Steel factory Photo credit: Laurentiu Iordache Victims of the Boom-Bust Cycle The world is drowning in steel – there is huge overcapacity in steel production worldwide. This is a direct result of the massive global credit expansion that has taken place over the past 15 years. Much of this capacity is located in China, but while the times were good, iron ore and steel production (and associated lines of production) was expanded everywhere else in the world as well. Heavy industries like steel, which represent quite a high stage of the production structure, i.e. are temporally far removed from the consumption stage, are especially prone to falling prey to boom-bust cycles. In a fiat money system run by central planning agencies and supplemented by a fractionally reserved banking system, the amplitude of business cycles will be especially pronounced (readers may have noticed that systemic crises have become increasingly severe with every new iteration). Experience shows that there exists a trade-off between frequency and amplitude: constant central bank intervention has lowered the frequency of economic downturns, but has it has made the crises much worse when they do strike, as imbalances have more time to accumulate. Moreover, the economy’s long term wealth creation capacity is slowly but surely fatally undermined, as more and more capital is consumed.

Topics:

Pater Tenebrarum considers the following as important: commerce department, commodities, Debt and the Fallacies of Paper Money, Dumping, Featured, Karolus Magnus, newsletter, On Economy, Shanghai steel rebar, Steel prices China

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Victims of the Boom-Bust Cycle

The world is drowning in steel – there is huge overcapacity in steel production worldwide. This is a direct result of the massive global credit expansion that has taken place over the past 15 years. Much of this capacity is located in China, but while the times were good, iron ore and steel production (and associated lines of production) was expanded everywhere else in the world as well.

Heavy industries like steel, which represent quite a high stage of the production structure, i.e. are temporally far removed from the consumption stage, are especially prone to falling prey to boom-bust cycles. In a fiat money system run by central planning agencies and supplemented by a fractionally reserved banking system, the amplitude of business cycles will be especially pronounced (readers may have noticed that systemic crises have become increasingly severe with every new iteration).

Experience shows that there exists a trade-off between frequency and amplitude: constant central bank intervention has lowered the frequency of economic downturns, but has it has made the crises much worse when they do strike, as imbalances have more time to accumulate.

Moreover, the economy’s long term wealth creation capacity is slowly but surely fatally undermined, as more and more capital is consumed. This is evidenced by the fact that economic growth is increasingly giving way to stagnation nearly everywhere in the world.

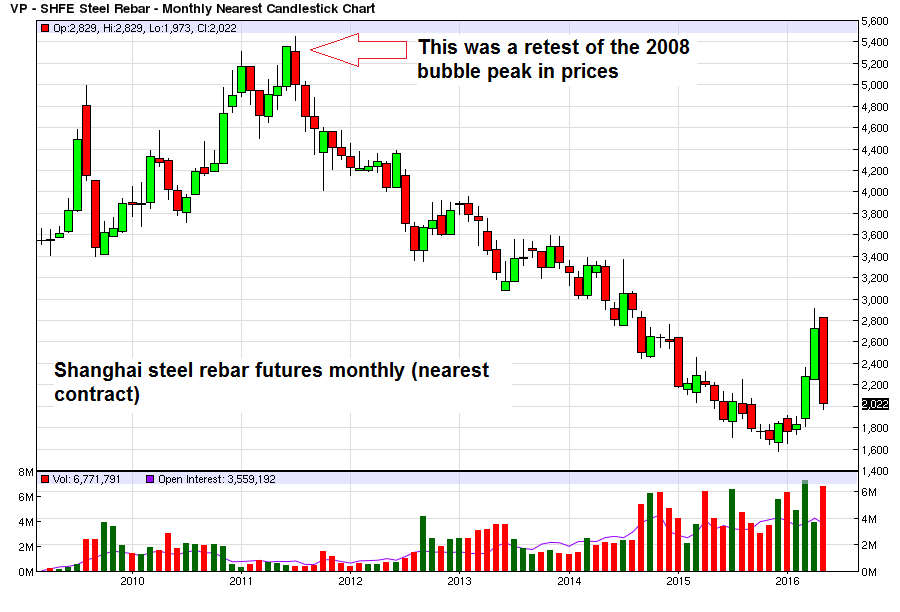

Shanghai steel rebar futures monthlySteel rebar futures prices in Shanghai, monthly. |

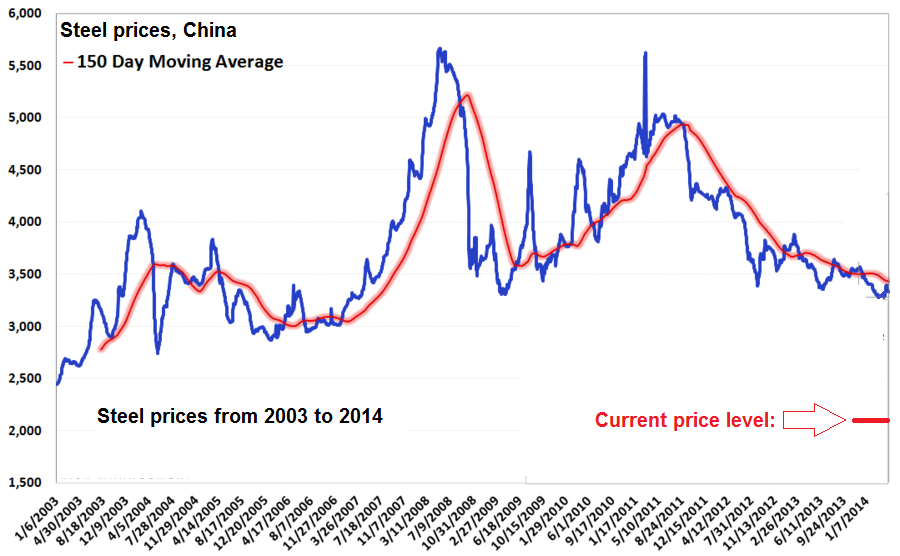

It is easy to see that the steel industry has been one of the focal points of the last cycle – all we need to do is look at the price history of steel. The longest continuous chart of steel rebar futures we could find is the one shown above, so we are supplementing it with a longer term line chart that shows steel prices from 2003 to 2014. As can be seen, current prices are well below the level they inhabited in 2003. In short, the entire price rise of the “bubble period” has been erased.

Steel prices, ChinaSteel prices from 2003 to 2014 – the red line on the right hand side indicates current price levels. |

The Return of “Just Prices”

As a result of all this, the steel industry (along with many other commodity industries) is facing a painful time of liquidation and reorganization. On the other hand, lower steel prices are obviously benefiting all steel users, such as the car industry and the construction industry, to name two important ones. Consumers obviously stand to benefit greatly from this as well, as the latter industries will have more scope to lower the prices of their products.

It seems glaringly obvious that in Western countries, the industries benefiting from low steel prices are far larger and far more important than the steel industry. And it should go without saying that anything that benefits consumers should be enthusiastically welcomed. In fact, the benefit to consumers should be the only standard by which such situations should be judged.

Moreover, lower steel prices are an important signal to the marketplace – they tell entrepreneurs that investments need to be shifted. There is no point in tying up factors of production in steel factories – it will be far better if they are deployed elsewhere.

All of this makes it utterly absurd that the EU, the US and China have begun slapping each other with massive tariffs on steel imports over the past several months (here are links to articles giving some color on the moves made by the EU and the retaliatory moves made by China). The latest event in this comedy of economic error is a massive increase of tariffs introduced by the US commerce department that involves not only China, but several more countries:

“The U.S. Department of Commerce (“DOC”) has made its final decision on anti-dumping investigations on imports of corrosion-resistant steel and concluded that China, India, Italy, South Korea and Taiwan are selling these products in the U.S. market below their fair values and therefore, are subject to anti-dumping duties. The ruling marks yet another major step in stemming the torrent of unfairly-traded foreign imports.

[…]

The biggest U.S. steel producers [five of them all in all, ed note], in June 2015, filed anti-dumping and countervailing duty petitions with the U.S. International Trade Commission (USITC) and the DOC against five countries accused for illegally dumping cheap corrosion-resistant steel.

[…]

Imports of corrosion-resistant steel from China, India, Italy, South Korea, and Taiwan were valued at an estimated $500.3 million, $219.6 million, $110 million, $509.1 million, and $534.4 million, respectively, in 2015 (combined value of nearly $1.9 billion). These products are being illegally dumped by foreign steel producers in the American market at unfairly low prices that significantly undercut the prices of U.S. steel makers.

The DOC, on Wednesday, imposed a whopping final anti-dumping duty rate of 209.97% on imports of these products from China. This will hurt Chinese exporters including Yieh Phui (China) Technomaterial Co. Ltd and Jiangyin Zongcheng Steel Co. Ltd. India, Taiwan, South Korea, and Italy received anti-dumping duties in the range of 3.05% to 92.12%.”

(emphasis added)

This article almost sounds like a satire of sorts. First of all, there is apparently a VAST CONSPIRACY between the steel makers in all these countries, hitherto well hidden from the public eye. Thank the Lord that US steelmakers have spotted it in good time! Who knows what evils may have befallen us otherwise!

Alas, the assertion that steel is “dumped below its fair value” requires us to accept the ludicrous idea that a bunch of bureaucrats actually knows what the “fair value” of steel is supposed to be. In Europe, medieval scholars once extensively discussed the notion of a “just price” in the context of religious doctrine – a debate that went on for centuries. They eventually concluded that there is no just price apart from the market price.

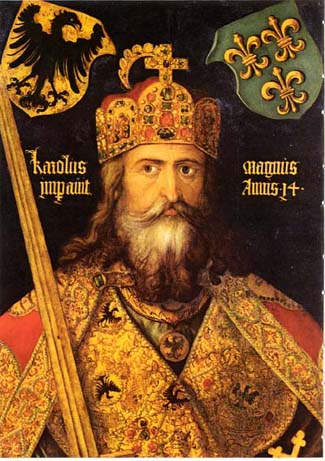

It took these several centuries of learned debate to finally get rid of most of Charlemagne’s extensive and absurd price controls. So essentially, today’s bureaucrats are assuming the role once played by kings, popes and their representatives in determining “just” prices. It sounds almost as though more than a thousand years of progress have just gone “poof”.

Karolus Magnus, a.k.a. Charlemagne, who introduced countless price controls and economic regulations at the Council of Nijmegen in AD 806. It took centuries to get rid of the economic decrees he and his successors imposed in the name of church doctrine (the fashionable pretext at the time. Today the pretext is provided by socialist doctrine).

No Fair! The Economics of “Dumping”

Let us briefly consider the economics of so-called “dumping”. From the perspective of consumers, the case seems crystal clear. Imagine for example that you long wanted to buy a new car, but were put off by its high cost. Suddenly, a car dealer near you lowers the price of the car you want by 30%. Are you going to a) buy it or b) complain about his “car dumping” and alarm the local Spanish Inquisition rep… , sorry, commerce department representative?

We can tell you what 99.99% of consumers would do. We can probably agree that if the remaining 0.01% had a second brain, it would feel lonely. We would come to similar conclusions about a car manufacturer complaining about low steel prices. We’d rightly consider him to be a few French fries short of a happy meal.

No-one expects the Spanish Inquisition!

However, those complaining are of course the steelmakers (all five of them!). What are they really complaining about though? As the charts above show, steel prices are currently very low, and steelmakers obviously don’t like that. So they demand that the State artificially raise them, under the pretext that low import prices constitute evidence of “dumping”.

In case you were wondering how the International Trade Commission of the department of commerce determines whether dumping takes place, here is the official definition of “unfair” prices (get out those prayer beads, ye unbelievers, as we familiarize you with official doctrine!):

“Dumping occurs when imported merchandise is sold in, or for export to, the United States at less than the normal value of the merchandise.”

See how easy it is? According to our sources, it was not quite clear whether the “normal value” of steel was last week’s or last year’s price, or the price in Shanghai or in Rome, so darts were thrown at the steel rebar futures chart we showed above (we cannot guarantee that his is how it really happened).

So the governments of the US, the EU and China are acting as enforcement arms of domestic steelmakers to the detriment of everybody else. Does that make any sense whatsoever? What if Chinese steelmakers offered to give us steel for free? Should we refuse to take it? Shouldn’t we rather be happy to get such a generous gift?

Even if allegations that China’s government is subsidizing its steelmakers are true (i.e., to be precise, if it is true that it is subsidizing them more than other governments are subsidizing theirs), it seems to us that the party that would be hurt the most by said dumping activity would be the dumpers themselves. We should happily let them proceed, in fact, they should be encouraged! The dumpers are evidently subsidizing US consumers and helping to raise their living standards. What’s not to like?

Here is something protectionists never talk about: if one makes it more difficult for others to sell their wares, how are they supposed to pay for what one wants to sell to them? If one thinks their arguments through, protectionists seem to believe that it would be best to have no trade at all. When they first came up with their ideas, they must have been thinking of all those immensely rich villages in the world’s most inaccessible mountain regions.

Coalition of Obsolete Industries

Obviously though, the governments involved in this trade spat are only acting in the best interests of steel workers. Just as they are only acting in the best interests of taxi drivers when regulating Uber out of existence in a city. Why, we should actually consider bringing back VHS video while we’re at it. Someone must have made those tape machines and tapes, and obviously they’re all out of a job as well.

We have remarked on previous occasions that stopping and reversing economic progress seems to be a major function of governments – and as the makers of the video below rightly ask: How are we ever going to have jobs if we don’t stop progress? Naturally, the same applies to free trade.

It’s time to side with the coalition of obsolete industries! Patriotic duty, etc.!

Conclusion

If Western steelmakers are not able to compete with Asian ones at current steel prices, then jacking import prices up by 200% may temporarily help to keep them in business, but they will no longer have an incentive to become more efficient. In the long run, they will simply be set up for an even bigger fall. The may enjoy an advantage for a brief time, but it isn’t going to last.

Since the amount of capital is finite, tying up capital and labor in an inefficient sector of the economy perforce deprives other sectors of these resources. Here one can interweave our example of the consumer who considers whether or not to buy a car, and finds to his delight that it is offered at a 30% discount one day. The money he saves will now be available for other uses.

In other words, not only is our hypothetical consumer’s living standard raised immediately, but the funds he saves will also benefit others. Whether he saves the money or spends it on other consumer goods, more economic opportunity will ensue. The important thing is that it is the consumer making the allocation decision. Ultimately the economy’s production structure is supposed to serve consumers after all – not government bureaucrats and cronies.

Charts by: BarChart, Hedgeye

Previous post