With the recent rise in inflation—with subsequent increases in both consumer and producer price levels—one suspects that sooner or later people on the left either would downplay it or find a way to spin the bad news into something positive like an alchemist would want to spin straw into gold. Both accounts have arrived, thanks to the New York Times and the hard-left publication, The Intercept. The various accounts in the Times hardly are surprising, given the link...

Read More »FOMC Chair Jerome Powell will REMAIN seated! How will the markets react to this decision? |

Marc Chandler from Bannockburn Global Forex discusses the FOMC reappointment of Jerome Powell and how the markets may react moving forward. More importantly, what happens to the bond market and do yields on the lower end of the curve continue to flatten? Marc Also discusses the USDJPY rally which he predicted last time he was with the Trader Summit community. Is there further to go or have we reached the range highs once again? Marc also talks about the aggressive move in the USDTRY and...

Read More »Around 12percent of the household budget went on taxes in 2019

23.11.2021 – In 2019, the average household disposable income in Switzerland was CHF 6609 per month. A large part of this amount was used for the consumption of goods and services, namely CHF 4985. Households spent 31.0% of their budget on compulsory expenditure such as taxes, social expenditure and health insurance premiums, averaging CHF 2973. These are some of the findings from the Household Budget Survey 2019, carried out by the Federal Statistical Office (FSO)....

Read More »What’s In Your Loan?

To listen to the audio version of this article click here Opposing Monetary Directions “Real estate is the future of the monetary system,” declares a real estate bug. Does this make any sense? We would ask him this. “OK how will houses be borrowed and lent?” “Look at this housing bond,” he says, pointing to a bond denominated in dollars, with principal and interest paid in dollars. “What do you mean ‘housing’ bond’,” we ask, “it’s a bond denominated in dollars!”...

Read More »When Everything Is Artifice and PR, Collapse Beckons

The notion that consequence can be as easily managed as PR is the ultimate artifice and the ultimate delusion. The consequences of the drip-drip-drip of moral decay is difficult to discern in day-to-day life. It’s easy to dismiss the ubiquity of artifice, PR, spin, corruption, racketeering, fraud, collusion and narrative manipulation (a.k.a. propaganda) as nothing more than human nature, but this dismissal of moral decay is nothing more than rationalizing the rot to...

Read More »Moving up in the world: could you work from home in the Alps?

Idyllic: Crans-Montana Keystone / Laurent Gillieron During the pandemic, some skiers have been doing just that. But does the romantic vision tally with the reality? It was in May, while hiking along the forest trails and waterfalls of La Tièche, with views towards the snow-dusted peaks of the Matterhorn and Mont Blanc, that fitness coach Jessica Z Christensen decided to spend more time in the Swiss mountains. After a decade of being a digital nomad, the Italian and...

Read More »The REAL ID Means a Real Leviathan

The annoyance of government edicts, no matter how petty, challenge my emotional equilibrium in a manner different from the various vagaries of life. Sure, I do not want to experience something such as a flat tire, but neither do I want to deal with pointless tasks required to satisfy a whim of the state, though, in the balance, the former I accept like a mosquito on a hot summer’s night, while the latter aches like a hammer to my thumb. Robert Higgs wrote Crisis and...

Read More »“Going Cashless” Isn’t as Easy as It Seems

Many economic commentators are in favor of phasing out cash. They are of the view that cash provides support to the shadow economy and permits tax evasion. It is also held that in times of economic shocks that push the economy into a recession the rising demand for cash exacerbates the downturn—it becomes a factor of instability. Rather than spend money and boost aggregate demand, the increased demand for cash works against this. Consequently, it is argued that...

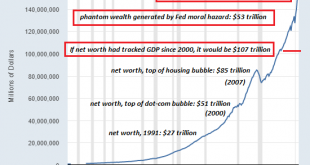

Read More »The Fed’s Moral Hazard Monster Is About to Lay Waste to “Wealth”

If the Fed set out to destroy the financial system, they’re very close to finishing the job. If you set out to destroy markets and the financial system, your most important weapon is moral hazard, the disconnection of risk and consequence. You disconnect risk from consequence by rewarding those making the riskiest bets and bailing out gamblers whose bets went bad. You reward those making the riskiest bets by pushing markets higher regardless of any other factors....

Read More »The Long Rehabilitation of Frank Fetter

Abstract: Economics has long history of “rehabilitations,” including W.H. Hutt’s rehabilitation of Say’s law, and Alfred Marshall’s attempt to rehabilitate David Ricardo. The rehabilitation of Frank A. Fetter should be as important as either of these, especially for economists working in the contemporary Austrian tradition. The historical records reveal that for the last century there has been underway a nearly unbroken series of efforts, especially by Austrian...

Read More » SNB & CHF

SNB & CHF