Today’s data on August’s consumer spending were strong, and data for the previous months were revised up. We now expect consumption growth to reach some 3.3% in Q3 and remain robust thereafter. Consumption growth above expectations in August August data on household consumption and income were published today. Real consumption rose by a strong 0.4% m-o-m in August, slightly above consensus estimates (+0.3%). Already published data on retail sales and car sales for August had been quite...

Read More »The Power of Brands

Successful brands can generate consistent and superior shareholder returns, explains Mayssa Al Midani, Financial Analyst at Pictet Wealth Management.

Read More »In conversation with Gaia Gaja

Published: Monday September 14 2015 The fifth-generation member of a distinguished Italian winemaking family is working with her father and sister to continuously improve the reputation of their wines which have achieved global recognition for their quality. Barbaresco in the Piemont region of northwest Italy is home to the Gaja winemaking business, producer of some of the world’s most renowned wines. The current owner is Angelo Gaja, the founder’s great grandson, who introduced techniques...

Read More »Equities: storm raging on the markets

Fears about the slowdown in China unleashed a wave of panic through the markets. The authorities in Beijing probably did not think the change in the way the exchange rate was fixed would detonate such an explosive correction on financial markets. The Shanghai Composite tumbled almost 27% in the week after that decision. It had already fallen 22% prior to that since mid-June. In China’s slipstream, the S&P 500 fell by 11%, the Stoxx Europe 600 by 15% and the Topix by 13% in local...

Read More »Exports slump as China rebalances

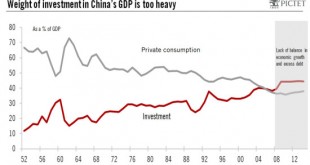

In the wake of China's slowdown, emerging markets have become a source of concern for investors. As China’s economy slows, exports by its trading partners have slumped, adding to concerns about the outlook for the global economy and for emerging markets in particular. Moreover, this comes on top of a structural slowdown in world trade growth, which has been sluggish in recent years. Exports from South Korea dropped by 14.7% y-o-y in August, their sharpest fall since 2009. China accounts for...

Read More »China shaking, but global economy holding firm

The slide recorded by Chinese leading indicators has ignited fears of a severe slowdown in the making. Nevertheless, the Beijing authorities still have plenty of firepower to hand to counter deflationary threats. China may be giving rise to much concern, but growth in the world economy is still being driven by the quickening US economy and the, admittedly, gentler acceleration in Europe. China’s authorities have a target for economic growth of around 6.5%. To offset the threat of a...

Read More »Multi-Generational Wealth, Singapore

This edition of Pictet's Family Office Master Class took place in Singapore and gave new insights into family office experiences, challenges and solutions on how to further institutionalise and professionalise their setups.

Read More »Despite concerns about China, the global economy remains on track

It has been a turbulent end to the summer for financial markets. The renewed market sell-off in China has reverberated across markets globally, as it amplified concerns, following the recent devaluation of the yuan, about the outlook for economic growth in China. We view recent developments on Chinese markets as a sharp correction rather than the start of a long-term bear market. In the meantime, the economic recovery in the US and the euro area continues to gain traction. Recent...

Read More »United States: unemployment rate has fallen to a seven-year low

In August 2015, job creation came in below expectations, but both June’s and July’s numbers were revised up, and most other indicators in today’s employment report were rather upbeat, including a marked drop in unemployment. Although it remains a tight call, we continue to believe the most likely scenario is for the Fed to wait until December before hiking rates. Non-farm payroll employment rose by 173,000 m-o-m in August 2015, below consensus expectations (217,000). However, July’s...

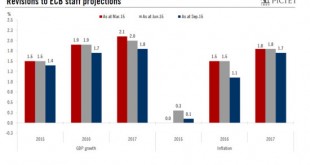

Read More »The ECB exhibits maximum flexibility

Should risks rise further in coming weeks, the ECB could decide to increase the size of its monthly asset purchases from the current pace of EUR60bn. While leaving policy rates and its QE programme unchanged at today’s meeting, the ECB reinforced its easing bias, highlighting renewed downside risks to both economic growth and inflation. ECB staff forecasts were revised lower as a result of less favourable global growth conditions, including in China, as well as tighter financial...

Read More » Perspectives Pictet

Perspectives Pictet