From the FT.

Read More »Human Intelligence and Helpless Infants

The Economist reports about research by Steven Piantadosi and Celeste Kidd from the University of Rochester who tried to explain why humans tend to be intelligent. Their answer: Because human babies are extraordinarily helpless when compared with other animals. … human infants take a year to learn even to walk, and need constant supervision for many years afterwards [indeed]. That helplessness is thought to be one consequence of intelligence—or, at least, of brain size. In order to keep...

Read More »Deposit Insurance: Economics and Politics

On VoxEU, Charles Calomiris and Matthew Jaremski discuss the origins of bank liability insurance. They argue that it is redistribution, not the aim to boost efficiency, which explains a lot of the action. … there are two theoretical approaches to explaining the creation and expansion of deposit insurance. The first is an economic approach grounded in potential efficiency gains from limiting bank runs (i.e. the public interest motivation). The second is a political approach grounded in the...

Read More »The Massachusetts Historical Commission And American Political Sclerosis

On his blog, John Cochrane happily reports about apparent agreement between Larry Summers and himself regarding the dangers of regulatory overkill and incompetence of government officials. John writes: This is a watershed. Here is the kind of reach out for middle ground that could unlock our political and economic sclerosis. Larry is likely to be in government again sooner or later, and I hope he will push hard for this — and with more effect than the last hundred or so anti-red-tape and...

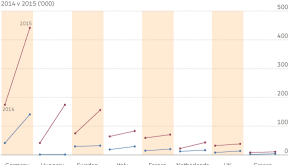

Read More »Asylum Seekers in the EU

… by year, country and status, from the FT.

Read More »Gottardo 2016

June 1st marks the official opening of the longest railway tunnel on Earth, cutting through the Alps. Official website. Profile of the rail track between Zurich and Lugano. Report about the contender.

Read More »Basic Income

In the FT, John Kay points out that basic income proposals have one major drawback: They are very—expensive. Not everyone agrees. Switzerland will hold a national referendum on the introduction of an unconditional basic income on June 5th, 2016. The supporters of the proposal write: A basic income already exists today. Everyone obtains one from somewhere; otherwise we would not be able to live. In our society today, no one can survive without an income. The level of a basic income is...

Read More »Commitment Against Alchemy?

In the FT, Martin Wolf discusses Mervyn King’s proposal to make the central bank a “pawnbroker for all seasons” as laid out in King’s recent book “The End of Alchemy.” Lord King offers a novel alternative. Central banks would still act as lenders of last resort. But they would no longer be forced to lend against virtually any asset, since that very possibility must create moral hazard. Instead, they would agree the terms on which they would lend against assets in a crisis, including...

Read More »Fiscal-Monetary Policy Interaction

In the Richmond Fed’s Econ Focus, Eric Leeper explains his views. Disparate confounding dynamics and simple policy rules: My view is that central banks have put far too many resources into understanding tiny fluctuations and too few resources into the things that actually matter. … Something like the basic Taylor rule doesn’t really serve as a useful litmus test for what policy is doing in the face of these DCDs, so it’s a little bizarre to me that a lot of central banks routinely calculate...

Read More »Efficiency versus Equity

On VoxEU, Torben Andersen and Jonas Maibom point out that empirical findings of a positive correlation between efficiency and equity need not contradict elementary theoretical predictions. The trade-off [between efficiency and equity] applies at the frontier of the possibility set of combinations of economic performance and income equality available to policy makers. If policies and institutions are ‘well-designed’, the country is at the frontier. There is no free lunch and a trade-off...

Read More » Dirk Niepelt

Dirk Niepelt