'Wake up call' yet to happen as the clock ticks on.A series of votes in the British parliament resulted in little new progress on the Brexit front; the outcome being that Theresa May will return to Brussels to attempt to improve her ‘deal’, which a new parliamentary vote scheduled for mid-February.However, Brussels has rejected the idea of reopening negotiations and it is not clear that mere tweaks will be enough to overcome the intense opposition in parliament to May’s initial deal.Bottom line is that there is still no sign of a meaningful ‘wake-up call’ happening in parliament, which is disappointing. A crucial amendment that would have banned a ‘no-deal’ Brexit and constrained May’s cabinet was voted down; and parliament remains hesitant to expand its powers and spearhead

Topics:

Team Asset Allocation and Macro Research considers the following as important: Brexit, Brexit currencies, Macroview, UK, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

'Wake up call' yet to happen as the clock ticks on.

A series of votes in the British parliament resulted in little new progress on the Brexit front; the outcome being that Theresa May will return to Brussels to attempt to improve her ‘deal’, which a new parliamentary vote scheduled for mid-February.

However, Brussels has rejected the idea of reopening negotiations and it is not clear that mere tweaks will be enough to overcome the intense opposition in parliament to May’s initial deal.

Bottom line is that there is still no sign of a meaningful ‘wake-up call’ happening in parliament, which is disappointing. A crucial amendment that would have banned a ‘no-deal’ Brexit and constrained May’s cabinet was voted down; and parliament remains hesitant to expand its powers and spearhead alternatives.

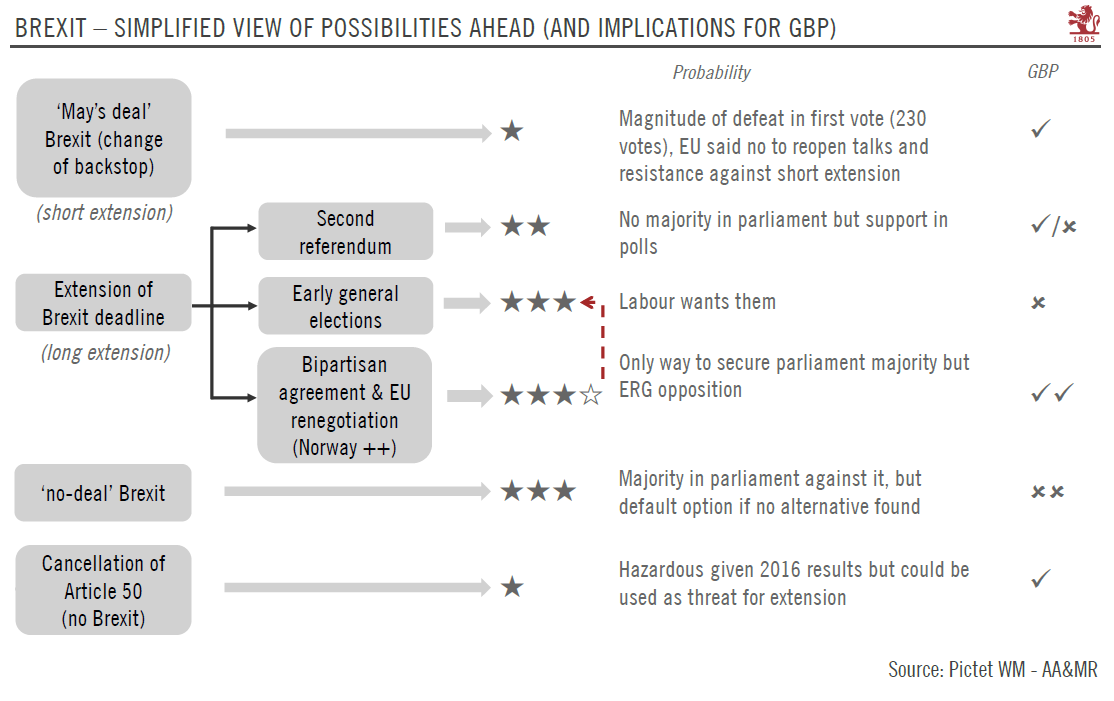

We therefore see a rising risk of a ‘no deal’ Brexit by the 29 March deadline, which remains the default option if no alternative is found by then.

This said, our main scenario remains that an extension of the Brexit deadline will ultimately be granted by the European Union (EU), which would allow time to find a bipartisan solution, most likely a softer version of May’s deal and closer trade links with the EU.

Uncertainty around the outcomes of Brexit and therefore our own scenario remain sizeable; complicating matters are May’s unclear intentions as she continues to insist on her deal, even at the risk of another defeat leading to an unintended ‘no deal’.

We see in the lack of credible alternatives a potential damping force on sterling in the next few days. The chance of a bipartisan agreement has dropped and time is running out, making a ‘no-deal’ Brexit a clear possibility. Our three-month forecast is unchanged at USD1.32, but volatility could remain high.