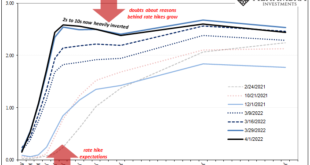

The yield curve inverted last week. Well, the part everyone watches, the 10 year/2 year Treasury yield spread, inverted, closing the week a solid 7 basis points in the negative. The difference between the 10 year and 2 year Treasury yields is not the yield curve though. The 10/2 spread is one point on the Treasury yield curve which is positively sloped from 1 month to 3 years, negatively sloped from 3 years to 10 years and positively sloped again from 10 out to 30...

Read More »Ukraine refugees struggle to exchange cash into Swiss francs

Thousands of Ukrainian refugees are finding that Swiss banks are refusing to convert the cash they brought with them into francs. More than 20,000 people fleeing the Ukraine war have registered in Switzerland so far. But they rely on the goodwill of Swiss families or state to support them as none can pay their way using the hryvnia currency that they have brought with them. Ukranian refugees with a special S PermitExternal link can open a Swiss bank account but...

Read More »The Short, Sweet Income Case For Ugly Inversion(s), Too

A nod to just how backward and upside down the world is now. The economic data everyone is made to pay attention to, payrolls, that one is, in my view, irrelevant. As is the consumer price estimates from earlier this week, the PCE Deflator. That’s another one which receives vast amounts of interest even though it is already old news. Yet, in the very same data release as the PCE, some other accounts importantly tied to labor, personal income, they slip unnoticed...

Read More »Keith Weiner on the Gold Market and How to Replace Government Paper Money

Keith Weiner is founder and CEO of Monetary Metals, an investment firm that pays interest on gold, and the founder of the Gold Standard Institute USA. Weiner’s mission is to provide entrepreneurial services and education to help restore gold as the world’s money par excellence. Mentioned in the Episode and Other Links of Interest: The YouTube version of this interview Keith Weiner’s bio at Monetary Metals Weiner’s Forbes article on gold and silver coins not...

Read More »The Greenback has Struggled even as Rate Expectations Rise

The effectiveness of the Federal Reserve's communication seems clear. The market has nearly 90 bp of tightening discounted here in Q2. This means that after a 25 bp hike to initiate the tightening cycle, the labor market's strength will allow the central bank to accelerate the pace. By the end of the week, the market will also have a better idea of the timing and pace of the balance sheet unwind. The March nonfarm payroll growth may have missed median estimates,...

Read More »Swiss privacy technology tackles rampant online intrusion

Anyone using the internet is being watched, and possibly manipulated, via a trail of digital breadcrumbs known as metadata. Two Swiss companies, one backed by former United States military whistleblower Chelsea Manning, are setting up smokescreens to confuse prying eyes and protect web users from big tech companies and government surveillance. Nym Technologies and HOPR employ mix networks (mixnet) to churn together the metadata that people leave behind when they...

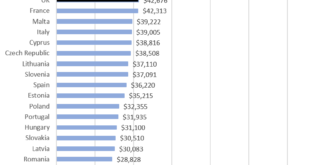

Read More »If Ukraine Joins the EU, It Will Be the Poorest Member by Far

Within days of the beginning of the Russian invasion of Ukraine, the Ukrainian regime applied for membership in the European Union. This is understandable from the perspective of Kyiv. If Ukraine is going to be denied membership in NATO—as increasingly looks to be the case—The Ukraine regime could nonetheless increase its geopolitical connections to the West by joining in the EU. Moreover, given the fact the EU is moving toward creating its own EU military...

Read More »European Environmentalists Have Made Energy Independence Impossible

Europe is not going to achieve a competitive energy transition with the current interventionist policies. Europe does not depend on Russian gas due to a coincidence, but because of a chain of mistaken policies: banning nuclear in Germany, prohibiting the development of domestic natural gas resources throughout the European Union, added to a massive and expensive renewable rollout without building a reliable backup. Solar and wind do not reduce dependency on Russian...

Read More »It’s All the Aliens’ Fault

As for our central banks’ defaulting on their lines of credit with the Martian Central Bank–that’s another alien intervention we’ll live to regret. I hope this won’t shock the more sensitive readers too greatly, but I’ve discovered undeniable evidence that all our planet’s problems are the result of alien intervention. Yes, aliens exist and are actively intervening in humanity’s activities, to our great detriment. Wars, plagues, The Illuminati, the World Economic...

Read More »Indonesien plant Steuer auf Crypto-Transaktionen

Schon im Mai will Indonesien einen Gesetzesentwurf umsetzen, der eine Mehrwertsteuer auf Transaktionen mit Cryptocoins im Land einführen wird. Damit reagierten Staatsvertreter auf den Boom des digitalen Asset-Tradings im Land. Crypto News: Indonesien plant Steuer auf Crypto-TransaktionenNachdem westliche Staaten vor allem versuchen den Cryptomarkt klein zu regulieren, versucht es Indonesien mit einem anderen Ansatz. Mit einer speziellen Steuer auf Transaktionen mit...

Read More » SNB & CHF

SNB & CHF