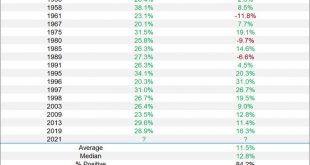

“Crypto’s Crash,” says some financial news headlines. The reality is Bitcoin, Ethereum and others are down about 10-15% in the last few days. The word “crash” may seem appropriate to describe the sharp decline, except 10%+ moves in a matter of days is the norm, not the exception for crypto. Ignoring the crypto crash, the S&P 500 went higher. The index is up over 25% this year. Despite such an outsized gain, the table below from LPL Research argues we should be...

Read More »Call to tap potential of professional working women

Six out of ten women lawyers in Switzerland work part-time. Keystone / Anthony Anex Women make up half of the highly skilled workforce in Switzerland, but work fewer hours, according to a study published on Tuesday. One in three would like to work more, under certain conditions. Women often opt for part-time work, and the liberal professions are no exception, says the studyExternal link carried out by the Sotomo Institute for the Swiss Union of Liberal Professions...

Read More »Biden’s Infrastructure Plan Points to Even More Price Inflation

What is the worst thing a government can do when there is high inflation and supply shortages? Multiply spending on energy and material-intensive areas. This is exactly what the US infrastructure plan is doing and—even worse—what other developed nations have decided to copy. If you thought there were problems of supply and difficulties to access goods and services in the middle of a strong recovery, imagine what will happen once central banks and governments turn the...

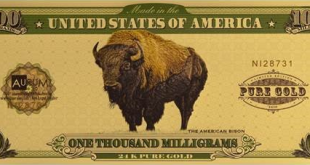

Read More »Monetary Metals Proves Marketplace for Gold Yield with Valaurum Gold Lease

Scottsdale, Ariz – November 16, 2021 – Monetary Metals is pleased to announce a new gold lease to Valaurum to expand production of the Aurum®, their physical gold currency product. The lease size has grown by 800%. Example of the Aurum®. Investors in the Monetary Metals gold lease are earning 2.25% interest on gold to finance production of the Aurum®, Valaurum’s physical gold currency product. “We’re thrilled to get a new gold lease with Monetary Metals to scale up...

Read More »Markteinbruch bedeutet nicht das Ende des Bitcoin Bullenruns

Zumindest wenn wir Nigel Green glauben können. Heute hat der Markt deutlich eingebüßt. Nahezu alle größeren Cryptocoins verloren im zweistelligen Prozentbereich. Ausgelöst wurde der Markteinbruch vor allem durch einen Cash-Out im BTC-Markt – Bitcoin selbst gab ungefähr 8 Prozent ab. Bitcoin News: Markteinbruch bedeutet nicht das Ende des Bitcoin Bullenruns Doch laut Nigel Green gibt es keinen Grund zur Sorge. Der CEO der DeVere Group glaubt nicht, dass die Rallye...

Read More »Weekly View – Big Splits

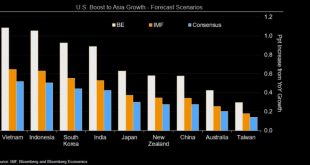

. US prices continue to rise, with the US consumer price index (CPI) for October coming in at its highest in three decades. President Biden made a boldly worded response as inflation becomes a growing focus among politicians with their eyes fixed on next year’s midterm elections. Oil prices fell on investors’ expectations that the US could free up strategic reserves to combat energy inflation. At the same time, bond yields rose on the back of the CPI release, but the...

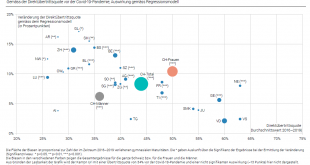

Read More »Wide variation in pandemic’s impact on post-compulsory education and training pathways

Due to the COVID-19 pandemic, academic Baccalaureate holders were much faster to transition to a higher education institution in 2020. This led to a record number of new students in the universities and institutes of technology. Transitions after a federal vocational or specialised Baccalaureate saw hardly any change. In vocational education and training (VET), the coronavirus crisis has only had a slight impact to date. These are findings from two new publications...

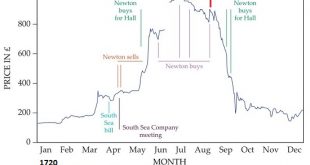

Read More »Paging Isaac Newton: Time to Buy the Top of This Bubble

Despite Newton’s tremendous intelligence and experience, he fell victim to the bubble along with the vast herd of credulous greedy punters. One of the most famous examples of smart people being sucked into a bubble and losing a packet as a result is Isaac Newton’s forays in and out of the 1720 South Seas Bubble that is estimated to have sucked in between 80% and 90% of the entire pool of investors in England. Some have claimed that Newton did not buy early in...

Read More »Perversity Thy Name is Dollar

[unable to retrieve full-text content]Breaking Down the Dollar Monetary System If you ask most people, “what is money?” they will answer that money is the generally accepted medium of exchange. If you ask Google Images, it will show you many pictures of green pieces of paper. Virtually everyone agrees that money means the dollar.

Read More »#RestartVienna at an unforgettable 10th Austrian Economics Conference – 1st Day

On November 4-5, the 10th Austrian Economics Conference took place at the Austrian Central Bank (Österreichische Nationalbank). The event was organized in collaboration with the Fundación Bases and the Hayek Institut and received more than 150 academics, researchers, think-tankers, entrepreneurs, and student advocates of the ideas of freedom from all over the world. #RestartVienna became a great motivation for the promoters of the ideas of the Austrian School to...

Read More » SNB & CHF

SNB & CHF