Overview: The firmer than expected US CPI set off a major reversal of the recent price action. It is a two-prong issue. The first is about inflation and the squeeze on the cost-of-living. The second, and more powerful in the capital markets is how the Fed is likely to respond. This drove US stocks and bonds lower and lifted the dollar broadly. Asia Pacific bourses were a sea of red. Most major markets were off 1-2%, while the Nikkei, the Hang Seng, and Australia’s...

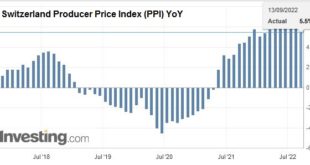

Read More »Swiss Producer and Import Price Index in August 2022: +5.5 percent YoY, -0.1 percent MoM

13.09.2022 – The Producer and Import Price Index fell in August 2022 by 0.1% compared with the previous month, reaching 109.6 points (December 2020 = 100). Lower prices were seen in particular for petroleum products, basic metals and semi-finished metal products. In contrast, chemical products became more expensive. Compared with August 2021, the price level of the whole range of domestic and imported products rose by 5.5%. These are the results from the Federal...

Read More »Promoting Natural Rights Instead of Conservatism: Looking at Rothbard and Jaffa

This is the story of a man, an intellectual, born after World War I, who spent studying his university years in New York and became acquainted and studied under German Jewish émigré who fled the Nazi regime in Germany, later becoming mentor and protégé. That man belonged to the political Right, taught in two different universities during his lifetime, the first one in the Eastern United States, the second in the Western part of the country, was cast out of more...

Read More »Thomas Jordan: Carl Menger Award Ceremony 2022: Introductory remarks on Ricardo Reis

Ladies and Gentlemen I welcome you all to the ceremony of the Carl Menger Award, given by the Verein für Socialpolitik. I do so in the name of the sponsors of the award, namely the Deutsche Bundesbank, the Oesterreichische Nationalbank and the Swiss National Bank, as well as on behalf of the selection committee. This important award is given in recognition of outstanding research work relating to monetary economics and monetary policy. The city selected as the venue...

Read More »Vorsicht bei Elon Musk Deepfake Cryptocoin-Betrug

Deepfakes werden immer detailverliebter. Inzwischen fällt es zusehends schwerer die Fakes von authentischen Aufnahmen zu unterscheiden. Dies hat leider auch die Tür geöffnet für Betrugsfälle, bei denen Prominente wie Elon Musk vermeintliche Crypto-Angebote bewerben. Crypto News: Vorsicht bei Elon Musk Deepfake Cryptocoin-BetrugIm Cryptomarkt ist der Name Elon Musk wohl der einflussreichste. Daher überrascht es nicht, dass vor allem Musk immer wieder in Deepfakes...

Read More »Fed says, ‘Quantitative Tightening does Nothing (QE too)’ [Ep. 288, Eurodollar University]

A study by the Federal Reserve finds that quantitative tightening has a statistically significant effect on rates and yields. Too bad the effect is IMMATERIAL in the EXTREME! Also, same study notes that quantitative easing is similarly a big, 'nothing burger' (their words; ok, ok - my words). ****EP. 288 REFERENCES**** How Many Rate Hikes Does Quantitative Tightening Equal?: https://bit.ly/3BwhD3y The Infatuation With Fanciful Stories of Fascinating Bank Reserves: https://bit.ly/3xcXyMT...

Read More »Will the Dollar Recover After CPI?

Overview: The US dollar remains offered ahead of today’s CPI report. Most European currencies are outperforming the dollar bloc, and the greenback is holding inside yesterday’s range against the yen. Most emerging market currencies are firmer, as well. China’s markets re-opened from the long-holiday weekend and the yuan is a touch softer. After the strong close to US equities yesterday, and some mild follow-through buying today in the futures, equities in the Asia...

Read More »How gold mining in Ghana is threatening Swiss chocolate

swissinfo.ch/Delali Adogla-Bessa As the world’s second-largest cocoa producer continues to lose swathes of farmland to illegal gold mining, Switzerland’s chocolate makers are waking up to the threat to their raw material supply. SWI swissinfo.ch special series: An African perspective on cocoa Native to Central and South America, cocoa cultivation in West Africa was first recorded in 1868. The archives of the Royal Botanic Gardens in Kew refer to a few cocoa trees...

Read More »Press Communication in the Metaverse: Rent a PR Cooperates With Zreality

Access to the metaverse is complex and expensive, which is why it is so far used almost exclusively by large companies. The Zurich and Verbier-based PR agency Rent a PR, which has been providing on-demand public relations and communications consulting for five years and has been accepting Bitcoin payments since 2019, is setting another milestone with cooperation and press conferences in the metaverse. The new service covers all the processes companies use to contact...

Read More »Home ownership remains a mirage for most Swiss

Many Swiss dream of owning a single-family home in the countryside and passing it on to their children. For most, this dream is increasingly unrealistic. Journalist and deputy head of the swissinfo.ch editorial group for German, French and Italian. Earlier, worked for Teletext and Switzerland’s French-language national broadcaster. More from this author | French DepartmentSamuel Jaberg In 2015, before starting a family, Ophélie* and her partner Laurent*...

Read More » SNB & CHF

SNB & CHF