The Henry Hazlitt Memorial Lecture, March 18, 20221 Many thanks to the Mises Institute and to sponsor Yousif Almoayyed for this opportunity to be with you all today as we consider one of the truly remarkable developments in the history of American central banking, money printing, and credit inflation. On a personal note, “the pursuit of clarity” has long been a goal of mine, and it’s a particular pleasure to present a lecture in honor of Henry Hazlitt, whose work is...

Read More »New Swiss bank pitches itself as digital, but not robotic

Switzerland’s shrinking banking universe has been bolstered by a new wealth management entrant, Alpian, which is aiming for the sweet spot between digital and human-centric services. Alpian has just secured a Swiss banking license along with a CHF19 million ($20.5 million) capital boost from the Italian banking group Intesa Sanpaolo. Looking at the bare figures, Switzerland could do with some reinforcements. The number of separate banking entities in the Alpine state...

Read More »FED Tightening, Commodities Prices and Emerging Markets Breakdown w/ Marc Chandler.

In this video with Marc Chandler we talked about the macro-economic outlook for the coming moths. We started out by adressing the US enemployement report then we talked about the FED policy of raising rates. Later we talked about the effects of the conflict on economies and commodities prices, expecially oil and natural gas. Later we talked about how these commodities prices are having an influence in emerging markets. In the end we talked about geo-politics and the polarization of east vs...

Read More »Switzerland has frozen CHF7.5bn in assets under Russia sanctions

Residents walk through rubble in the Ukrainian city of Bucha on Wednesday. Hundreds of tortured and murdered civilians have been found in Bucha and other parts of the Kyiv region after the Russian army retreated from those areas. Keystone / Roman Pilipey Switzerland has so far frozen some CHF7.5 billion ($8 billion) in funds and assets under sanctions against Russians to punish Moscow’s invasion of Ukraine. These are funds in frozen accounts and properties in four...

Read More »For Freak’s Sake, People, Even the Crash Test Dummies Are Nervous

Those trusting the Fed to be visibly weak, corrupt and incompetent forever might be in for an unwelcome surprise. When even the crash test dummies are nervous, it pays to pay attention. Being in a mild crash isn’t too bad if all the protective devices inflate as intended. But in a horrific crash where nothing goes as planned, it’s like speeding in a ready-to-explode Pinto and being side-swiped by a semi on Dead Man’s Curve. The stock market is in the Pinto, and the...

Read More »Swiss consumers spend big on organic products

The organic food market in Switzerland experienced slower growth in 2021 than the previous year. However, consumers are spending more than ever on organic products. According to annual figures released by the organic food association Bio Suisse on Wednesday, the market for organic products grew 0.6% in 2021 to reach a share of 10.9% of the total market. In 2020, the association recorded a 4% growth in organic sales. One of the reasons for the slower growth is that...

Read More »And Now for a Really Bad Response to Political Calamity: Autarky

The invasion of Ukraine, the spike in inflation and the risks of supply shortages have made some politicians dust off some of the worst economic ideas in history: autarky and protectionism. Some believe that if our nation produced everything we needed we would all be better off because we would not depend on others. The idea comes from a deep lack of understanding of economics. There is no such thing as autarky. There is no such thing as covering all the needs of a...

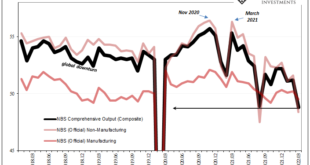

Read More »Equities Finding a Bid in Europe After Sliding in Asia Pacific

Overview: The capital markets are calmer today. The market is digesting the FOMC minutes, where officials tipped an aggressive path to shrink the balance sheet and confirmed an “expeditious” campaign to lift the Fed funds rate to neutrality. Benchmark 10-year yields are softer, with the US off a couple basis points to 2.58%. European yields are 1-3 bp lower. After the equity losses in the US yesterday, including a 2.2% drop in the NASDAQ, Asia Pacific equities...

Read More »Meta plant Implementierung von Cryptocoins

Unter dem Namen „Meta“ hat Mark Zuckerberg erst vor kurzem sein Unternehmen neu aufgestellt. Das mit dem Unternehmen verbundene Metaverse soll nicht nur die Social Media Plattform Facebook beinhalten, sondern einer ganzen Familie an Apps ein Zuhause bieten. Für die Finanzabwicklung im Metaverse wird offenbar sogar an einem eigenen Cryptocoin gearbeitet. Crypto News: Meta plant Implementierung von Cryptocoins Unter dem Arbeitstitel “Zuck Buck” wird derzeit eine...

Read More »Goldilocks And The Three Central Banks

This isn’t going to be like the tale of Goldilocks, at least not how it’s usually told. There are three central banks, sure, call them bears if you wish, each pursuing a different set of fuzzy policies. One is clearly hot, the other quite cold, the final almost certainly won’t be “just right.” Rather, this one in the middle simply finds itself…in the middle of the other two. Running red-hot to the point of near-horror, that’s “our” Federal Reserve. The FOMC minutes...

Read More » SNB & CHF

SNB & CHF