Much has been said and written over the last years on the topic of the gradual elimination of cash that we witness in our economic activity and everyday transactions. The massive and widespread political campaigns and practical measures geared at making cash a thing of the past and encouraging the use of electronic money instead have been a deeply divisive issue, especially as the institutional pressure intensifies. The push for a cashless society It is true that the rise of plastic money, online payments and electronic transactions has been to a large extent the result of technological progress, faster and more reliable processing systems, as well as consumers’ familiarity with the online world and automation that increased exponentially in the last decades. However, it wasn’t just

Topics:

Claudio Grass considers the following as important: Claudio Grass, Economics, Fiat money, Finance, Gold, media propaganda, Politics, property rights, Thoughts, War on cash

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Investec writes Swiss milk producers demand 1 franc a litre

Much has been said and written over the last years on the topic of the gradual elimination of cash that we witness in our economic activity and everyday transactions. The massive and widespread political campaigns and practical measures geared at making cash a thing of the past and encouraging the use of electronic money instead have been a deeply divisive issue, especially as the institutional pressure intensifies.

The push for a cashless society

It is true that the rise of plastic money, online payments and electronic transactions has been to a large extent the result of technological progress, faster and more reliable processing systems, as well as consumers’ familiarity with the online world and automation that increased exponentially in the last decades. However, it wasn’t just progress alone that fueled this move. Significant political and institutional pressure on consumers to adopt these methods and abandon cash altogether has been building up for years. And while the arguments might have varied in the past, the goal has always been a cashless society.

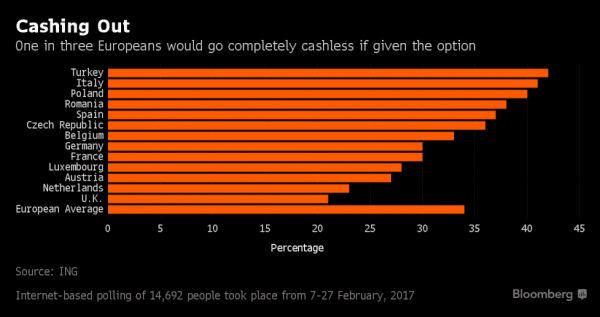

As Manfred Gburek outlined in his recent article on the matter, the quality of the debate that reaches the average citizen is particularly poor, as most arguments are emotional and largely lack any kind of rational or factual basis. This is also compounded by the scare tactics employed by political figures and institutional voices in their efforts to justify anti-cash measures and legislation. While the usual sales pitches in favor of electronic money once mainly focused on convenience, the advantages of modern technologies and the elimination of the burden of having to carry physical notes, they largely failed to convince citizens of cash-loving countries with a tradition and strong preference for spending physical money over plastic. This is particularly relevant in Europe, where the adoption rates of electronic money have been especially diverse. Nordic states have been eager to make the transition from cash, while others have shown fierce resistance, like Germany and Switzerland, where over 70% of all transactions are still in cash, according to a recent study by the SNB.

Hence, a very different message was adopted. Instead of exalting the virtues of electronic transactions, the focus shifted to demonizing cash. The new narrative now aims at stoking fear, security concerns and casting suspicions over those who insist on retaining the choice to use cash. Doubts over the motives of the cash-loyalists are widely dispersed, as the choice of physical notes is increasingly intertwined with having something to hide.

An all too common example of this sort of rhetoric is the argument that physical paper notes of a high denomination are used by criminals and terrorists, to facilitate their nefarious activities and help them conduct their evil business untraced. Thus, the narrative goes, it makes sense and it is absolutely worth it to bar all citizens from using these notes for legitimate purposes, if it means making the operational processes of the bad actors a little bit more complicated. It is obvious that the argument is seriously flawed, as criminals notoriously use all kinds of goods and transaction vehicles, from art pieces to illicit drugs, and are therefore very unlikely to be severely affected by such a move; at best, it would cause some annoyance and temporary inconvenience. Nevertheless, this still acted as the main selling point for the 2016 ECB’s decision to scrap the EUR 500 note, a move that was finally completed at the end of April, when the central banks of Germany and Austria stopped printing the note, the last ones to do so in the Eurozone.

Overall, this slow but steady shift, fueled by the idea that limiting everyone’s options is a small price to pay to stop a few bad actors, is nothing new. Restricting various rights, from privacy to financial sovereignty, or sacrificing them altogether, for the sake of security is historically among the oldest moves in the political playbook. What is different this time, however, is that thanks to the meteoric rise of technological advancements in processing systems and data management, the means to enforce these limitations have never been more capable of such a widespread economic, political and social impact.

What’s at stake

Naturally, privacy is among the first victims of the war on cash. A concrete way in which this is achieved is through the already widespread legislation that lowers the cash amount thresholds above which every transaction must be reported or is just simply illegal. Italy and France are leading the way, having made cash transactions over EUR1000 illegal, while Spain doesn’t lag too far behind with a limit of EUR 2500. Forcing an increasingly large portion of the economic activity onto electronic systems has a dire effect on the citizen’s privacy rights. Especially given the capabilities of big data technologies and the granularity of the analysis that they can deliver, the information that a centralized authority can have access to has terrifying implications. Spending habits and other transaction-related data can be used to form patterns and include information pertaining to everything from social and professional circles to political inclinations and affiliations. Some might argue that knowing about it and acting upon it are two very different things and that it is a leap to suppose that any government might weaponize this data to practically further its political agenda or to penalize dissenting voices. And yet, dystopian as it might seem, we already have examples that clearly demonstrate the ominous potential of going down this path.

China’s infamous “social credit” system, set to fully go live next year, is based on massive data collection and is aimed at rating and eventually standardizing the behavior of its citizens. By rewarding behaviors that the Party deems desirable and penalizing “offenders”, the system’s goal is a uniformly positive and harmonious society, according to government-defined parameters, while it also encourages citizens to report on each other and to denounce the rule breakers. An essential ingredient for this to work has been the government’s access to the citizens’ financial data. An extensive range of economic activity information has been fed into the system, from transactions and spending habits to debt and credit data.

One of the most recent examples of the real-life implications of using financial data in this manner surfaced at the beginning of the year, when a court published a “map of deadbeat debtors” on the popular social media platform WeChat. As described by China Daily, “users are given an on-screen radar, which allows them to discover if there is anyone who owes money within a 500-meter radius.” Citizens in the area are then encouraged to contact the authorities if they know a person whose name appears on that map and have reason to believe that they can afford to pay back their debt. Now one might argue that it is morally a good thing to motivate those who can to pay back their debts, but this is not the point. The point is that this strategy sows division in society and increases the government’s power over its citizens. And as we all know; power corrupts and absolute power corrupts absolutely.

Other pilot programs and early trials of the new system have also demonstrated its horrifying potential in allowing the state to exert total control over the lives of its citizens. Pilot schemes have seen travel bans used as punishment for those with low social scores, with over 9 million people being denied the right to buy tickets for domestic flights and another 6 million banned from traveling by train. The pilot projects also included offering material rewards to citizens who help the authorities enforce restrictions of religious practices, reporting those who pray publicly or members of the intensely targeted Uyghur Muslim minority who fast during Ramadan.

Claudio Grass, Precious Metals Advisory Switzerland

In the upcoming second part, we’ll examine the economic and human cost of these policies and their impact on society, while we’ll also look at the options that remain open to investors and savers who value their privacy and financial sovereignty.

Bildrechte: © v.poth / Foltolia