Technology plays an increasingly important role in our lives, from business interactions to the way we communicate in our private lives. Pictet’s 2019 edition of its annual Latam Family Office masterclass – which took place in Nassau, the Bahamas – delved into this topic around the central themes of geopolitics, families and the new power of social media. Alongside a Pictet line-up that included managing partners Marc Pictet and Boris Collardi, guest panelists and speakers ranged from the...

Read More »US-China trade update

Reasoning suggests China will not use US treasuries or the RMB as trade weapons.Trade tensions between the US and China have risen sharply but we believe the situation would need to escalate much further before China resorts to the extreme weapons of currency devaluation and/or selling down its US Treasuries.The fundamental reason for this argument is that such strategies do not serve China’s own interests. On the contrary, they could cause severe damage to the Chinese economy.Should markets...

Read More »China growth moderates in April

After a strong first quarter for Chinese growth, signs point to a weaker Q2.Latest hard data indicate that China’s growth momentum moderated in April, after a strong Q1. Industrial activity, fixed investment and consumption all weakened in April.In the context of escalating trade tensions with the US, we expect the Chinese government to step up stimulus measures to support growth in the coming months, especially in the area of infrastructure investment and household consumption.Given the...

Read More »No doubt remaining: German domestic demand is resilient

German activity has accelerated in the first quarter of the year on the back of a strong domestic economy.German GDP rose by 0.4% quarter-on-quarter in Q1, accelerating from a flat figure in Q4.The strong Q1 GDP growth is good news and confirms our long-held view that domestic demand remains resilient despite many external headwinds.The signal given by other data (factory orders, surveys) suggests that some negative payback is likely in Q2.The prospect of higher German growth (on average) in...

Read More »A premium mode of transport for urban commuters

Technological innovations offer a Swiss solution to modern traffic problems in the form of a powerful e-bike capable of long-distance, high-speed urban commuting with full connectivity modelled on global brands such as TeslaSwitzerland may not feature on lists of the world’s leading carmakers, but it is home to the manufacturer of a state-of-the-art form of commuter transport. Stromer battery-powered e-bikes, made in the small village of Oberwangen near Bern, are capable of travelling...

Read More »Core sovereign bond yields – update

We are adjusting downward our year-end targets for the 10-year US Treasury and Bund yields.Taking hold of two important changes to our central macroeconomic scenarios, we are adjusting downward our year-end target for the 10-year US Treasury yield from 3.0% to 2.8% and the Bund yield from 0.5% to 0.3%. The drivers behind this include lower inflation expectations, rising US-China trade tensions against a constant monetary policy backdrop.Four consecutive disappointing US inflation prints have...

Read More »US-China trade: New tariffs – watch the second derivative

Our view about US-China trade tensions remains largely unchanged. We expect limited direct impact on the US economy, but the indirect costs could be more significant.The direct macro cost on the US economy of the raised tariffs to 25% from 10%, and the fresh counter-tariffs from China, should be limited in our view, at around 0.1% of US GDP.The US economy tends to be much more sensitive to financial conditions than to the narrow question of the tariffs’ impact on end-purchasers in the US....

Read More »Weekly View – Game of chicken

The CIO office’s view of the week ahead.As a US-China trade negotiation impasse became evident last week, markets corrected a bit, particularly cyclical sectors. Given the strong US economy, Trump is feeling empowered to pursue his agenda, raising existing tariffs from 10-25% on USD 200bn worth of goods with immediate effect and threatening more. Now we will wait to see how China retaliates. For the time being, we feel assured that the Chinese authorities will not use currency or its US...

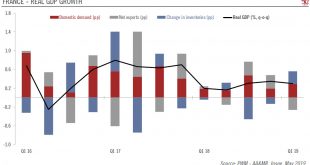

Read More »French tax cuts designed to reboot Macron’s presidency

The French government’s response to the ‘yellow vest’ protests could provide a meaningful boost to consumer spending, mostly next year.Following a series of townhall meetings with French citizens up and down France, President Emmanuel Macron responded to social unrest with two doses of fiscal easing. The December package (worth EUR10bn) was incorporated in the stability plan sent to Brussels before Easter and is included in the 3.1% public deficit planned for this year. The measures...

Read More »What we are watching for now

[embedded content] Equity markets have reached new highs, extending the longest bull market in US history. However, César Pérez Ruiz, Head of Investments and CIO at Pictet Wealth Management, is conscious of complacency in markets and keeping protection on portfolios as tail risks remain. Geopolitical developments such as the potential escalation of Iranian tensions and drawn-out trade negotiations between the US and China, could send short-term volatility through markets.

Read More » Perspectives Pictet

Perspectives Pictet