The UK referendum is three months away. Three-month options are a common benchmark for various market segments; from speculators, to fund managers to corporations. Events over the past week have raised the risks that the UK votes to leave the EU. The market has responded forcefully today, and even if you only follow the spot market, what is happening in the options market is significant. First, three-month volatility has jumped 2.6 percentage points to 14.5%. It appears to be the...

Read More »The house that provides its own energy

Construction is nearly complete on an innovative, multi-family house in canton Zürich that can collect and store enough solar power to fulfil the energy needs of its tenants. (SRF/swissinfo.ch) The project has been aptly named “The House of the Future”, and it is claimed to be the world’s first energy self-sufficient apartment block. The dwelling is being built in Brütten, and by springtime it will be ready to house nine families. The construction of a self-sufficient house poses the...

Read More »Brexit Risks Rising

An ill-conceived strategy undermined by mismanagement and bad fortune is increasing the risks that the UK votes to leave the EU in June. Nearly everything that could, has gone wrong for UK Prime Minister Cameron. While many investors have anticipated the UK would remain in the EU, the increased risks will likely weigh on sterling, with potential for sharp losses. Sterling is already the worst performer among the majors here in Q1. It is from 3.3% which is more than twice the loss of...

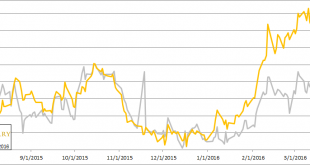

Read More »Great Graphic: 10-Year Break-Evens and Oil

Until last September, the Federal Reserve seems to play down the market-based measures of inflation expectations, preferring the surveys that showed views were anchored. At the September 2015 FOMC meeting where the Fed had been expected to tighten until the August turmoil, officials cited among other considerations, the decline in market-based measures of inflation expectations. There are many problems with using the spread between conventional Treasuries and the inflation-linked...

Read More »Terrorist Strike in Brussels Causes Market Angst

A series of attacks at Brussels airport and metro casts a pall over the market. The attacks come as Europe prepares what for many will be a long holiday weekend. Gold, the dollar and yen seem to have been the beneficiaries. Bonds are generally firmer and equities lower. However, in late morning activity in London, the markets began stabilizing. Sterling remains the weakest of the major currencies. It is nearly as much as it was yesterday (0.7%) against the dollar. Osborne has...

Read More »Labour costs 2014: Labour costs in Switzerland: marked differences according to enterprise size

22.03.2016 09:15 - FSO, Economic Surveys (0353-1601-50) Labour costs 2014 Labour costs in Switzerland: marked differences according to enterprise size Neuchâtel, 22.03.2016 (FSO) – In 2014, average labour costs in Switzerland amounted to CHF 59.60 per hour worked across the secondary and tertiary sectors. According to the Federal Statistical Office (FSO), costs vary considerably from one sector to another and are influenced by enterprise size. Download this press release (pdf, 129 KB)...

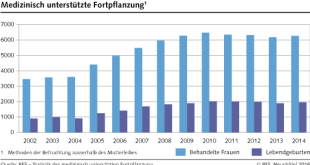

Read More »Assisted reproductive technology in 2014: definitive data: Uptake of in-vitro fertilisation on the rise again

22.03.2016 09:15 – FSO, Health (0353-1603-60) Assisted reproductive technology in 2014: definitive data Uptake of in-vitro fertilisation on the rise again Neuchâtel, 22.03.2016 (FSO) – In 2014, 6269 couples wishing to have children turned to in-vitro fertilisation. This resulted in the birth of 1955 live children. These figures are slightly higher than those for 2013 but remain lower than those observed between 2009 and 2012. These are some of the latest results of the assisted...

Read More »Der weiterentwickelte Hof – ein Drama in vier Reformen

Es war einmal ein Bauer. Willy hiess er. Er hatte einen Hof, 65 Kühe, seine Frau Vreneli, einen anständigen und allseits respektierten Fuhrpark, war glücklich, zufrieden und wohlhabend. Dann kam die Wende auf dem Milchmarkt: Milch kam ausser Mode. Er wusste nicht wie weiter und suchte Rat bei seinem Knecht Christian. Christian empfahl im Rahmen des Fitnessprogramms “Farm95” einen Teil der Kühe zu verkaufen. Es blieben noch 42. Der Milchertrag war noch gut. Nach der Jahrtausendwende kam...

Read More »Silver Gone Wild Report, 20 Mar, 2016

Early on Monday morning (Arizona time), silver began to rise. From its close on Friday of $15.46, it ran up to $15.82. Then it began to slide, eventually dropping to $15.17 by midmorning on Wednesday. Then… *BAM* The Fed said not a lot. It will go on manipulating the rate of interest rate to the same level as it had been previously. This was not what the market was expecting, as many believed the Fed was on the war rate-hiking path. Lower interest means more quantity of money dollars which...

Read More »Emerging Markets: Preview of the Week Ahead

EM ended the week on a mixed note after posting strong post-FOMC gains. The bounce in risk seems likely to continue this week, with little on the horizon to derail it. Specific country risk remains in play, however, with heightened political concerns in Brazil and South Africa. Taiwan reports February export orders Monday, which are expected at -10% y/y vs. -12.4% in January. It reports February IP Wednesday, which is expected at -5.45% y/y vs. -5.65% in January. The central bank then...

Read More » SNB & CHF

SNB & CHF