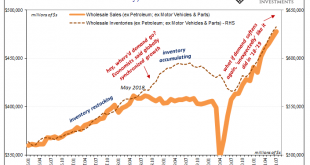

This is yet another one of those crucial recent developments which should contribute much clarity about the economic situation, yet is exploited in other ways (political) adding only more to the general state of economic confusion. The shelves may be empty in a lot of places around the country, leaving anyone with the impression there just aren’t enough goods. Shortage of goods, everyone’s thinking, by virtue of economics (small “e”) it will be another significant...

Read More »China kostet der Crypto-Bann eine Billionen Dollar

Gerüchten zufolge bereut man in Peking längst den Crypto-Bann, der vor wenigen Monaten landesweit ausgesprochen wurde. Dieser hatte den Crypto Mining Markt durchgerüttelt und die vermeintliche Monopolstellung des Landes in diesem Sektor zerstört. Crypto News: China kostet der Crypto-Bann eine Billionen Dollar Assets im Wert von 10 Milliarden US-Dollar wurden durch die Politik Pekings jährlich aus dem Land gejagt. Bei einer prognostizierten Wachstumsrate des Marktes...

Read More »FATF hat ihre Bekanntgabe aktualisiert

Die FATF hat an ihrer Plenarsitzung im Oktober 2021 ihre Bekanntgabe zu Hochrisiko- und weiteren unter Beobachtung stehenden Ländern aktualisiert. Weiterführende Informationen sind verfügbar unter: The Financial Action Task Force (FATF) ist ein internationales Gremium, das Massnahmen zur Bekämpfung von Geldwäscherei, Terrorismus- und Proliferationsfinanzierung entwickelt und fördert. Die Schweiz ist eines der FATF-Mitgliedsländer. Basierend auf den Ergebnissen der...

Read More »Digitalization Could Move Medical Care Beyond “Government Healthcare”

The reductive and lazy dismissals of the possibility of bringing about free market systems of healthcare, in addition to the administrative and legislative hurdles imposed by government agencies, have all been brought into the limelight in the wake of the pandemic. However, dealing with them is not the purpose of this article; there are a sufficient number which can easily address the usual complaints. One impact of the pandemic, particularly relevant to political...

Read More »Carbon offsetting explained in 2 minutes

Countries lower their carbon footprint and become climate neutral by limiting the amount of greenhouse gases they produce and by compensating the emissions that can't be cut. The carbon offsetting market has become increasingly attractive for countries, companies and individuals, who finance projects that will either suck CO2 out of the atmosphere, or reduce the CO2 release. This is done by buying carbon offsets. Carbon offsetting will be a major point of tension at...

Read More »Reading Jeff Snider: 1970s Inflation vs. 2020s Price Increases [Ep. 130, Macropiece Theater]

Time travel to the early 1970s where we hear the Nixon Tapes, read memorandums, and study Congressional testimony to understand what the Federal Reserve knew, and when they knew it. Turns out they didn't know "money" then and they still don't today. A reading, by Emil Kalinowski. ----------WHO---------- Jeff Snider of Alhambra Investments. Read by Emil Kalinowski. Art by David Parkins. Intro/outro is "Amber Lights" by Chill Cole at Epidemic Sound....

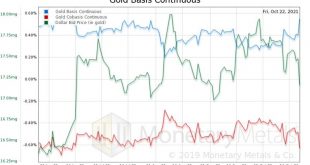

Read More »Why Isn’t Gold Going Up with Inflation?

Many voices in the gold community are making a simple point. Look at the prices of oil, copper, and other commodities. They are skyrocketing. The mainstream explanation—shared by Keynesians, Monetarists, and many Austrians—is that the cause of this skyrocketing is the increase in the quantity of what is called “money”. The price of gold has not been going up. The inference is that it should be going up (note the word “should” is very dangerous in trading). The...

Read More »Doing 90 MPH on Deadman’s Curve: A Few Thoughts on Risk

When the wreck is recovered, witnesses will wonder why they took such heedless, foolish risks.You’re in the back seat wedged between tipsy revelers, the driver is drunk and heading into Deadman’s Curve at 90 miles per hour. Nobody’s worried because the driver has never crashed. Before they slid into euphoric incoherence, the other passengers answered your doubts with statistics and pretty charts showing that the driver had never had an accident, so there was nothing...

Read More »Aktualisierte Sanktionsmeldung

Das Eidgenössische Departement für Wirtschaft, Bildung und Forschung WBF hat eine Änderung des Anhangs 3 der Verordnung vom 27. August 2014 über Massnahmen zur Vermeidung der Umgehung internationaler Sanktionen im Zusammenhang mit der Situation in der Ukraine (SR 946.231.176.72) publiziert. Am 22. Oktober 2021 hat das Eidgenössische Departement für Wirtschaft, Bildung und Forschung WBF die Liste der in diesem Kontext sanktionierten Personen, Unternehmen und...

Read More »Surprise! Biden Continues the CIA’s JFK Assassination Cover-Up

Before I address President Biden’s decision last Friday to continue the national-security establishment’s cover-up of its November 22, 1963, regime-change operation in Dallas, I wish to make one thing perfectly clear: I am not Nostradamus. Yes, I fully realize that I repeatedly predicted that Biden would never order the release of those 60-year-old assassination-related records that the CIA has steadfastly been keeping secret from the American people. (See here and...

Read More » SNB & CHF

SNB & CHF