In a paper, Reto Föllmi and Isabel Martínez document trends in income and wealth inequality in Switzerland over the last 100 years. Daniel Hug reports in the NZZaS (figures below taken from NZZaS). Data (World Wealth and Income Database, based on tax records). Some findings: Income inequality has been rather stable and is modest … … although social mobility as reflected in educational attainment is low. Income inequality at the very top has increased. The top 1% of income recipients earn at least CHF 300 000 annually (net income before tax), the top 0.01% at least CHF 4 million. Wealth is distributed much more unequally. The top 1% own roughly 40%, slightly more than in the United States and twice as much as in France and the UK. The wealth distribution is more equal if retirement

Topics:

Dirk Niepelt considers the following as important: Education, Income inequality, inequality, Notes, Public education, Switzerland, Wealth inequality

This could be interesting, too:

Investec writes The best places to be a working woman in 2025 – Switzerland near the bottom

Fintechnews Switzerland writes Top 12 Fintech Courses and Certifications in Switzerland in 2025

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Dirk Niepelt writes Does the US Administration Prohibit the Use of Reserves?

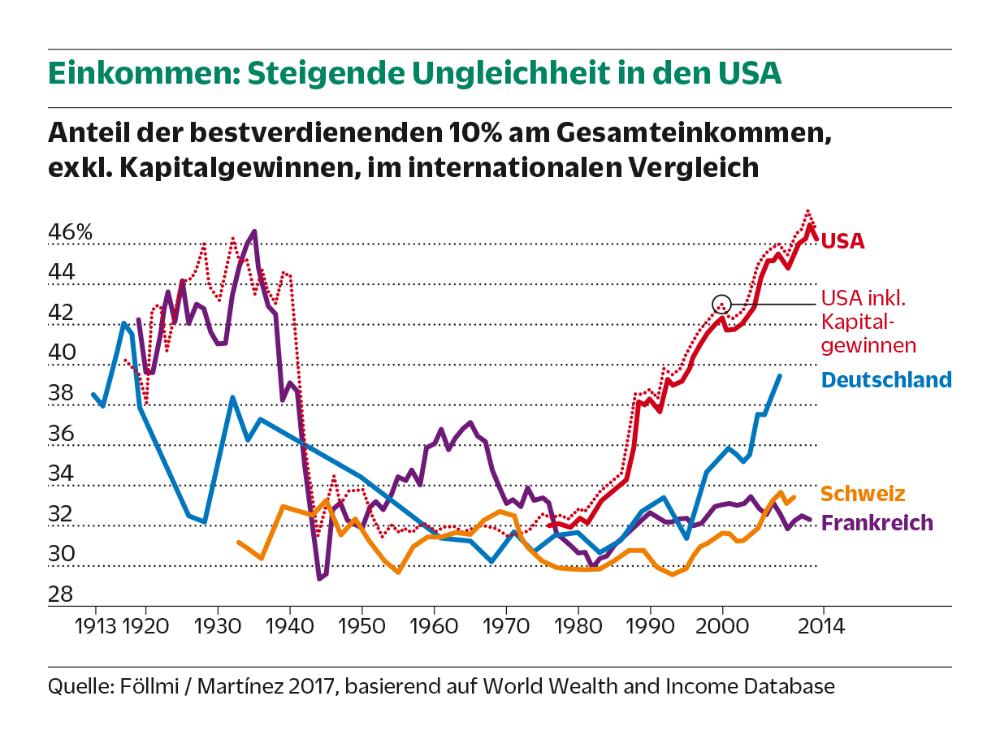

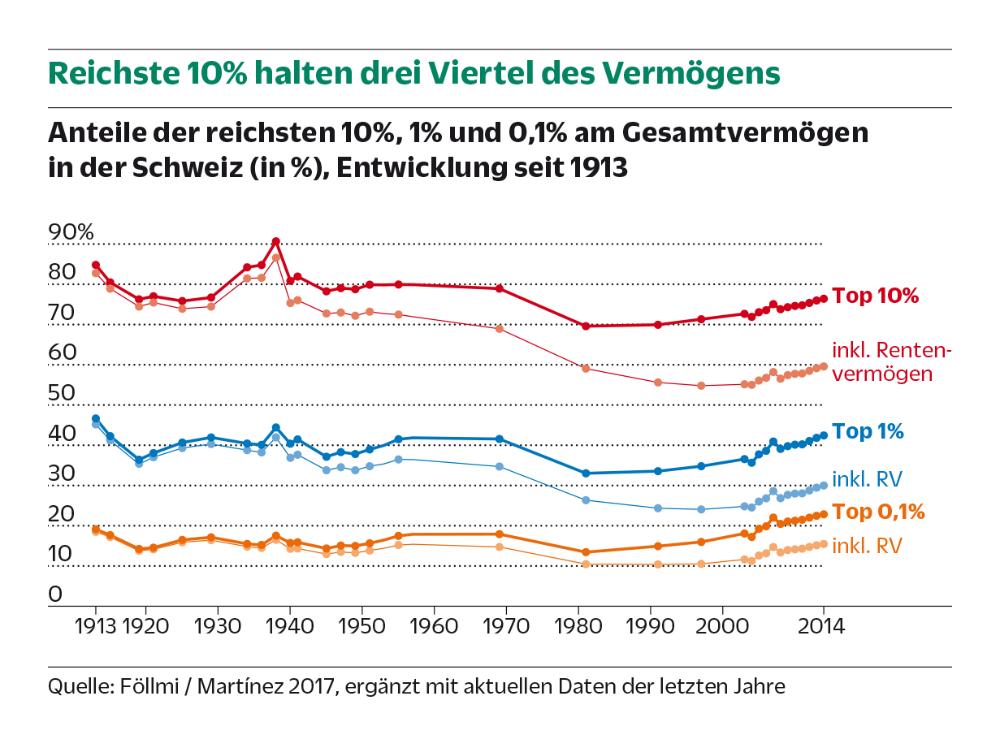

In a paper, Reto Föllmi and Isabel Martínez document trends in income and wealth inequality in Switzerland over the last 100 years.

Daniel Hug reports in the NZZaS (figures below taken from NZZaS).

Data (World Wealth and Income Database, based on tax records).

Some findings:

- Income inequality has been rather stable and is modest …

- … although social mobility as reflected in educational attainment is low.

- Income inequality at the very top has increased.

- The top 1% of income recipients earn at least CHF 300 000 annually (net income before tax), the top 0.01% at least CHF 4 million.

- Wealth is distributed much more unequally. The top 1% own roughly 40%, slightly more than in the United States and twice as much as in France and the UK.

- The wealth distribution is more equal if retirement savings in the second and third pillar are accounted for. PAYG funded pensions (first pillar) also contribute towards reducing inequality after taxes and transfers, much more so than taxes.