Read More »Bi-Weekly Economic Review: Extending The Cycle

This economic cycle is one of the longest on record for the US, eight years and counting since the end of the last recession. It has also been, as almost everyone knows, a fairly weak expansion, one that has managed to disappoint both bull and bear. Growth has oscillated around a 2% rate for most of the expansion, falling at times perilously close to recession while at others rising tantalizingly close to escape...

Read More »Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece. Wednesday’s FOMC will be the main event, with the Fed expected to hike 25bp...

Read More »A Biased 2017 Forecast, Part 1

“The idea that the future is unpredictable is undermined every day by the ease with which the past is explained.” – Daniel Kahneman, Thinking, Fast and Slow A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after...

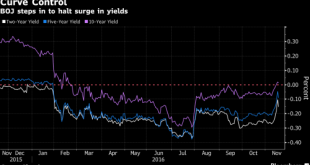

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More »FX Daily, October 11: The Dollar Remains Bid

Swiss Franc EUR CHF - Euro Swiss Franc, October 11 2016(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar is bid against all the major and most emerging market curerncies. An important driver is the backing up of US rates. The two-year yield, which is particularly sensitive to Fed policy is at it highest levbel since early June (~86 bp). The US 10-year yield is five basis points hihger...

Read More »Global Stocks Slide, S&P Set To Open Red For The Year As Hawkish Fed Ignites “Risk Off”

After yesterday's algo-driven mad dash to close the S&P green both for the day and for the year following Fed minutes that came in shocking hawkish, the selling has continued overnight, led by the commodity complex as rate hike fears have pushed oil back down some 2% from yesterday's 7 month highs, which in turn has dragged global stocks lower to a six-week low, while pushing bond yields higher across developed nations as the market suddenly reprices the probability of a June/July rate...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org