Following July’s deceleration in export growth, we may revise downward our 2018 GDP growth forecast for Japan if trade tensions escalate further.Japanese exports softened further in July, rising by 3.9% year-over-year (y-o-y), compared with 6.7% in June, in JPY terms. Growth in imports strengthened in July to 14.6% y-o-y, compared with 2.6% in the previous month. As a result, Japan’s trade balance fell into deficit territory in July.Transportation equipment (mainly passenger cars) saw its growth rate drop into negative territory (-4.0% y-o-y) in July, from positive growth of 2.7% y-o-y in the previous month. Japanese exports to the US were especially weak, declining by 5.2% y-o-y, compared with -0.9% in the previous month. Exports to China held up, rising 11.9% y-o-y, followed by those

Topics:

Dong Chen considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Following July’s deceleration in export growth, we may revise downward our 2018 GDP growth forecast for Japan if trade tensions escalate further.

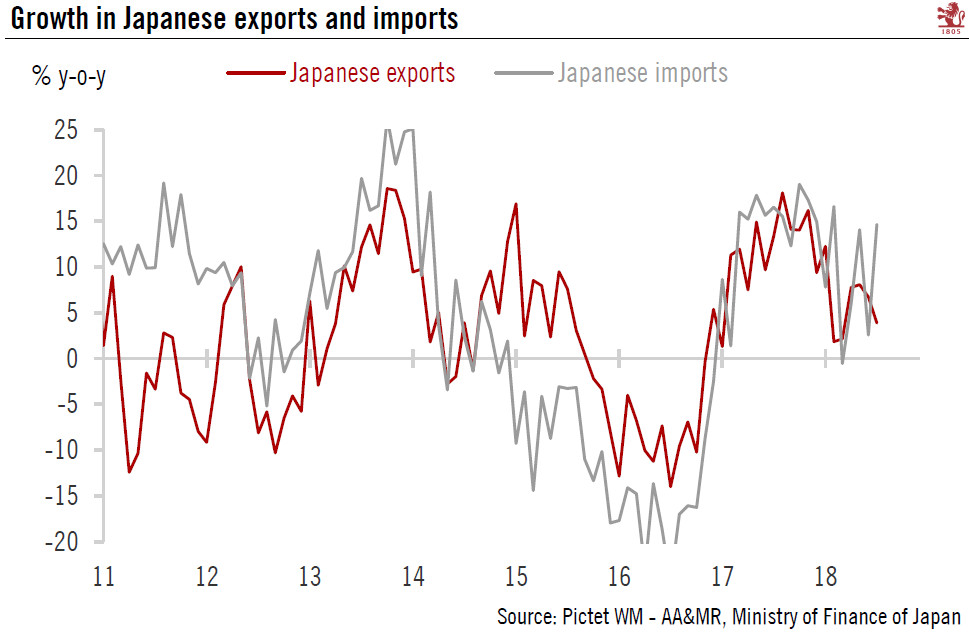

Japanese exports softened further in July, rising by 3.9% year-over-year (y-o-y), compared with 6.7% in June, in JPY terms. Growth in imports strengthened in July to 14.6% y-o-y, compared with 2.6% in the previous month. As a result, Japan’s trade balance fell into deficit territory in July.

Transportation equipment (mainly passenger cars) saw its growth rate drop into negative territory (-4.0% y-o-y) in July, from positive growth of 2.7% y-o-y in the previous month. Japanese exports to the US were especially weak, declining by 5.2% y-o-y, compared with -0.9% in the previous month. Exports to China held up, rising 11.9% y-o-y, followed by those to the EU and the rest of Asia.

Looking forward, we expect to see more headwinds against the export sector in Japan. The trade war with the US poses the greatest risk. Japan is not currently at the centre of trade conflicts, but could be hit heavily if Trump’s threat of 25% tariffs on automobiles were to materialise. Automobiles are Japan’s top export item (including to the US), accounting for 20% of the country’s total exports in 2017. In addition, even if automobile tariffs are avoided, Japan could still be affected if trade tensions between the US and the rest of the world (particularly China) continue to intensify.

All in all, our GDP growth forecast for Japan stands at 1.0% for 2018. The growing risk on the external front poses a downside risk to this forecast. We keep monitoring the development of events and may revise this forecast if the situation shifts materially.