As we predicted over a year ago, in a world in which QE has failed, and in which the ice-cold grip of NIRP has to be global in order to achieve its intended purpose of forcing savers around the world to spend the taxed product of their labor, one thing has to be abolished: cash. This explains the recent flurry of articles in outlets such as BBG and the FT, and op-eds by such "established" economists as Larry Summers, all advocating the death of cash, a process which would begin by...

Read More »MXN Shorts Crushed After Mexican Central Bank Unexpectedly Hikes Rate By 50bps, Peso Soars

It was already a torrid day for commodity currencies, among which the MXN, or Mexican Peso, which were surging on today's latest crude short squeeze and then as if pulling a PBOC with just one intention - to crush the shorts - the Mexican Central Bank or Banxico, dealt a crushing blow on anyone short the MXN when it announced an unexpected 50 bps rate hike in the overnight rate to 3.75%. From the central bank: "The target for the overnight interbank funding rate is increased by 50 basis...

Read More »MXN Shorts Crushed After Mexican Central Bank Unexpectedly Hikes Rate By 50bps, Peso Soars

It was already a torrid day for commodity currencies, among which the MXN, or Mexican Peso, which were surging on today's latest crude short squeeze and then as if pulling a PBOC with just one intention - to crush the shorts - the Mexican Central Bank or Banxico, dealt a crushing blow on anyone short the MXN when it announced an unexpected 50 bps rate hike in the overnight rate to 3.75%. From the central bank: "The target for the overnight interbank funding rate is increased by 50 basis...

Read More »The Value of Silver & Gold In A Financial Crisis – With Mark O’Byrne of GoldCore

Mark O'Byrne, co-founder of GoldCore spoke with Josh Sigurdson and John Sneisen about his thoughts on currency vs. money, the insane IOU note printing and debt accumulation by central banks throughout the world. Mark went over the importance and security of owning silver and gold which holds an infinite preserved value while paper money always reverts to zero eventually. Along with the dollar crash on the horizon, Mark spoke about the insane practice of implementing bail-in regimes which...

Read More »The stock market’s siamese twin oiled Friday’s rally

Dear Investors! Because the stock market is currently strongly correlated to the energy sector, Friday’s rally responded in kind on the news of a surge of 12.3% in the NYMEX WTI sweet crude market after a report had suggested that OPEC may finally agree to cut its production to reduce the world glut. The news instantly oiled the S&P 500’s rise of 1.95%. However despite the strong daily gain, oil prices still ended the week down in spite of being the best one-day gain since February...

Read More »The stock market’s siamese twin oiled Friday’s rally

Dear Investors! Because the stock market is currently strongly correlated to the energy sector, Friday’s rally responded in kind on the news of a surge of 12.3% in the NYMEX WTI sweet crude market after a report had suggested that OPEC may finally agree to cut its production to reduce the world glut. The news instantly oiled the S&P 500’s rise of 1.95%. However despite the strong daily gain, oil prices still ended the week down in spite of being the best one-day gain since February...

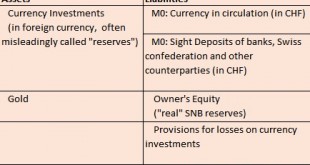

Read More »SNB Sight Deposits, Speculative Position CHF, February15

Headlines Second week of February: Speculative position: As expected rise to 7268 x 125k contracts long USD, short CHF.Sight Deposits: SNB intervenes for 0.9 bln. CHF during the bad market conditions; safe haven inflows were directed towards CHF or Swiss did not cover their trade surplus with the purchase of foreign assets.FX: EUR/CHF fell under 1.10 and EUR/USD over 1.12. Background Sight deposits are currently the by far most important means of financing for SNB currency purchases, for...

Read More »SNB Sight Deposits, Speculative Position CHF, February15

Headlines Second week of February: Speculative position: As expected rise to 7268 x 125k contracts long USD, short CHF.Sight Deposits: SNB intervenes for 0.9 bln. CHF during the bad market conditions; safe haven inflows were directed towards CHF or Swiss did not cover their trade surplus with the purchase of foreign assets.FX: EUR/CHF fell under 1.10 and EUR/USD over 1.12. Background Sight deposits are currently the by far most important means of financing for SNB currency purchases, for...

Read More »Weekly SNB Intervention Update: Sight Deposits and Speculative Position

Headlines Second week of February: Speculative position: As expected rise to 7268 x 125k contracts long USD, short CHF.Sight Deposits: SNB intervenes for 0.9 bln. CHF during the bad market conditions; safe haven inflows were directed towards CHF or Swiss did not cover their trade surplus with the purchase of foreign assets.FX: EUR/CHF fell under 1.10 and EUR/USD over 1.12. Background Sight deposits are currently the by far most important means of financing for SNB currency purchases, for...

Read More »The Silver Blaze Report, 14 Feb, 2016

Again, we had another big drop in the dollar this week. No, we don’t mean against the dollar derivatives known as the euro, pound, etc. We mean by the only standard capable of measuring it: gold. The dollar fell 1.4 milligrams, to 25.1mg gold. Or, if you prefer, 0.1 grams of silver. For some reason, it’s obvious when the price of gold in Zimbabwe goes up from Z$118,000,000 to Z$123,700,000 that Zimbabweans are not getting rich. But when the price of gold rises from US $1,118 to $1,237, as...

Read More » SNB & CHF

SNB & CHF