The euro has hit new lows against the US dollar. We are revising down our EUR/USD projections for the next few months.The euro broke to the downside from its tight trading range relative to the US dollar since the end of May. These new lows go against our expectations of a gradual appreciation of the single currency relative to the greenback in the second half of the year and indicate that we have underestimated the short-term risks related to the euro.As a consequence, we have lowered our projections for the EUR/USD rate. While we continue to expect an appreciation of the euro against the dollar from current levels, the short-term downside pressures on the single currency are greater than previously thought.The recent sell-off of the Turkish lira, coupled with the increasing risks of a

Topics:

Luc Luyet considers the following as important: euro currency forecast, euro dollar exchange rate, euro dollar rate, Macroview, US dollar strength

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The euro has hit new lows against the US dollar. We are revising down our EUR/USD projections for the next few months.

The euro broke to the downside from its tight trading range relative to the US dollar since the end of May. These new lows go against our expectations of a gradual appreciation of the single currency relative to the greenback in the second half of the year and indicate that we have underestimated the short-term risks related to the euro.

As a consequence, we have lowered our projections for the EUR/USD rate. While we continue to expect an appreciation of the euro against the dollar from current levels, the short-term downside pressures on the single currency are greater than previously thought.

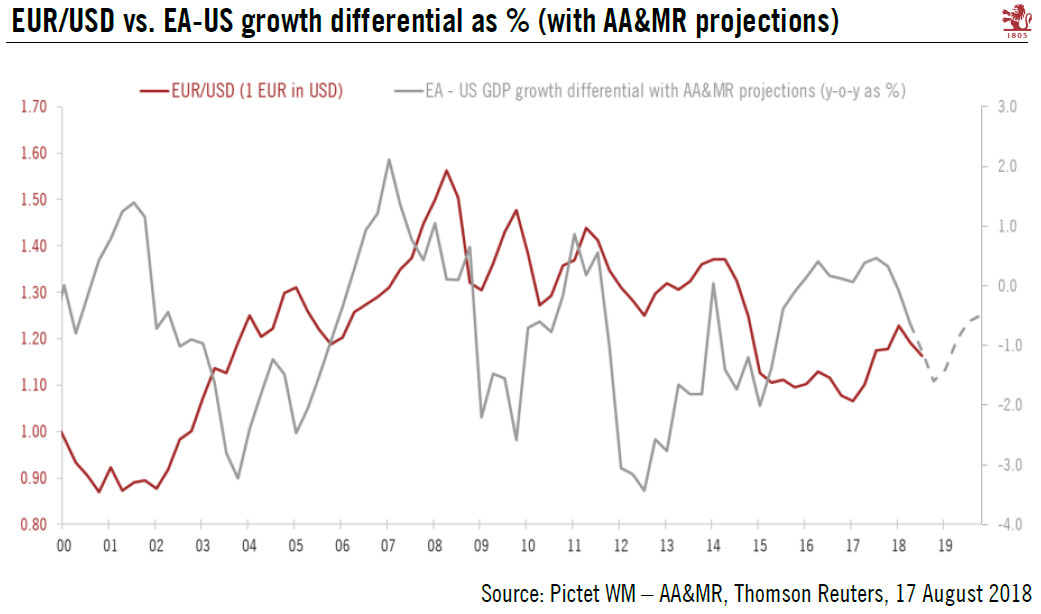

The recent sell-off of the Turkish lira, coupled with the increasing risks of a disorderly Brexit and concerns over the Italian budget have particularly weighed on the euro. While these short-term drivers are likely to put a lid on the euro’s upside potential for the next two months, medium-term drivers, such as the growth differential and monetary policy divergence, continue to point to an appreciation of the euro relative to the US dollar.

To reflect higher short-term headwinds for the EUR/USD rate, we have lowered our projections. The new projections are USD1.15 (3-month), USD1.18 (6-month) and USD1.24 (12-month) per EUR.