Die Energiekrise hat auch den Cryptomarkt erreicht. Gerade das Crypto Mining verschlingt viel Energie, die in der aktuellen politischen Lage teuer geworden ist. Doch trotz steigender Kosten hat die Bitcoin-Hashrate nun ein neues Allzeithoch erreicht. Bitcoin News: Bitcoin Hashrate auf Allzeithoch trotz EnergiekriseMit 6,28 Blocks pro Stunde ist die Hashrate in den vergangenen 7 Tagen auf einen Wert gestiegen, der bisher unerreicht war. Die Belohnungen für die Miner...

Read More »Calmer Capital Markets…for the Moment

Overview: The capital markets are quiet today. Equity markets and bond yields have a slight upside bias, while the dollar is little changed. Despite reports that the lockdown in Chengdu is easing, Chinese equities underperformed in the Asia Pacific region. Japan, Hong Kong, Taiwan, and Australia eked out modest gains. After sliding around 2.4% over the past two sessions, the Stoxx 600 is up fractionally. US futures have edged slightly higher. The US 10-year yield is...

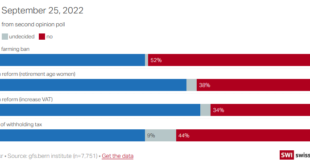

Read More »Support drops for pension reform and factory farming ban

A reform of the Swiss old age pension system has lost ground but is still likely to win a majority in a nationwide vote later this month, pollsters say. Worked in radio and newspaper journalism, as well as teaching and tourism before joining swissinfo.ch’s predecessor Swiss Radio International in the 1980s. He reports from parliament, and focuses on direct democracy issues. More from this author | English DepartmentUrs Geiser Support for a proposed ban on...

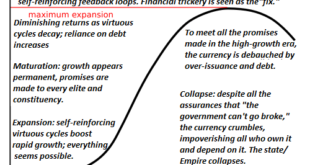

Read More »The Fourth Turn, Turn, Turn

The cycles of The Fourth Turning, Fischer and Turchin are all in alignment at this point in history.. The 1997 book The Fourth Turning: An American Prophecy proposed a cyclical pattern of four 20-year generations which culminate in a national crisis every 80 years.The book identifies these dates as Fourth Turnings: 1781 (Revolutionary War), 1861 (Civil War) and 1941 (global war). add 80 years and voila, 2021. I use the term Fourth Turning generically to describe an...

Read More »The Russians (Propaganda) Are Coming!

The headline reads “Moscow World Standard to Destroy LBMA’s Monopoly in Precious Metals Pricing”. Wow! Could it be? Is this it?! The gold revaluation we’ve all been waiting for! Someone, who has the power, will give us a venue in which we can sell our gold at its true price… how does $50,000 sound, eh? Not so fast. Betting Against the Incumbent? For one thing, there are sanctions. If you’re a citizen of a Western country, there is a legal barrier between you and a...

Read More »Swiss price watchdog lays out options for slashing electricity costs

Cutting down on fees for the grid connection could save consumers around CHF350 million ($365 million), according to Meierhans. © Keystone / Salvatore Di Nolfi By reducing grid connection fees and municipal duties, the federal government could help to keep electricity bills down, Stefan Meierhans told Le Matin Dimanche newspaper. Meierhans said it is possible for the government to change the framework conditions that would allow a lowering of fees for using the grid....

Read More »What Problem Does Gold Solve?

Realising that you need to protect your portfolio from financial systemic risks is a tricky thing. Because, not only have you identified that all is not well in the economy but you now need to make a decision about how best to protect your investments. In all likelihood, this is why you own or are thinking about owning gold bullion. Have you ever asked yourself? What problem does gold solve in today’s environment? Should I own gold ETFs or gold bullion? What is and...

Read More »Dollar Crushes World Economy yet Media Won’t Ask ‘Why?’ [Ep. 289, Eurodollar University]

"Emerging markets burn through currency reserves as crisis risks grow," notes the Wall Street Journal. But what sticks in Mr. Jeff Snider's craw is that there's no mention as to why this is. To ask the question would move the Federal Reserve out of the media's glowing spotlight. ****EP. 289 REFERENCES**** Emerging markets burn through currency reserves as crisis risks grow: https://on.wsj.com/3RZdWbM The Infatuation With Fanciful Stories of Fascinating Bank Reserves:...

Read More »Former UBS CEO sees no need for two big Swiss banks

Ermotti also called into question the need for 24 cantonal banks. Keystone / Elia Bianchi Having two big players like UBS and Credit Suisse provides no “compelling” economic benefit for Switzerland, Sergio Ermotti has told the NZZ am Sonntag newspaper. “The strength of the country’s financial centre is its diversification, which is much more important than the number of big banks,” the former UBS CEO said in an interview published on Sunday. In the last ten years,...

Read More »Novartis to spend $300m on biotherapeutics drive

Swiss pharmaceuticals giant Novartis is currently restructuring its business. © Keystone / Urs Flueeler Swiss pharmaceutical company Novartis is investing $300 million ($288 million) in biotherapeutics development, which includes a new $100 million biologics hub at its home base in Basel. A further $110 million will be spent on research and production at a Novartis site in Slovenia and $60 million in Austria, the company announced on Monday. Biotherapeutics is a...

Read More » SNB & CHF

SNB & CHF