The Swiss competition commission (COMCO) has opened an investigation into suspected unlawful use of a patent to reduce competitive pressure by Swiss pharmaceutical giant Novartis. The probe, which is in collaboration with the European Commission, is looking into whether the company used unlawful means to ward off competition for its own dermatological treatments. COMCO conducted an early morning raid at the company’s Basel headquarters on September 13 in connection...

Read More »Molinari Explains the Difference between Monarchy and Popular Government

With the impending burial of the United Kingdom’s Queen Elizabeth II, republicans from London to Sydney have ramped up their efforts to end the British monarchy. The resulting war of words between monarchists and their opponents has highlighted the sheer diversity of opinions over the desirability of monarchy. Indeed, it would be impossible to enumerate all the different criteria on which different groups and individuals judge monarchy as an institution. However, for...

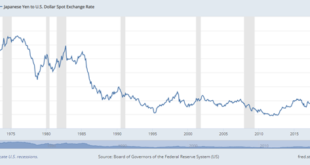

Read More »Government Intervention into International Currency Exchange Rates: Japan as a Case Study

The recent hefty depreciation of the yen to a twenty-four-year low against the dollar has raised eyebrows due to the yen’s traditional safe haven role in times of turmoil, such as the war in Ukraine. The yen’s decline had already started when major central banks signaled a tightening of monetary policy to fight inflation while the Bank of Japan (BoJ) doubled down on its loose monetary policy and zero target for ten-year bond yields. The depreciation accelerated...

Read More »The End of Cheap Food

Global food production rests on soil and rain. Robots don’t change that. Of all the modern-day miracles, the least appreciated is the incredible abundance of low cost food in the U.S. and other developed countries.The era of cheap food is ending, for a variety of mutually reinforcing reasons. We’ve become so dependent on industrial-scale agriculture fueled by diesel that we’ve forgotten that when it comes to producing food, “every little bit helps”–even small...

Read More »Swiss car importer pledges to end petrol vehicle sales

The proportion of electric cars is increasing on Swiss roads. © Keystone / Christian Beutler Switzerland’s largest car importer, AMAG, plans to sell purely electric powered vehicles from 2040 and is diversifying into solar systems and heat pumps. AMAG, which imports cars and sells them to dealerships, said on Tuesday that it will acquire Swiss photovoltaic pioneer Helion to help its conversion to a renewable energy business. The takeover will create a new Energy...

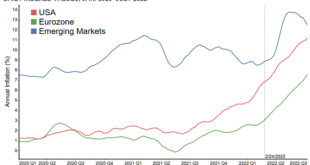

Read More »No One Wants a Recession, but Central Banks are willing to Take the Risk to Demonstrate Anti-Inflation Resolve

The week ahead is busy. Three G7 central banks meet, the Federal Reserve, the Bank of Japan, and the Bank of England. In addition, Japan and Canada report their latest CPI readings, and the flash September PMI are released. There are three elements of the Fed's meeting that are worth previewing. First is the interest rate decision itself and the accompanying statement. Ironically, this seems to be the most straightforward. Even before the August CPI surprise, the...

Read More »Ethereum Merge erfolgreich

Der Ethereum Merge war erfolgreich, doch der Markt zeigte keine positive Reaktion. ETH verlor im Wochenvergleich deutlich. Währenddessen zeigte die Hashrate des Ethereum Classic eine klare Reaktion. Ethereum News: Ethereum Merge erfolgreichDer ETH verlor mehr als 17 Prozent im Wochenvergleich. Der größte Verlust geschah aber noch vor dem Merge. In den letzten 24 Stunden kamen weitere 3 Prozent Kursverlust hinzu, so dass der ETH das Wochenende mit weniger als 1.500...

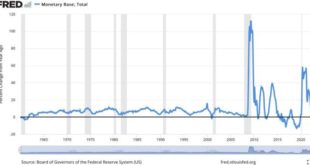

Read More »Powell’s Pivot to “Pain” but No Gain: Triggering the Coming Recession

Jay “The Inflation We Caused Is Transitory” Powell finally did it. On Friday, the Fed chair finally mustered the courage to say that he is going to do the job he has been hired to do: the Fed will not “pivot” to cut interest rates until inflation slows meaningfully and persistently—even if the stock, bond, and housing bear markets become much worse and the economy goes into recession. Powell’s Speech Translated Below we provide key quotes from Powell’s Jackson Hole...

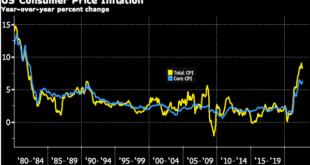

Read More »US CPI Data Release Update

It is easy to get caught up in data releases. The media is keen to read a lot into them, hoping it will offer some sense of what is really going on, so often the news is about numbers just announced or expectations for what one economic measure will show from one month to the next. However, as we outline below, many of the numbers that are released on a frequent and regular basis (CPI and employment, for example) can be misleading. Whether it’s down to the inputs or...

Read More »The Fed Is Wrong to Make Policies Based upon the Phillips Curve

Speaking at Jackson Hole, Wyoming, on August 26, 2022, the chair of the Federal Reserve, Jerome Powell, said the Fed must continue to raise interest rates—and keep them elevated for a while—to bring the fastest inflation in decades back under control. Powell said that a tighter interest rate stance is likely to come at a cost to workers and overall growth. However, he holds that not acting would allow price increases to become a more permanent feature of the economy...

Read More » SNB & CHF

SNB & CHF