Over the past couple of weeks, we reviewed the U.S. government confiscation of gold by Executive Order in 1933. (see “Gold Confiscation: Will History Repeat Itself?” and “The Facts of Gold Confiscation: The Saga Continues”). One of the points was that the difference between 1933 and today is that gold is not money for banks today. This means banks are not on a gold standard. Some observers have stated that the announcement by Russia’s Central Bank on March 25 to purchase gold at a ‘fixed’ 5,000 rubles per gram is a return to the gold standard or that it creates a gold-backed ruble. Below we provide context to the announcement. Also, why the central bank buying gold at a ‘fixed’ price is not the same as a gold standard. Russia Sets its Fixed Gold Price The

Topics:

Stephen Flood considers the following as important: 6a.) GoldCore, 6a) Gold & Monetary Metals, Commentary, Economics, Featured, Geopolitics, Gold, gold analysis, gold and silver, gold news today, gold price, gold price analysis, gold price prediction, gold price today, Gold Standard, inflation, News, newsletter, Precious Metals, Putin, ruble, Russia, Russian central bank, sanctions, Ukraine

This could be interesting, too:

investrends.ch writes SIX liefert den Direktzugang nach Griechenland

investrends.ch writes LLB hält Gewinn 2025 trotz Übernahmekosten stabil

investrends.ch writes BB Biotech bestätigt Gewinn 2025

investrends.ch writes Edmond de Rothschild AM knackt die 100-Milliarden-Marke – fünftes Rekordjahr in Folge

Over the past couple of weeks, we reviewed the U.S. government confiscation of gold by Executive Order in 1933. (see “Gold Confiscation: Will History Repeat Itself?” and “The Facts of Gold Confiscation: The Saga Continues”).

One of the points was that the difference between 1933 and today is that gold is not money for banks today. This means banks are not on a gold standard.

Some observers have stated that the announcement by Russia’s Central Bank on March 25 to purchase gold at a ‘fixed’ 5,000 rubles per gram is a return to the gold standard or that it creates a gold-backed ruble.

Below we provide context to the announcement.

Also, why the central bank buying gold at a ‘fixed’ price is not the same as a gold standard.

Russia Sets its Fixed Gold Price

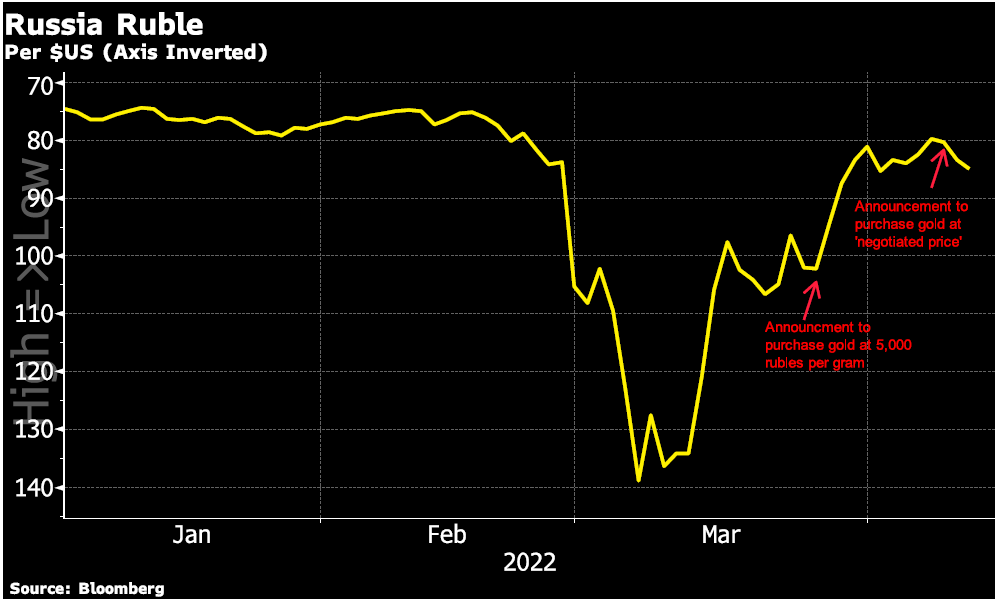

The announcement on March 25 that Russia’s central bank would buy gold from domestic producers beginning March 28 at a fixed 5,000 rubles per gram.

This price ‘fix’ was originally announced to run from March 28 through June 30, but this was revised on April 8 to a ‘negotiated price’.

The policy is an attempt to acquire (domestically mined) at potentially below-market prices with rubles the Bank of Russia can simply print.

The central bank’s initial offer announced on March 25 at a fixed price of 5000 rubles per gram was clearly attractive from the Bank’s (and government’s) perspective. Although not from local producers’ perspectives.

The ruble was quite depressed, and 5,000 rubles per gram was significantly below London market gold prices converted to rubles.

However, now that the ruble has recovered to around 80/dollar, the offer was close to what gold would be worth in rubles on global markets.

Russian RubleThe ruble has risen sharply in recent days on the back of demands that Russian oil and gas exports to the West be paid for in rubles or gold. This has created false demand for the ruble. And Russian energy exporters must turn any euro or dollar receipts directly over to the government in any event. |

|

| Additionally, the sanctions have made it challenging for Russia’s domestic producers to sell their gold through the usual channels.

Also, the ruble market is heavily controlled and very illiquid. It is clear why the Russian central bank would want to buy gold from its producers. This is because gold is the world’s oldest form of international liquidity. Also, if the central bank can get it at a discount all the better. Moreover, remember that the central bank can print the rubles it pays domestic gold producers. Printing currency is relatively costless, and a common practice during the war! The question then is why would Russian miners sell their gold at below-market prices to the Bank of Russia? And how useful would these rubles be to domestic producers in need of foreign material and expertise? The first answer is that the sanctions have essentially barred Russia’s gold producers from selling their gold in Western markets. Further, the only available markets for domestic gold producers are local banks and the Russian central bank. In essence, domestic gold miners now face a monopsony – one buyer for their output; they are captive sellers. |

|

Ruble Backed By Gold: Is It Just A Gamble?All of this means that it should be no great surprise that foreign miners in Russia want out: i.e., Kinross Gold to sell all Russian assets in a $680M deal (BNN Bloomberg, 04/05). Furthermore, there is strong private demand for gold in Russia, and local banks have been selling gold. Many locals were glad to rid themselves of rubles in exchange for gold or other hard currency, especially at the start of the war as per in reports. But this is regulated since gold is too important an asset for the government at this time to be sold to those who want to cash in their rubles. Russia’s central bank had been buying gold for reserve purposes until oil prices tumbled down sharply in early 2020. This happened when it announced that it would put its gold buying on hold. For more on this see our December 9, 2021, post- Russia: A Prominent Player in the Global Gold Market. Russia’s central bank setting a ruble price for purchases from producers is not the same as a gold standard. This is also not equivalent to a gold-backed ruble as some observers have suggested with headlines such as: “It’s Official! Russian Central Bank Announces That the Ruble is Tied to Gold! 5,000 Rubles per Gram” and “A Note on the New Russian “Gold Standard”. A gold standard ruble would require the government to maintain a fixed ruble price for gold in an unregulated market. This is entirely different from and has entirely different implications than, an offer to purchase domestically mined gold from captive local gold miners at 5,000 rubles per gram. Additionally, a gold standard ruble would require the Bank of Russia to buy (or sell) gold for (or from) its gold reserves at a fixed price, on-demand. The offer to buy gold is one thing but selling gold at a fixed price is something else entirely. This would mean that anyone that holds rubles could exchange those rubles for gold at the 5,000 rubles per gram price. Meaning Russia’s gold reserves would dwindle rapidly as Russians (and foreign holders, holding unwanted rubles, want to exchange all their rubles for gold. Then the Bank of Russia will then immediately have to close its gold window. To declare that one gram of gold is worth 5,000 rubles is easy. However, to make it good through the active buying and selling of gold in an unregulated market is something the Bank of Russia simply cannot do. In short, the Bank of Russia is seizing the opportunity provided by this war, and the related sanctions limiting the exports of gold from its domestic producers. It is purchasing gold from the captive gold mining industry at favorable ruble prices – with essentially costless ruble outlays the central bank prints. |

Tags: Commentary,Economics,Featured,Geopolitics,Gold,gold analysis,gold and silver,gold news today,gold price,gold price analysis,gold price prediction,gold price today,gold standard,inflation,News,newsletter,Precious Metals,Putin,ruble,Russia,Russian central bank,sanctions,Ukraine