EM and risk recovered nicely from the Brexit turmoil last week. Yet we think markets are getting too carried away with the “low rates forever” theme and are likely underestimating the capability of the Fed to tighten before 2018. This Friday, the June jobs data could spark a shift in sentiment with a strong reading. Consensus is currently 175k jobs created, up from 38k in May. We don’t think individual EM...

Read More »FX Weekly Preview: If No Article 50 Soon, What are the Fundamental Drivers?

Summary Impact of Brexit will take some time to be seen, but the U.K. is already losing influence. U.S. employment data is not sufficient to get the Fed to hike this month. Pressure continues to build on the BOJ to act. There have been two developments that are shaping investment climate. The first was the dramatic rally in equity markets last week, with many recovering nearly all that was lost on the Brexit...

Read More »Swiss Retail Sales -2.3 percent nominal (YoY) and -1.6 percent real (YoY)

01.07.2016 09:15 – FSO, Economic Surveys (0353-1606-60) The Used Goods Question Retail sales in several countries like Germany, Italy, Japan and Switzerland continue to fall. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans...

Read More »Swiss Social Security Accounts 2014: Social security expenditure accounted for 24.5percent of GDP

01.07.2016 09:15 – FSO, Social Analysis (0353-1606-70) Swiss Social Security Accounts 2014 Social security expenditure accounted for 24.5% of GDP Neuchâtel, 01.07.2016 (FSO) – In 2014 expenditure on social benefits from the Swiss social security system amounted to CHF 157 billion. This corresponds to a 24.5% share of the gross domestic product (GDP). Compared with the previous year, inflation-adjusted expenditure...

Read More »Weekly speculative Positions: Bulls and Bears Saw Speculative Opportunity in Euros

In the sessions before and after the UK referendum speculators in the currency futures did three things. First, they generally reduced exposure.This means gross longs and short positions were reduced. Of the 16 gross speculative currency futures positions we track, 12 fell. Euro: Speculators were divided Second, speculators were divided about what to do with the euro. The bulls added 20.9k contracts to their gross long...

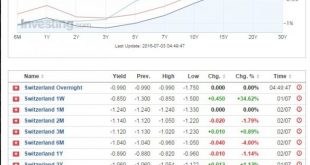

Read More »Swiss Bond Yields all Negative up to 30 years: Greatest Bubble in Financial History

Graham Summers says that central banks have lost control and investors are crazy. They pay the Swiss government for the right to own their bonds. One point is missing: Swiss rates are “more negative than others”, because investors expect a slow appreciation of the Swiss franc. Sometimes it’s critical to look clearly at the big picture. The big picture is that the financial world has allocated capital… trillions of...

Read More »Mooning the Elite

Connecting Dots BALTIMORE – U.S. stocks bounced on Tuesday, with the Dow up 269 points [and even further on Wednesday, ed.]. Was that all there was? Is the “Brexit” scare over? We don’t know… but we’re going to take a pause today. Instead of trying to connect the new dots, we’re going to take a look at the old dots we’ve already strung together. We’ve been connecting the dots every day (except weekends) for the last...

Read More »FX Weekly Review: June 27 – July 01: Swiss Franc Strength Reversed

Swiss Franc Currency Index The Swiss franc (-0.3%) and the yen (-0.5%) were the worst performers as so-called “safe haven” buying was reversed during the week after Brexit. But the Swiss Franc index is still stronger in the last month. Via Financial Times. Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance. On a three years interval, the Swiss...

Read More »If the UK Economy Tanks, Don’t Blame Brexit

The Pool of Real Wealth Last Thursday, the people of Britain voted in a referendum to leave the European Union (EU). Most commentators view Britain’s exit (“Brexit”) from the European Union as bad news for economic growth in the UK and the euro zone. As a result, it is argued, the growth rate in the rest of the world will be also badly affected. It is more likely that, whether the pace of real economic growth over time...

Read More »When the Deep State Controls All Wealth

Investors have realized Brexit isn’t the end of the world. First, because they think it won’t really happen. After all, elites can fix elections, buy politicians, and control public policy… surely, they can fix this! A letter in the Financial Times reminds us that Swedish voters cast their ballots against nuclear power in 1980. The government just ignored them, doubling nuclear power generation over the next 36...

Read More » SNB & CHF

SNB & CHF