Venue: The Pianist Studio Imagination and music enjoyment has no age limit. The Pianist Studio believes in giving opportunity to our students regardless of age to showcase their learning thus far in different stages of learning. No one is too new to be on stage, we don't only build musical skills but confidence in life! Watch Other Student Features: http://bit.ly/q1wert3y The Pianist Studio Music School is also an approved ABRSM Exam Centre in Singapore which is recognized in 93 countries...

Read More »The Pianist Studio Student Feature: Dong Chen

Venue: The Pianist Studio Imagination and music enjoyment has no age limit. The Pianist Studio believes in giving opportunity to our students regardless of age to showcase their learning thus far in different stages of learning. No one is too new to be on stage, we don't only build musical skills but confidence in life! Watch Other Student Features: http://bit.ly/q1wert3y The Pianist Studio Music School is also an approved ABRSM Exam Centre in Singapore which is recognized in 93 countries...

Read More »Pictet Perspectives — Towards ‘Chinafication’

With growth indicators faltering and markets unsettled, policy makers in advanced economies are being forced to look at new ways to prolong the expansion. In many ways, their concerns are the same as their Chinese counterparts’. Could (Should) they also adopt Chinese economic policies? https://www.group.pictet/wealth-management

Read More »Pictet Perspectives — Towards ‘Chinafication’

With growth indicators faltering and markets unsettled, policy makers in advanced economies are being forced to look at new ways to prolong the expansion. In many ways, their concerns are the same as their Chinese counterparts’. Could (Should) they also adopt Chinese economic policies? https://www.group.pictet/wealth-management

Read More »Perspectives Pictet

This website uses cookies to enhance user navigation and to collect statistical data. To refuse the use of cookies, change your settings or for more information, please click on the following link: Cookies policy. By continuing to browse this website, you accept the use of cookies for the above purposes.

Read More »Euro/USD: things look pretty stable

Competing forces mean the two currencies could remain in a holding pattern for a while.The euro has remained relatively stable relative to the US dollar in the wake of the European Central Bank (ECB) and US Federal Reserve (Fed) September policy meetings. Growth and interest rate differentials, two key drivers for the EUR/USD rate, suggest things could stay this way.The growth differential (based on leading indicators) has barely budged since March after a sharp decline that began in late...

Read More »Goodbye quantitative tightening

Following this week’s sharp movement in the USD overnight repurchase agreement (repo) rate, people are wondering what the US Federal Reserve (Fed) can do to counter a similar event in the future.One measure of the USD overnight repo rate (there exist several) spiked to 6% on Tuesday 17 September, probably due a scarcity of bank reserves at the Fed at a time when US corporates needed cash to pay their taxes as did investors/banks (probably to absorb strong US Treasury issuance. Hence, cash...

Read More »MMT, la nouvelle théorie en vogue à Washington

L’influence du ‘Modern Monetary Theory’ est susceptible d’augmenter dans les milieux économiques et politiques américains.La nouvelle théorie monétaire (Modern Monetary Theory/MMT), théorie macroéconomique défendue par des économistes hétérodoxes, commence à faire son chemin aux Etats-Unis. Cette théorie adopte une approche expérimentale de l’économie, basée sur la conviction fondamentale que la monnaie est créée par le gouvernement à travers les dépenses budgétaires, et non par les banques...

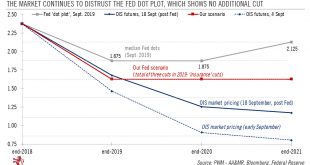

Read More »Powell plays the ‘insurance’ card again

In spite of internal divisions, the Fed may go for a third rate cut in October and step in to alleviate pressure in repo market.The Federal Reserve (Fed) cut rates by 0.25% on Wednesday, as widely anticipated. The new fed funds target range is 1.75%-2.00%. The interest rate on banks’ excess reserves was cut by 0.30% to 1.80%. Fed Chairman Jerome Powell again justified this second rate cut since July as “insurance” against risks to the US outlook – mostly the weak global growth picture and...

Read More »What more QE means for Bund yields

In spite of an initial rise in 10-year Bund yields after the ECB’s latest stimulus, our central scenario is for a renewed decline by year’s end.The 10-year Bund yield moved up from its recent lows of -0.71% to -0.45% on September 16, driven mostly by an element of disappointment regarding the European Central Bank’s (ECB) latest stimulus measures and some renewed hopes for a US-China trade truce. In particular, we suspect the rebound in yields was triggered by the ECB’s failure to increase...

Read More » Perspectives Pictet

Perspectives Pictet