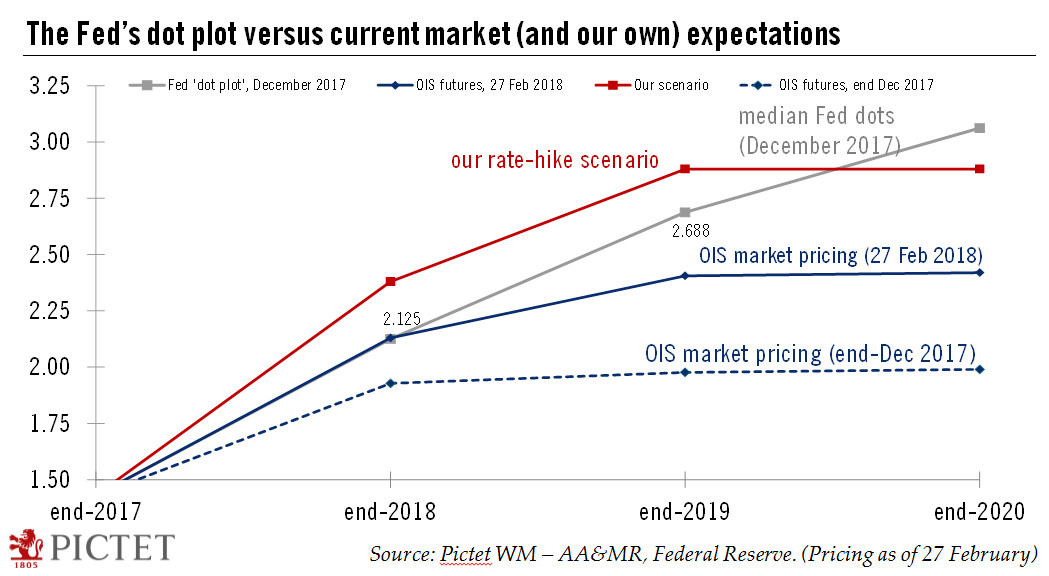

The Fed remains upbeat on growth and its members may be tempted to raise their rate expectations.Fed Chair Jerome Powell highlighted continuity with Janet Yellen’s monetary policy in his testimony before Congress today.He highlighted “positive developments” since the December meeting. This could be a hint that an additional rate hike could be in the pipeline (The Fed indicated three rate hikes in the December dot plot).Reading between the lines, it remains clear that the Powell Fed will not seek to undermine the large fiscal easing with sudden monetary tightening.We continue to expect four rate hikes this year and two hikes in 2019, above current market expectations. But these market expectations have been rising lately.Read full report here

Topics:

Thomas Costerg considers the following as important: Fed dot chart, Fed monetary tightening, Fed rate hikes, Jerome Powell, Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

The Fed remains upbeat on growth and its members may be tempted to raise their rate expectations.

Fed Chair Jerome Powell highlighted continuity with Janet Yellen’s monetary policy in his testimony before Congress today.

He highlighted “positive developments” since the December meeting. This could be a hint that an additional rate hike could be in the pipeline (The Fed indicated three rate hikes in the December dot plot).

Reading between the lines, it remains clear that the Powell Fed will not seek to undermine the large fiscal easing with sudden monetary tightening.

We continue to expect four rate hikes this year and two hikes in 2019, above current market expectations. But these market expectations have been rising lately.