Die Rallye hat sich ein wenig beruhigt. Trotzdem liegt der BTC in der Nähe seines Allzeithochs. Dem Kursanstieg zum Trotz bleiben jedoch die Gebühren auf moderatem Niveau und sanken zuletzt sogar deutlich – woran liegt es? Bitcoin News: Gebühren für Bitcoin sinken trotz Höchstkursen Arcane Research hat festgestellt, dass die Gebühren im Wochenvergleich um 26 Prozent gesunken sind. Dies hat vor allem zwei Gründe: Erstens werden immer mehr Bitcoin-Transaktionen über...

Read More »The ‘Growth Scare’ Keeps Growing Out Of The Macro (Money) Illusion

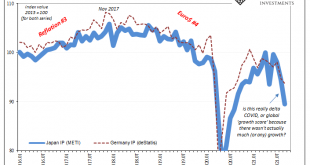

When Japan’s Ministry of Trade, Economy, and Industry (METI) reported earlier in November that Japanese Industrial Production (IP) had plunged again during the month of September 2021, it was so easy to just dismiss the decline as a product of delta COVID. According to these figures, industrial output fell an unsightly 5.4%…from August 2021, meaning month-over-month not year-over-year. Altogether, IP in Japan is down just over 10% since June, nearly 11% since...

Read More »How Play Suisse made waves among the streamers

The way that the Swiss watch television today has changed a bit since the 1960s. akg-images In a little over a year Play Suisse, the streaming service of the Swiss Broadcasting Corporation (SBC), has become a major player in the Swiss digital landscape, surpassing platforms like Disney+ and Amazon Prime Video. Critic Max Borg looks at the strengths and weaknesses of Play Suisse and its rivals. To mark the first anniversary of Play Suisse, the SBC, SWI swissinfo.ch’s...

Read More »Smallpox: The Historical Myths behind Mandatory Vaccines

Throughout the corona “pandemic” the Holy Grail of public health officials has been vaccination: only by vaccinating enough people—first the elderly and infirm, then all adults, and now even children—can the nefarious virus be beaten. As vaccination has proven less than wholly successful in preventing the spread of coronavirus, with studies showing rapidly declining protection from the vaccines, governments have doubled down, introducing not only “booster” shots for...

Read More »When Risk and Opportunity Become Personal

The opportunity to lower our exposure to risk is always present in some fashion, but embracing this opportunity becomes critical when precarity and change-points rise like restless seas. The Chinese characters that comprise the equivalent of “crisis” are famously–and incorrectly–translated as “danger” and “opportunity.” This mis-translation has reached the peculiar prominence of being repeated often enough to be taken as accurate, but according to Wikipedia and...

Read More »Geldcast Update: Lessons from interest rate problems

Fabio Canetg The Australian central bank is being attacked by the markets and is losing control over interest rates. Something similar happened to the Swiss National Bank in 2015 with the minimum exchange rate for the euro. But what is behind this? The government should be able to borrow cheaply. That is what the Reserve Bank of Australia (RBA) promised when the pandemic broke out. It fixed the interest rate on three-year government bonds at 0.1%. Economists call...

Read More »The Inca Empire: An Indigenous Leviathan State

One of the realities that nullifies persistent interpretations of the European colonization of the Americas as a cataclysm of subjugation is the existence of state exploitation in the precontact New World. As I have recently shown, many common Indians lived in banal slavery to a political class—the same servitude that every “citizen” of a state lives under, compelled to labor for the benefit of others, albeit with its own unique packaging and set of justifications....

Read More »Is Price Stability Really a Good Thing?

Contrary to popular thinking, there is no such thing as a price level that should be stabilized by the central bank in order to promote economic prosperity. Original Article: “Is Price Stability Really a Good Thing?” One of the mandates of the Federal Reserve System is to attain price stability. It is held that price stability is the key as far as economic stability is concerned. What is it all about? The idea of price stability originates from the view that...

Read More »Turkey gets a Reprieve before US Thanksgiving, but Capital Strike may not be Over

Overview: The dramatic collapse of the Turkish lira was like an accident one could not help look at, but it was not an accident, but the result of a disregard for the exchange rate and compromised institutions. The lira was off around 15% at its worst yesterday, before settling 11.2% lower. After falling for 11 sessions, it has steadied today (~2.7%) but the capital strike may not be over. On the other hand, the Reserve Bank of New Zealand delivered the 25 bp...

Read More »Ethereum gewinnt trotz 3 Prozent Kursverlust

Der Markt befindet sich seit einer Woche wieder in einem Abwärtstrend. Der BTC verlor 7 Prozent im Wochenvergleich und führte den gesamten Markt in eine kleinere Bärenphase. Auch Ethereum verlor 3 Prozent, kann sich aber dennoch als Gewinner der vergangenen 7 Tage sehen. Ethereum News: Ethereum gewinnt trotz 3 Prozent Kursverlust Der ETH kann sich als großer Gewinner des Marktes sehen, weil die Marktkapitalisierung um etwa 6,7 Prozent verlor. Doch Ethereum gab in...

Read More » SNB & CHF

SNB & CHF